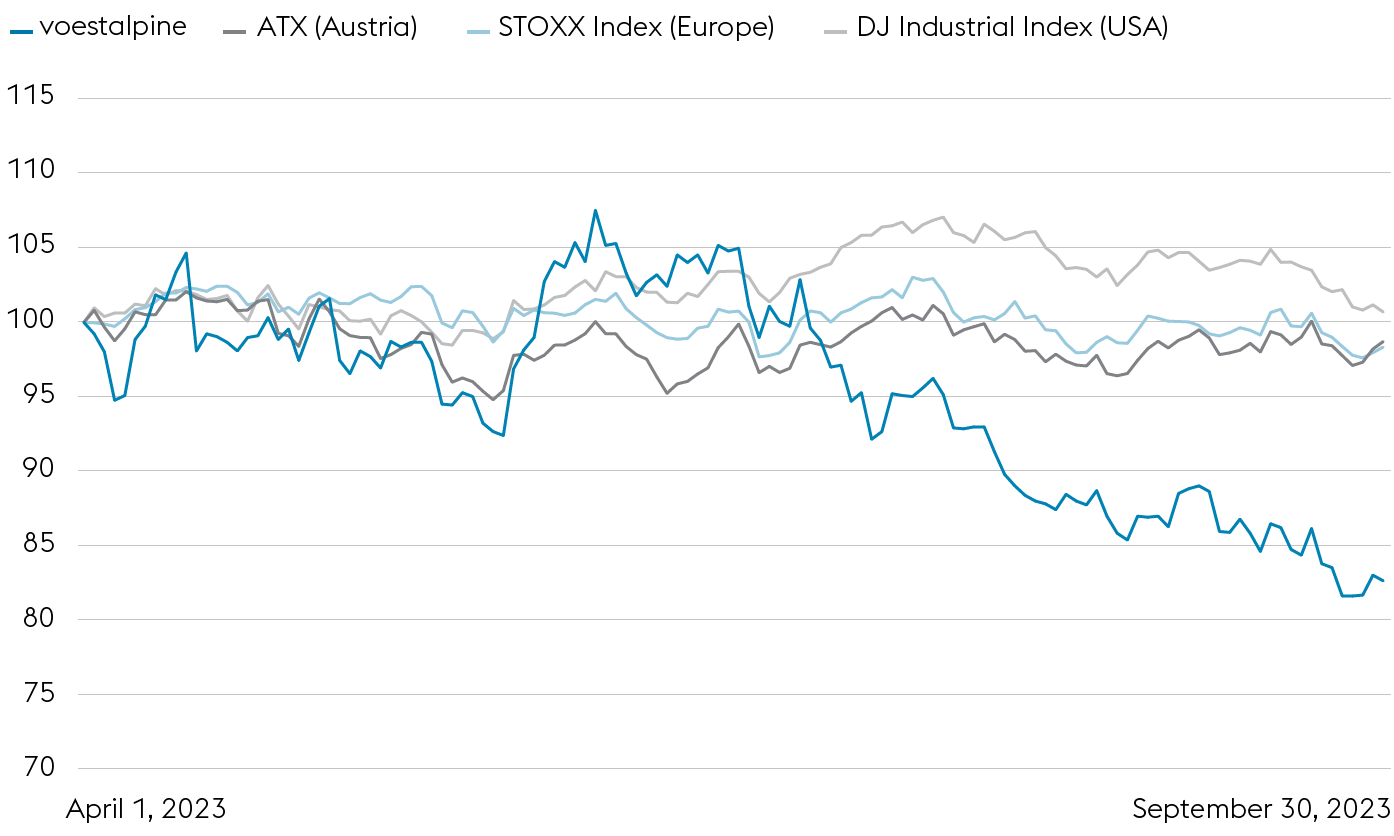

voestalpine AG VS. THE ATX AND INTERNATIONAL INDICES

Changes compared to March 31, 2023, in %

Overall, the global economy and international capital markets faced major challenges and uncertainties in the first half of the business year 2023/24—from inflation to monetary policy and the economy. In Europe, for example, the discussion focused on whether there would be a “hard landing” or “soft landing”, i.e. a recession or only reduced growth. In any case, growth forecasts for Europe were revised downward in the reporting period. In addition, numerous companies reduced their earnings forecasts. In addition, the forecast of declining growth in Germany, Europe’s largest economy, weighed on market developments.

The defining issue on the capital markets in the first half of the business year 2023/24 remained the interest rate policies of the Federal Reserve (FED) in the U.S. and the European Central Bank (ECB) in Europe. The aim of the ECB and the FED is to get a grip on high inflation, which is massively dampening purchasing power and thus consumption. Contrary to the predictions of experts, the ECB raised key interest rates in September 2023 for the tenth time in succession since July 2022. This decision was taken despite a weaker economic outlook and caused discussion and uncertainty among investors, as the high interest rates are making it massively difficult to raise capital and are curbing consumer spending by private individuals and investment activity by companies.

The voestalpine share price was still characterized by a significant upward trend in the second half of the previous business year. This was followed by a largely stable development in the first quarter of 2023/24. Like all cyclically sensitive shares, the voestalpine share came under pressure in the Northern summer of 2023—triggered by external developments such as the negative economic forecasts and corresponding leading indicators. Specifically, the voestalpine share price decreased from EUR 31.28 at the beginning of the business year to EUR 25.84 at the end of the first half of the business year 2023/24. This is a decline of 17.4%. Comparative indices such as the ATX, STOXX Index Europe, or the Dow Jones Industrial Index recorded a largely stable development during the same period.