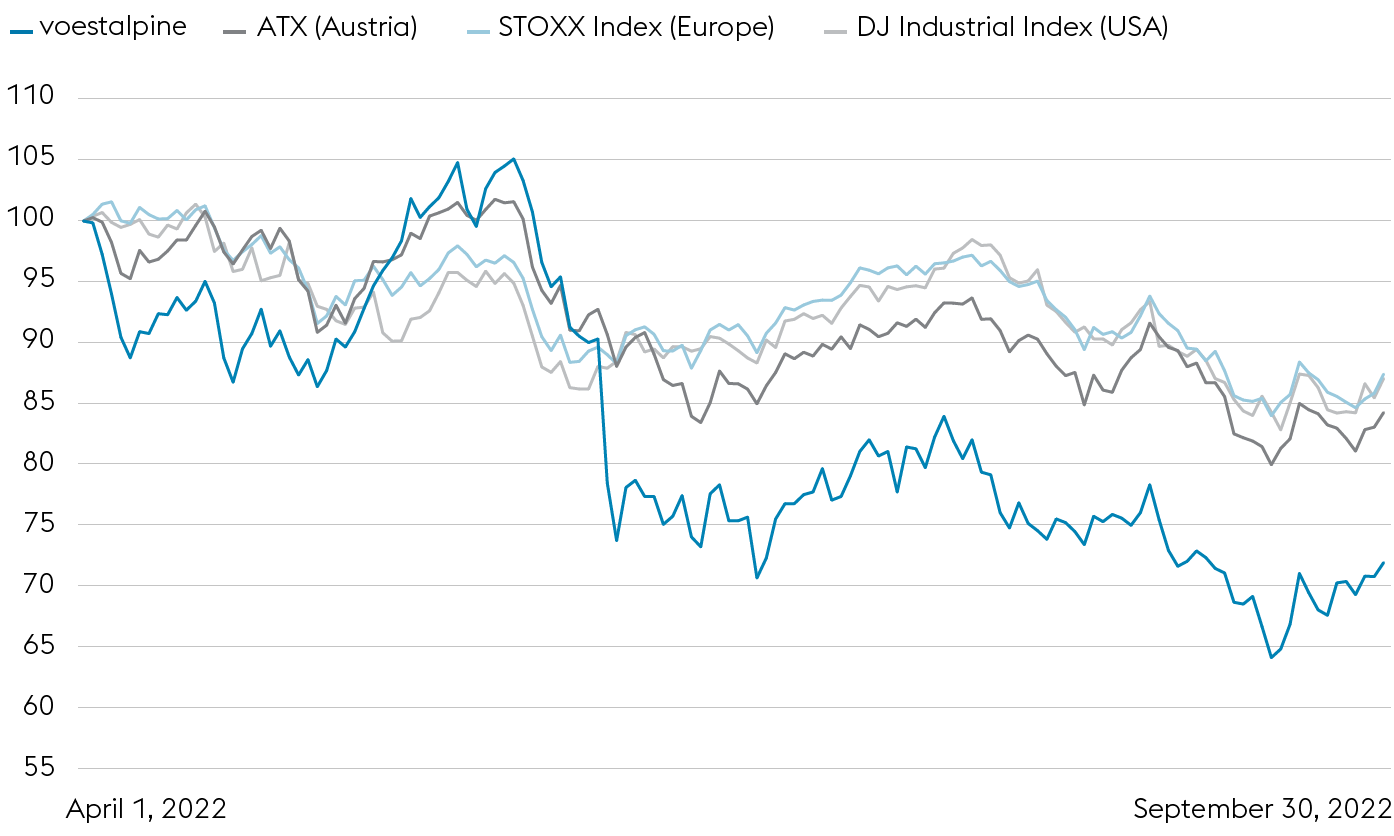

voestalpine AG VS. THE ATX AND INTERNATIONAL INDICES

Changes compared to March 31, 2022, in %

Highly challenging conditions marked the first half of the company’s business year 2022/23 in the international capital markets. Central banks in both the United States and Europe counteracted sharply rising inflation rates through incremental adjustments of the prime rate. While the exorbitant increases in energy costs were the primary driver of consumer prices in Europe, the inflationary momentum in the U.S. was caused primarily by high demand. The dramatic interest rate increases fueled fears that the economies in Europe and the U.S. could slide into a recession as a result. A number of other factors besides interest rate policies raised the risk of such a scenario coming to pass. For example, the difficulty of estimating how long the Ukraine war will continue and what its long-term economic consequences will be intensified investors’ pronounced uncertainty. The news flow related to the Ukraine war regarding the potential suspension of Russian natural gas deliveries further unsettled investors. This is because such a scenario would impact especially energy-intensive industries as well as their upstream and downstream supply chains. Given these tensions, the highly contentious political debates not only led to substantial swings in the spot prices for electricity and natural gas but also greatly exacerbated volatilities in the stock markets. Unstable global supply chains, which had detrimental effects on production in the automotive industry, among others, further exacerbated the negative sentiment. The precursor indicators also reinforced signs that an economic contraction is imminent. U.S. investors, in particular, increasingly withdrew from European stock markets and shunned especially the stock of companies sensitive to macroeconomic developments. Hence the price of the voestalpine share was determined by external factors. While the company’s share price trended laterally at the start of the business year 2022/23, the unfavorable outlook began to trigger significant price declines starting in the early Northern summer of calendar year 2022. In such a high risk environment, investors tend to shift their focus away from corporate performance indicators. This was clear following the presentation of the company’s record performance in the first business quarter of 2022/23. The price of the voestalpine share shed 30% of its value within a mere two weeks of the date on which the results were published. A period of largely stable price trends followed the initial high volatility. voestalpine’s share did not see yet more substantial price drops until the end of the reporting period. In sum, the price of voestalpine’s share fell during the first half of the business year 2022/23 by more than one third, from EUR 26.98 per share as of April 1, 2022, to EUR 17.51 as of September 30, 2022. The benchmark indices—ATX (the leading Austrian share index), STOXX Index Europe, and Dow Jones Industrial—lost between 15% and 20% of their value during the same period.