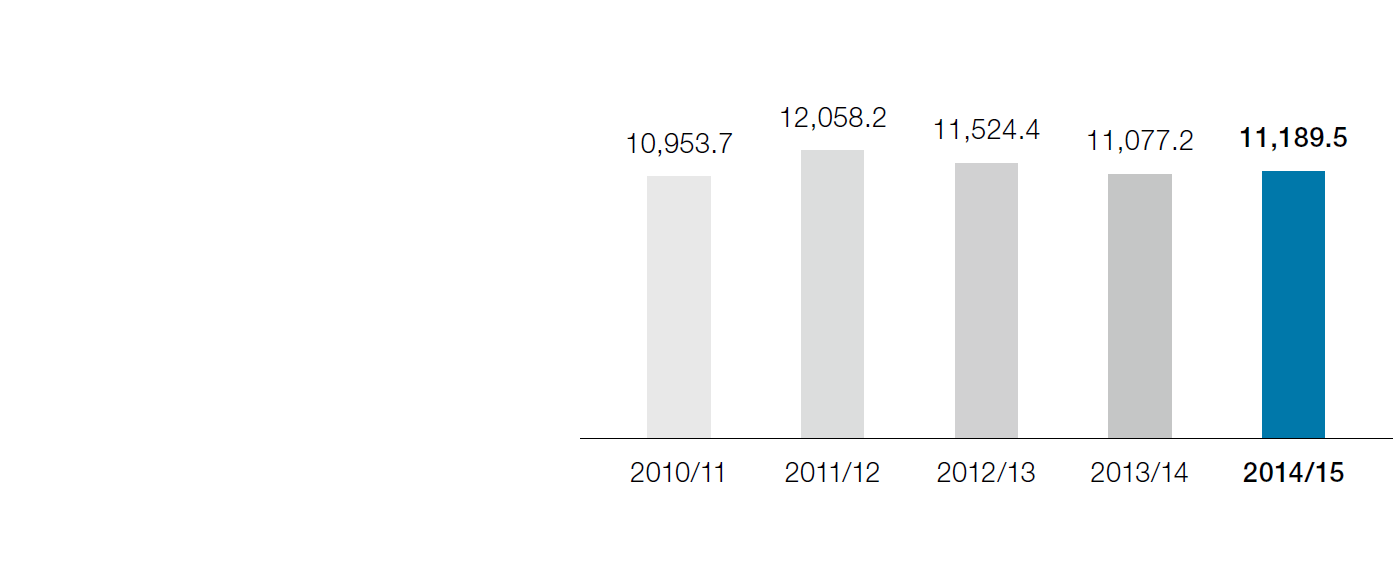

Revenue of the voestalpine Group

In millions of euros

In 2014/15, despite the weakening of the market price level in a number of business units due to the decline of raw materials prices, the voestalpine Group’s revenue rose slightly in a year-to-year comparison, going up by 1.0% from EUR 11,077.2 million to EUR 11,189.5 million. At 5.7%, the Special Steel Division, which was least affected by the decline of raw materials prices, reported the largest revenue gain, while the Steel Division’s revenue increase was comparatively moderate at 1.7%. In contrast, the Metal Engineering Division and the Metal Forming Division both recorded a slight decrease in revenue. While the Metal Engineering Division’s decline in revenue is due to the closure of the standard rail production in Duisburg as of the end of the 2013 calendar year, the reason for the decrease in the Metal Forming Division is the divestment of the Flamco Group and of the Plastics operations during the year under review (see Chapter “Acquisitions/Divestments”).

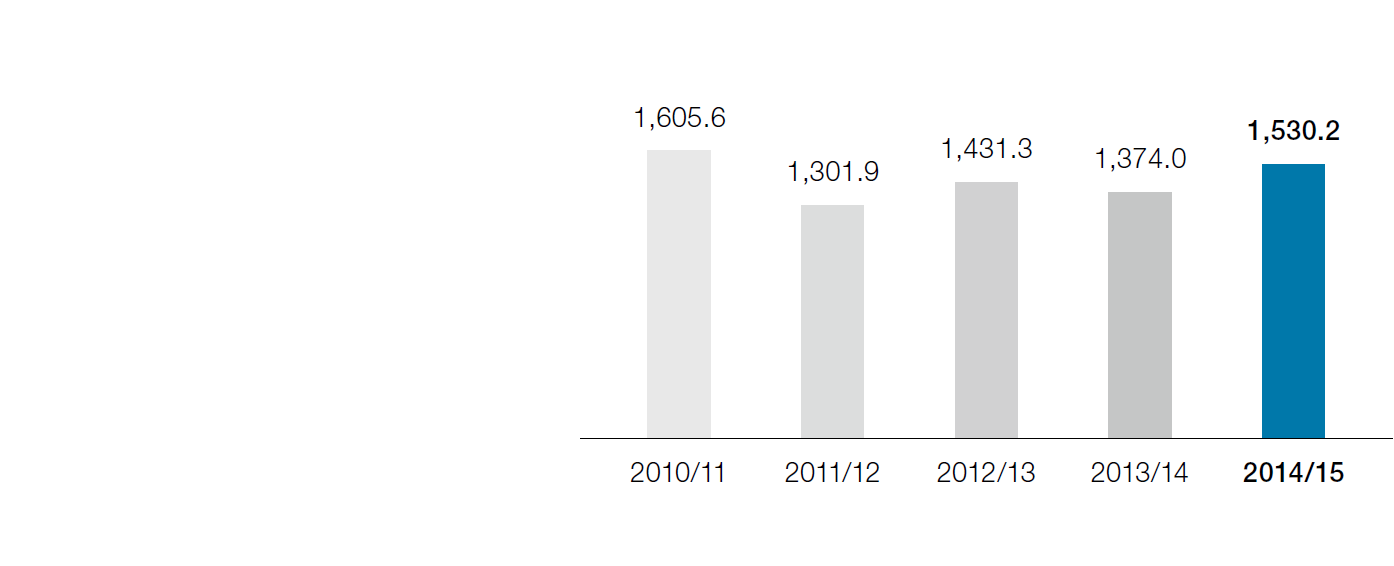

All four divisions were able to increase their operating result (EBITDA) in the business year 2014/15. In the Steel Division and the Special Steel Division, the gain was due to an increase in delivery volumes as well as the first positive effects from the cost optimization and efficiency improvement programs. While in the Steel Division the boost in volume is largely due to the (temporarily) stronger energy segment, in the Special Steel Division, the reason lies in higher demand for tool steel and special materials, particularly from Asia and North America. In the Metal Engineering Division, the weakening of the Welding Consumables business segment was compensated by an expansion of activities in the Turnout Systems business segment. In the Metal Forming Division, the rise in EBITDA is the result of non-recurring effects totaling EUR 61.9 million from the sale of the Flamco Group in August 2014, the agreement to sell the automotive companies voestalpine Polynorm Van Niftrik B.V. and voestalpine Polynorm Plastics B.V. at the end of September 2014, and a structural reorganization of pension obligations in several Dutch companies belonging to the division. It should be mentioned here that the loss of earnings contributions from the divested companies is not taken into account in the non-recurring effects. Against this backdrop, the voestalpine Group’s EBITDA rose by 11.4% from EUR 1,374.0 million to EUR 1,530.2 million. Adjusted by the non-recurring earnings contributions, EBITDA in the business year 2014/15 amounted to EUR 1,468.3 million, which equals an adjusted increase of 6.9%.

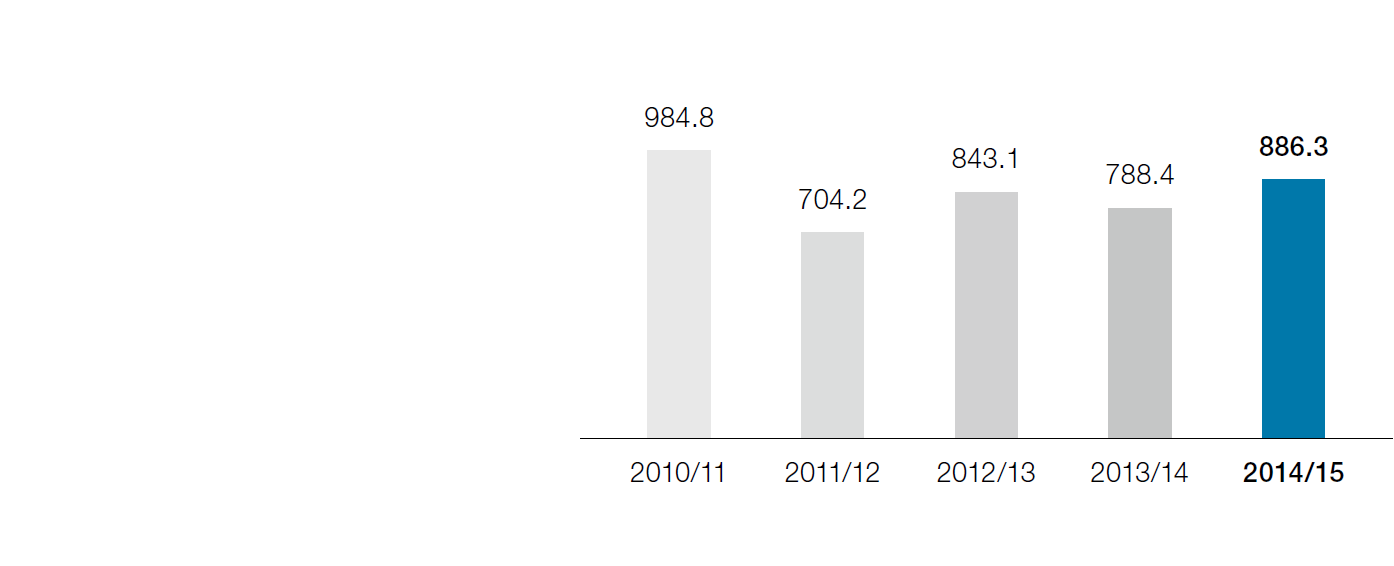

At 12.4%, profit from operations (EBIT) went up by a similar range in terms of percentages as the operating result; in absolute terms, EBIT rose from EUR 788.4 million to EUR 886.3 million. This includes a non-recurring earnings contribution of EUR 45.2 million due to the described one-time effects and is reduced by impairment losses on individual assets that do not form part of the core business. Thus, adjusted EBIT rose by 6.7% to EUR 841.1 million.

Share page