The political framework

The next UN Climate Change Conference (COP26) was postponed to November 2021 on account of the Covid-19 pandemic. This means that material aspects of the 2015 UN Paris Agreement have still not been implemented fully five years after the accord was reached; in particular, this concerns a climate change mitigation framework that is largely uniform, comparable, and fair across the globe. At the European and national level, however, increasingly ambitious political targets are being set with respect to decarbonization, in turn putting strong pressure on energy-intensive industries to act.

Within the European Union, the focus is on the Green Deal that the EU Commission launched in November 2019: It is designed to make Europe the first climate-neutral continent. This goal arises mainly from the obligation under the Paris Agreement to achieve reductions between 80% and 95% in greenhouse gas emissions by 2050. It is now to be implemented through a number of legislative measures. The Green Deal aims to align all issues related to the orienting of the economic and social system toward sustainability and coordinate them under an overarching European concept. This integrated approach is generally positive and also accords with voestalpine’s long-held view. Realistically speaking, however, it may be very challenging at the political level to implement these goals in the current economic environment.

At the time the present CR Report was prepared, the European Commission had already submitted proposals regarding EU-wide climate legislation with far-reaching powers over the design and implementation of energy and climate plans at the national level, for one, and a long-term industrial strategy aimed at sustainability, for another. Actions that will be significant in both the short and the medium term are to be announced in the near future. For example, a marked tightening of the 2030 reduction goal for CO2 emissions is currently under discussion. This is important because it will provide the framework for all elements of the EU’s energy and climate policies.

Sectors such as the steel industry that are governed by the EU Emissions Trading System (EU ETS) already are obliged to reduce emissions by 43% compared with 2005 (onset of the emissions trading system). This will raise a major question: How will target increases be considered in the so-called “effort sharing”—i.e., the distribution of the burden via proportionate CO2 reductions in ETS-governed sectors and others such as traffic or buildings?

While emissions trading at the European level is subject to binding targets and measures, in other respects the EU only provides a general roadmap that individual member states are free to interpret as their ambition dictates. Besides the regulations on effort sharing, this also includes regulations regarding state aid, energy taxes as well as energy and emissions trading. In order to better align national policies with the European Union’s target achievement, the EU Commission thus plans to review absolutely all relevant climate and energy requirements by 2021 and to draw up proposals for revising and implementing them in the individual member states.

Finding a consistent and durable solution—at the political level and in accord with World Trade Organization (WTO) requirements—with respect to the previously evident competitive distortions and the resulting flood of imports into Europe of steel products manufactured with limited consideration of sustainability issues will be decisive to the ecologically-minded reconstruction of the economic system following the Covid-19 pandemic in Europe.

Above and beyond an industrial and hydrogen strategy, the German federal government has adopted a steel action plan (Handlungskonzept Stahl) which, on a very concrete level, concerns measures to support the steel industry during the transition to climate-friendly production and to create markets for “green steel.” In Austria, the federal government that took office in January 2020 has presented a program for the legislative period through 2024 that is very ambitious with respect to climate change mitigation; its aim to achieve climate neutrality no later than by 2040 substantially surpasses the goals of both the global climate pact and the European Union. However, the entire legislative framework required to this end—e.g., expansion of renewable energy, energy efficiency, hydrogen strategy—has not yet been put in place.

Both at the level of the EU and nationally, voestalpine is in constant talks, directly and via industry associations, with political decision makers, the scientific community, environmental organizations, and industrial partners. voestalpine’s basic position remains unchanged: The decarbonization strategies that the Group has developed must be viable not just technologically but also economically. This requires specific support in connection with the transformation’s additional costs (related to both investments and operations), which could be accomplished, for example, by directing earmarked funds back to the companies for climate mitigation investments under the EU ETS as well as by making green energy available and less expensive than it is today.

EU Emissions trading

The EU’s emissions trading system comprises some 11,000 energy-intensive plants, primarily in the power generation and processing industries. These companies must purchase allowances for every ton of carbon dioxide they emit. A fixed number of free allowances is allocated to particular sectors that are exposed to the risk of production being moved elsewhere (“carbon leakage”) because of internationally divergent climate protection standards. Just as in previous years on average, the voestalpine Group’s need to purchase additional allowances (difference between the total allowances needed less allocation of free allowances) in the business year 2019/20 equated to roughly one third of its total CO2 emissions of 13.6 million tons. It is expected from today’s vantage point that the need for additional allowances during the coming emissions trading period that runs from 2021 to 2030 will reach a similar scale.

Emission trading allowances: forecast for voestalpine

Number of additional allowances to be purchased, 2021–2030 trading period: approx. 45 million

However, the emissions trading directive gives the EU Commission the option of periodically or even continuously intervening in the system by modifying key parameters that concern the total number of allocations and hence the pricing.

Following the massive increase in the price of CO2 allowances in the past two business years, most recently developments remained very volatile despite the temporary decrease in prices. This was due mainly to the general economic downturn that started at the end of the first quarter of the calendar year 2020 on account of the Covid-19 pandemic. Long-term pricing forecasts are subject to very large fluctuations, given the uncertainties about the system in and of itself (especially, potential interventions and discussions about a tightening of the 2030 goals), the actual shape of the Green Deal, and future macroeconomic developments. The voestalpine Group regularly assesses price developments and forecasts with an eye toward risk management so that it can adjust its procurement strategy for CO2 allowances as necessary in the event of major changes.

Decarbonization: voestalpine’s approach to transformation

voestalpine is committed to the 2015 Paris Agreement’s goal to bring about a more than 80% reduction in greenhouse gas emissions by the middle of this century and pursues a consistent and long-term decarbonization strategy to this end.

Its extensive research and development programs—e.g., the EU’s flagship H2FUTURE project, which was started up in 2019, runs until 2021, and aims to generate green hydrogen on an industrial scale—are designed to enable the transformation from coal-based to hydrogenbased steelmaking in the long term.

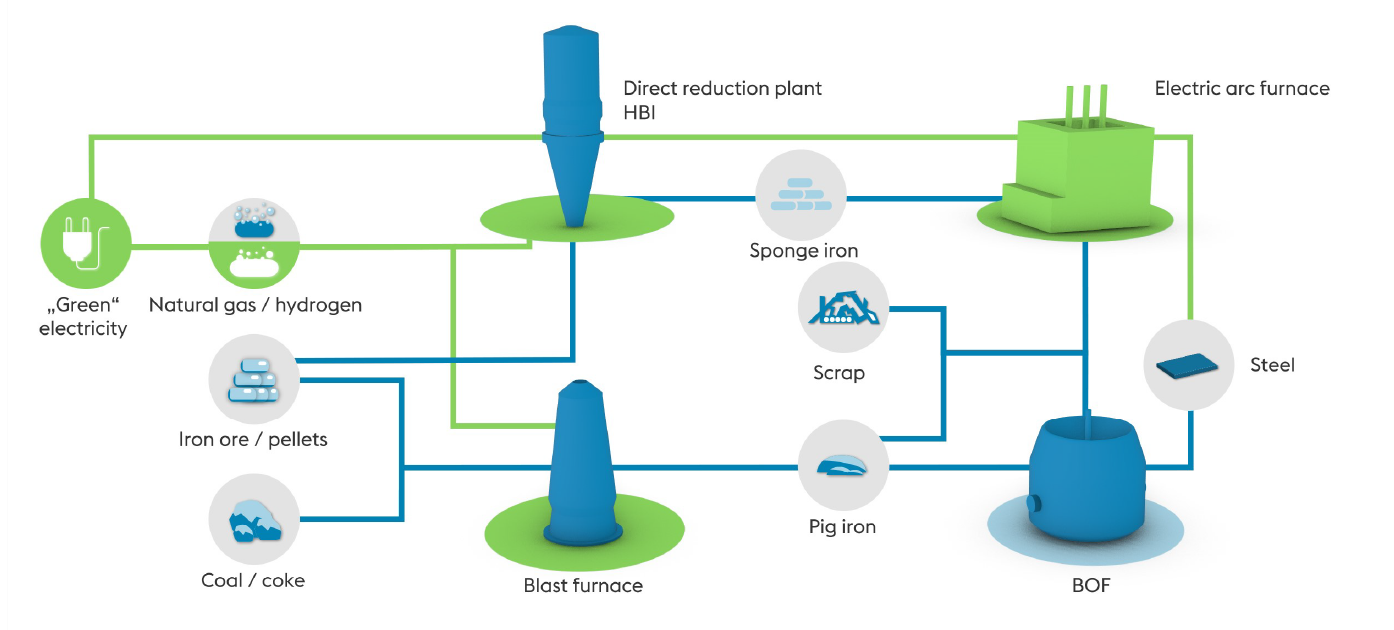

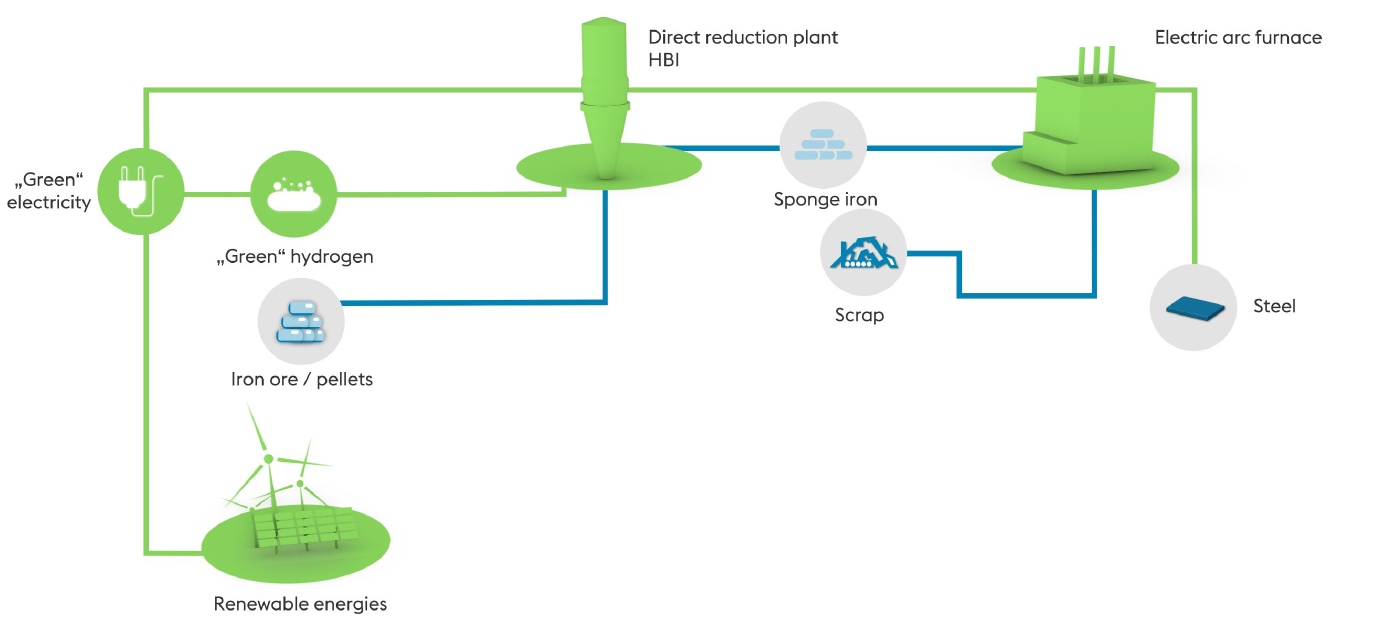

voestalpine has also been exploring concrete interim steps. For instance, a hybrid approach that involves switching incrementally from the blast furnace route based on coal to the electric steel route based on green electricity is being explored both economically and technically. It would make it possible from 2030 to lower the CO2 emissions resulting from the Group’s steel plants in Linz and Donawitz by about one third. The technological challenge lies in ensuring that product quality stays the same. An additional three terawatt hours of electricity from renewable sources would be required for this approach, in turn making it necessary to expand the network accordingly.

Hybrid steel plant by 2030/35

Using HBI as a high-quality pre-material

Besides pig iron and scrap, the hybrid approach also involves using hot briquetted iron (HBI) as a sophisticated pre-material, which voestalpine is already manufacturing at its direct reduction plant in Texas, USA. This raw materials mix contains a greater proportion of HBI and thus represents a major innovation in this approach. In the long term, the aim is to produce the same steel grades as they are available today using “green” HBI based on hydrogen in lieu of natural gas as well as based on scrap.

Breakthrough technology

> 80% reduction in CO2 by 2050

This transformation presupposes both the availability of electricity from renewable sources and its financial feasibility. In the final analysis, the broad-based implementation of CO2-minimized technologies will depend on the degree to which they can be deployed competitively at the global level also. However, the political framework for and thus the economic feasibility of this approach have not yet been established.

Concurrently with the long-term development of the novel hydrogen metallurgy, which is still in the development phase, voestalpine also pursues research and development projects involving the hydrogen-based reduction of ores and the direct production of crude steel using hydrogen plasma.

Furthermore, voestalpine participates intensively in cross-sector projects that deal with the economic and technological viability of carbon capture and usage (CCU), i.e., the separation and conversion of carbon dioxide into raw materials for the chemical and petrochemical industries.

Innovative projects aimed at decarbonization in the long term

The EU’s flagship H2FUTURE project concerns the generation and feasibility of green hydrogen—i.e., hydrogen that has been produced using renewable energy—using so-called proton exchange membrane (PEM) electrolyte technology on a major industrial scale.

By contrast to conventional approaches to the reforming of natural gas, the splitting of water into hydrogen and oxygen does not generate any CO2.

The H2FUTURE project consortium is a joint venture of six partners in Austria, Germany, and the Netherlands: VERBUND (Austria’s largest electricity provider) as the coordinator and provider of electricity; voestalpine as the operator; Siemens as the provider of technology; the Austrian Power Grid (APG) as the operator of the transmission network; and both K1-MET and the Energy Research Centre of the Netherlands (ECN-TNO) as scientific partners. The EU is supporting this demonstration project as part of the Fuel Cells and Hydrogen Joint Undertaking (FCH JU) by covering 70% of the total funding volume of some EUR 18 million, because the findings are to be made applicable to other energy-intensive sectors that could utilize hydrogen in the long term as well.

The pilot plant was successfully started up at the end of 2019 and will now test the application scenarios set forth in the project order by 2021.

Moreover, voestalpine also participates in “Clean Steel” among other ventures, a public/private partnership model that is being funded through EU research grants and participating companies’ own investments. The purpose of this project is to research low-carbon steelmaking technologies on an industrial scale. Both the specific modalities and the project selection are currently being worked out.

Share page