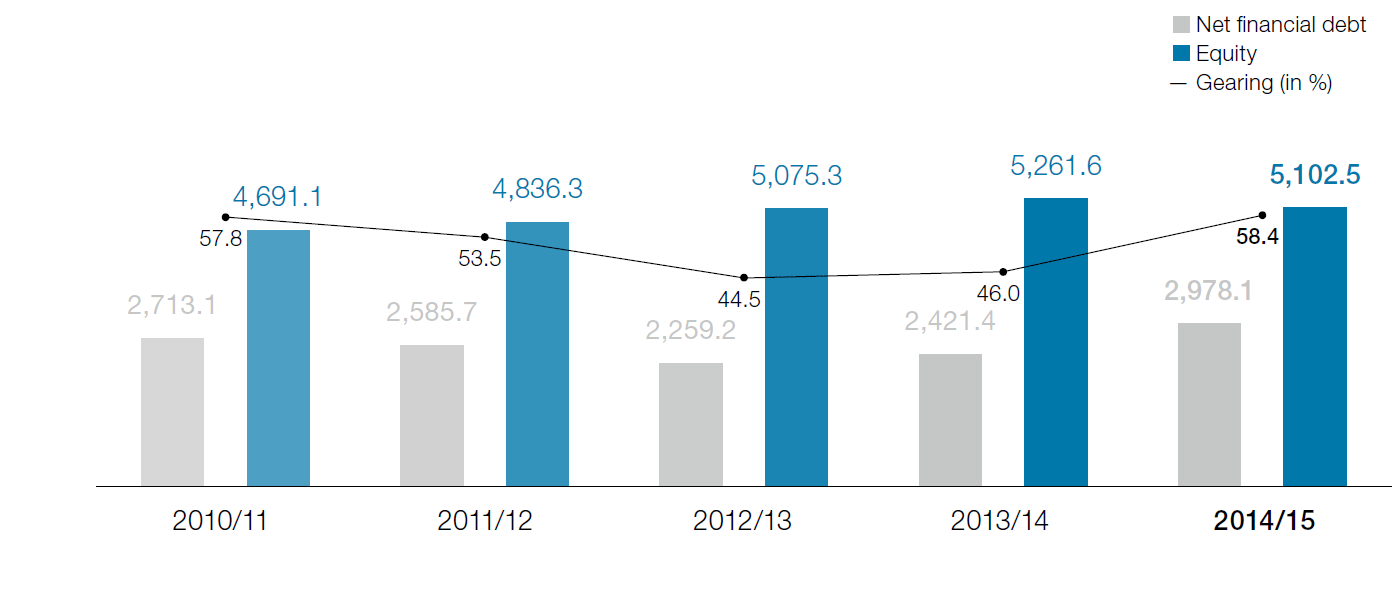

In a year-over-year comparison, the equity of the voestalpine Group declined by 3.0% from EUR 5,261.6 million as of March 31, 2014 to EUR 5,102.5 million as of March 31, 2015, although at EUR 594.2 million, the profit for the period experienced a positive trend. In contrast, however, net financial debt rose during the same period by 23.0% from EUR 2,421.4 million to EUR 2,978.1 million; as a result, the gearing ratio went up from 46.0% to 58.4%. On the one hand, this development was triggered by a change in the financing structure due to the previously mentioned refinancing of hybrid bond 2007, which is recognized in equity, by corporate bond 2014, which is reported as part of borrowed capital; consequently, equity fell by EUR 500.0 million and, at the same time, net debt rose accordingly. On the other hand, ultimately, items that did not affect income in the consolidated statement of comprehensive income in the business year 2014/15 had a significant impact on equity. While foreign currency translation boosted equity by EUR 142.2 million (previous year: EUR –111.4 million), equity declined by EUR 186.6 million (previous year: EUR –28.2 million) due to actuarial losses. The positive effect in respect to foreign currency translation is primarily the result of an increase in assets and debt of US subsidiaries because of the appreciation of the US dollar vis-à-vis the euro, the Group’s reporting currency, as of March 31, 2015 in a year-to-year comparison. The actuarial losses are the result of the change in the discount rate with regard to pensions and other employee obligations. In this context, it is remarkable that despite the Group’s considerably expanded investment activities in the reporting year, the gearing ratio would have improved even more if it had not been for the change in the equity/debt ratio as a consequence of hybrid bond 2007 being called.

- The Group

- Management Report

- Menu item: Market environment

- Menu item: Key figures

- Menu item: Events in the course of the year

- Menu item: Events after the reporting date

- Menu item: Investments

- Menu item: Acquisitions / Divestments

- Menu item: Employees

- Menu item: Raw materials

- Menu item: Research and development

- Menu item: Environment

- Menu item: Risk report

- Menu item: Rights and obligations

- Menu item: Outlook

- Divisional Reports

- Financial Statements

- Notes

- Menu item: General information

- Menu item: Accounting policies

- Menu item: Scope of consolidated financial statements

- Menu item: Acquisitions

- Menu item: Investments in associates and joint ventures

- Menu item: Acquisitions after the reporting period

- Menu item: Notes to the income statement

- Menu item: Notes to the statement of financial position – Assets

- Menu item: Notes to the statement of financial position – Equity and liabilities

- Menu item: Other Notes

- Menu item: 23. Financial instruments

- Menu item: 24. Statement of cash flows

- Menu item: 25. Related party disclosures

- Menu item: 26. Employee information

- Menu item: 27. Expenses for the Group auditor

- Menu item: 28. Disclosures

- Menu item: 29. Events after the reporting period

- Menu item: 30. Earnings per share

- Menu item: 31. Appropriation of net profit

- Menu item: Auditor’s report

- Menu item: Management Board statement

- Menu item: Investments

Share page