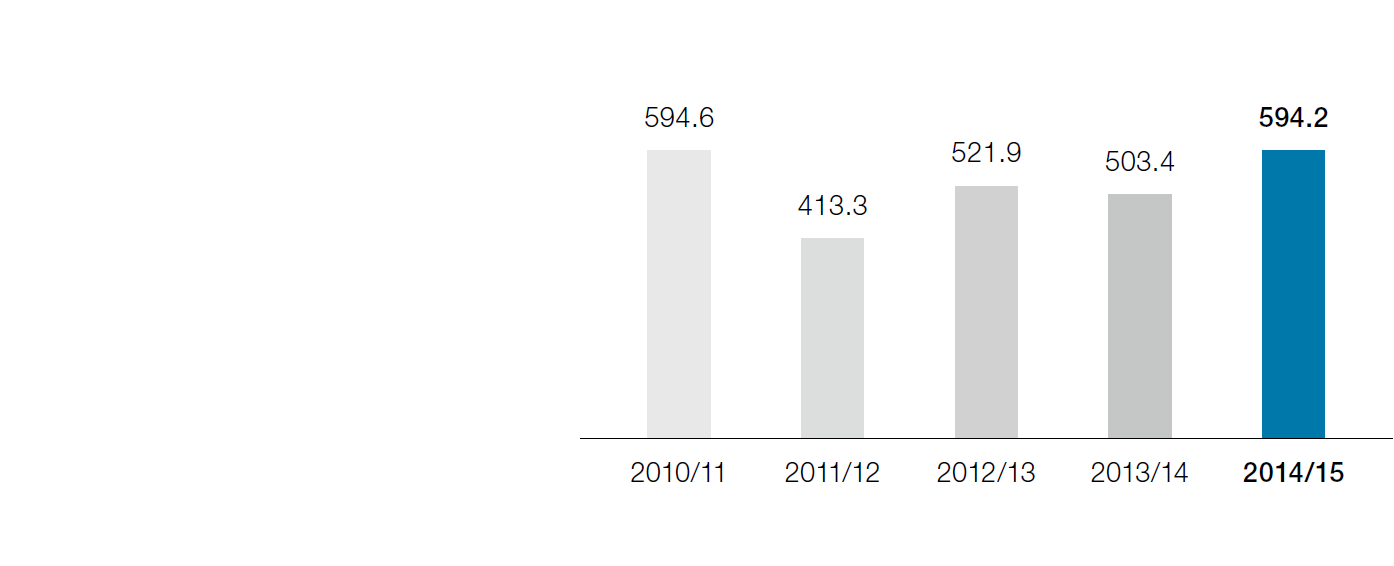

Profit for the period

In millions of euros

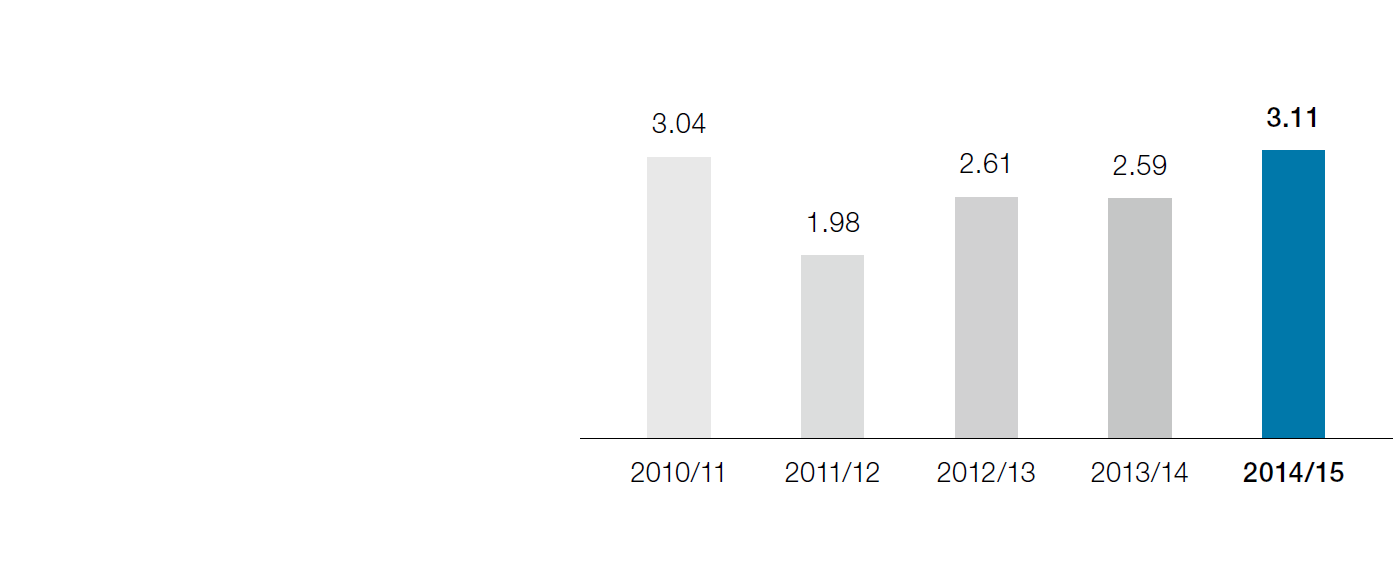

EPS – Earnings per share

In euros

The improvement by 15.6% in the profit before tax, which went from EUR 640.8 million in the business year 2013/14 to EUR 740.9 million in the year under review, was even more significant than in the operational sector. Adjusted by the non-recurring effect of EUR 45.2 million, profit before tax shows a gain of 8.6% to EUR 695.7 million. Despite a higher gross financial debt due to refinancing hybrid bond 2007 (volume EUR 500.0 million), which was redeemed as of the end of October 2014, the net interest charges were reduced year-over-year by 1.5% from EUR 147.6 million to EUR 145.4 million. The bond was refinanced through a corporate bond, which was issued in mid-October 2014 with a volume of EUR 400.0 million. While hybrid bond 2007 was recognized in equity, corporate bond 2014 is recognized as part of borrowed capital. Besides higher finance income, the primary reason for the lower interest charges was the declining interest rate in the past business year. Profit for the period as of March 31, 2015 comes to EUR 594.2 million (previous year: EUR 503.4 million), an increase of 18.0%. After deducting the non-recurring effects (EUR 42.4 million), there is a plus of 9.6%, bringing this figure to EUR 551.8 million. The income tax rate, which fell from 21.4% to 19.8% had a positive impact on this reporting category because, among other reasons, there were no taxes on earnings for most of the non-recurring effects.

Share page