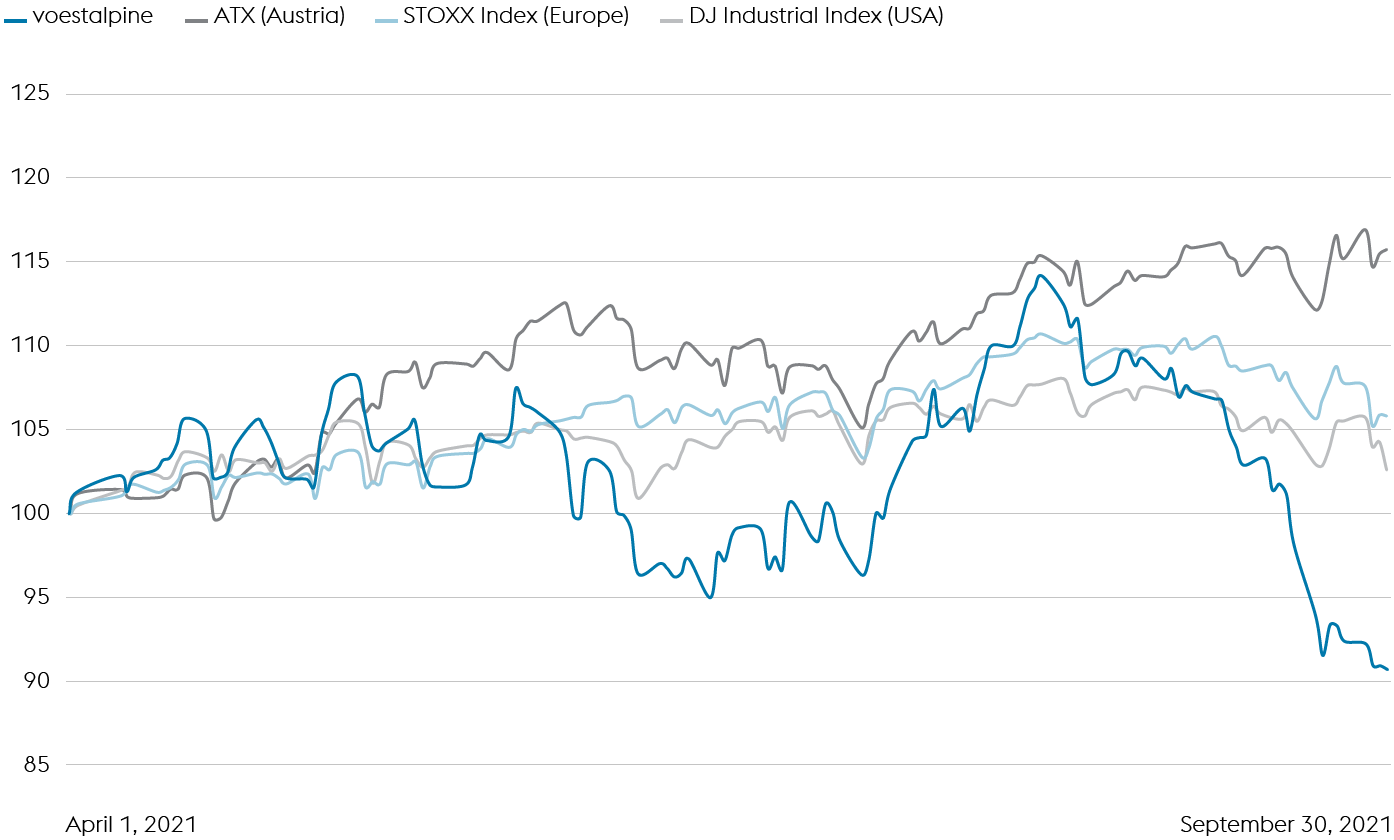

voestalpine AG VS. the ATX and international indices

Changes compared to March 31, 2021, in %

While the voestalpine share experienced a strong rally over the course of the business year 2020/21, it moved laterally during the first few months of the current business year. Economies the world over rapidly returned to a growth trajectory thanks to the economic stimulus packages that were put in place worldwide as well as the breakthrough in COVID-19 vaccinations. The fact that the stock markets did not continue their upward trajectory in the spring of calendar year 2021 despite robust economic growth is rooted in growing fears of inflation. Supply chain bottlenecks in pre-materials, high freight costs, unstable value chains as well as sharp increases in prices for raw materials and energy have been driving up prices for consumer goods. This, in turn, diverted investors’ attention to the central banks yet again. The European Central Bank (ECB) has indicated that it will not adjust its expansive monetary policies. The Federal Reserve (Fed), by contrast, announced that it will abandon its crisis mode and thus will taper its purchases of securities in order to prevent the economy from overheating. As soon as voestalpine presented its solid earnings figures for the first quarter of its business year 2021/22 and published its guidance in early August on its projected earnings for the current business year, the voestalpine share started to generate strong gains, briefly even surpassing the EUR 40 threshold.

Developments in September, however, were shaped by sharper share price declines. The global capital markets were not rattled by the rising numbers of COVID-19 infections. Instead, what initially affected the voestalpine share was the weakening of the automotive industry, which struggled due to the limited availability of semiconductor chips. Add to that the payment difficulties of the second-largest Chinese real estate conglomerate, which represents a material threat to the global economy. Issues specific to the steel industry were yet another negative factor impacting voestalpine’s share price. After rising to record highs in the spot markets through the Northern summer, steel prices retreated for the first time in September 2021, triggering the fear that the rally in the steel market might be nearing its end.

As of the close of September 2021, the price of the voestalpine share was EUR 32.04, which means that it lost about 10% of its value in the first half of the business year 2021/22. During the same period, the two benchmark indices, STOXX Index Europe and Dow Jones Industrial, improved a bit, whereas the ATX recorded stronger growth thanks to the strong weighting of financial securities. In contrast to cyclical industrials, bank and insurance stocks benefited from the potential tapering of the Fed’s extremely loose monetary policy and an associated increase in the interest rate.