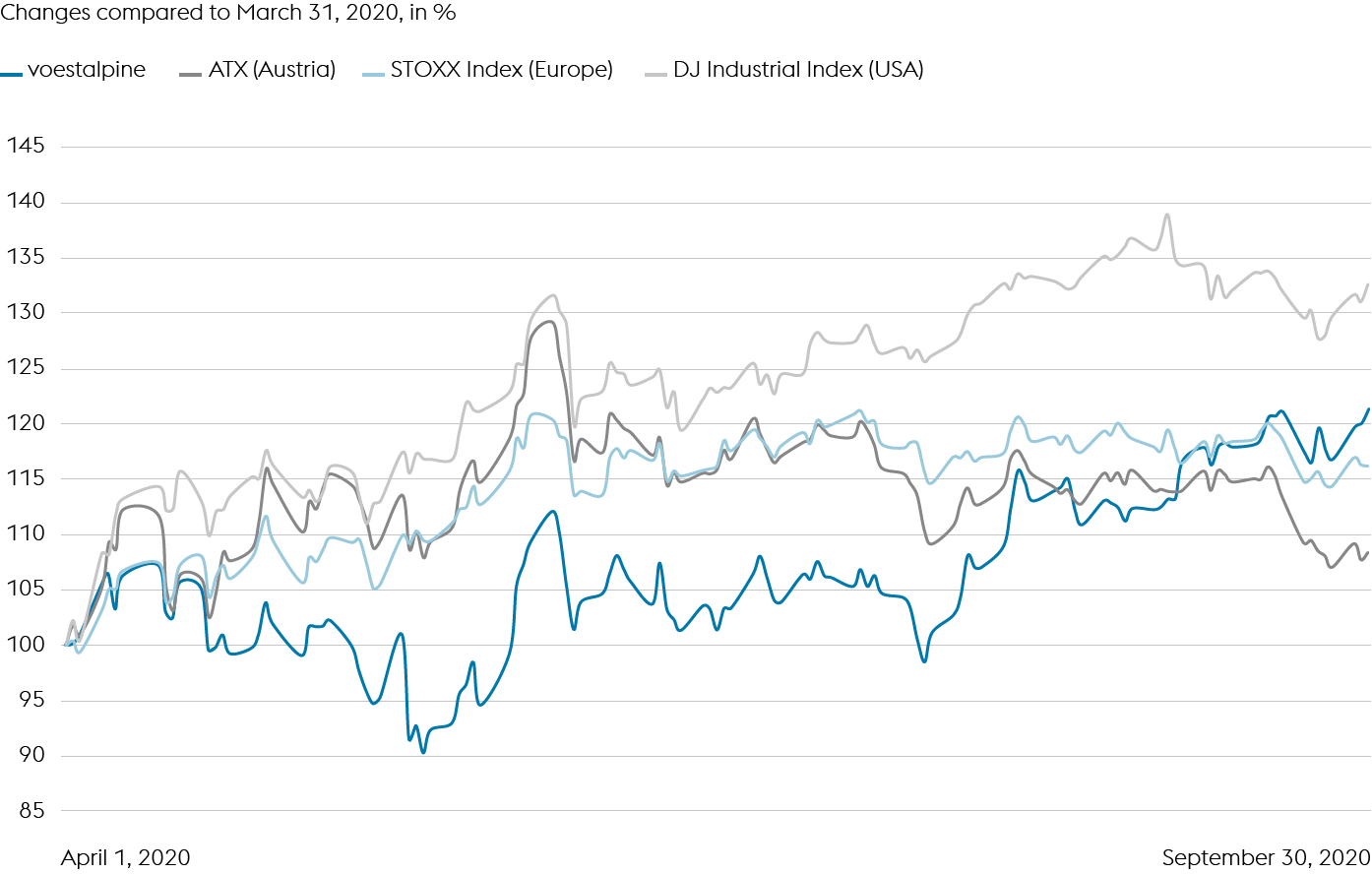

voestalpine AG VS. The ATX and international indices

On the international capital markets, the fourth quarter of the Group’s previous business year (which equates to the first quarter of the 2020 calendar year) was dominated by the fallout from the COVID-19 pandemic. Shares plunged dramatically in direct response to the rise in the number of infections globally. The market rebound that began at the end of March 2020 continued into the start of the Group’s business year 2020/21 (which equates to the second calendar quarter). This development was driven first and foremost by national governments’ announcements of wide-ranging support measures designed to limit increases in both corporate bankruptcies and unemployment and thus to boost consumer confidence. But share prices continued to fluctuate widely, given the ongoing spread of COVID-19 worldwide. In contrast to the general trend, however, the voestalpine share shed some of its value in the first few weeks of the business year 2020/21. The voestalpine Group’s strong orientation toward the automotive customer segment had a negative effect owing to comprehensive production shutdowns at original equipment manufacturers (OEMs). On May 21, 2020, the voestalpine share dropped to EUR 16.74, its lowest in the current business year to date. An upward trajectory followed once European governments managed somewhat to get a grip on the spread of COVID-19. Economists’ forecasts became more optimistic as a result. Orders from the automotive industry picked up again, in turn boosting capacity utilization rates as well as prices in the European steel industry. In sum, these factors led to more positive assessments by investors.

Against this backdrop, the voestalpine share rose by 21.4% in the first six months of the current business year, from EUR 18.54 as of April 1, 2020, to EUR 22.50 as of September 30, 2020. The two benchmark indices, ATX and STOXX (Europe), rose by a mere 8.4% and 16.2%, respectively, during the same period. By contrast, the Dow Jones Industrial delivered much better performance, rising by almost one third between early April 2020 and the end of September 2020.

Share page