The international stock markets developed very positively in the business year 2016/17 despite numerous geopolitical uncertainties. The Brexit vote in the UK at the end of June 2016 led to short-term drops in share prices—some of them significant—while other political events such as the failed constitutional reform and the resulting government crisis in Italy had very little impact on the capital markets. Contrary to original fears, the unexpected outcome of the presidential elections in the USA likewise did not lead to any significant losses on the global stock markets. Rather, this marked the start of an upturn not just on the US exchanges but in Europe as well. Although the compartmentalization of the US economy discussed in the election campaign represents a risk, not least for the export-driven European industry, investors’ attention is clearly mainly focused on the significant infrastructure measures proposed by the new US president and their anticipated positive effects on growth.

Global economic development over the course of the 2016 calendar year and in the first few months of 2017 was characterized by a burgeoning recovery in the most important regions of the world. This was mainly due to the stabilization of economic growth in China over the course of the year on the one hand, and the stronger-than-expected upward trend in Europe on the other. The steel sector saw increasingly positive sentiment from the fall of 2016 on the back of an improvement in steel prices, driven by rising raw materials prices and more optimistic economic expectations, as well as by the EU Commission’s increasingly restrictive approach to non-competitive steel imports.

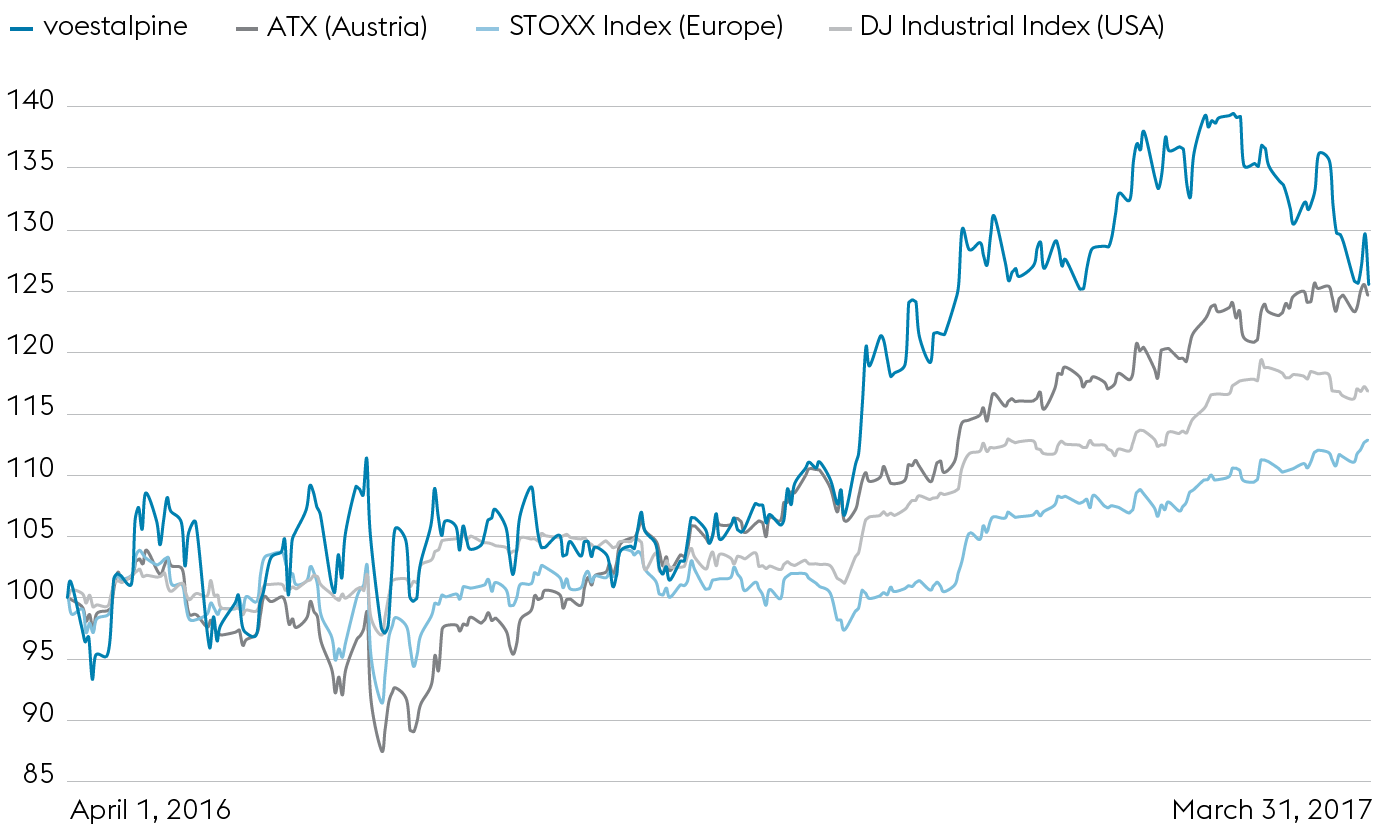

In this environment, the voestalpine share trended sideways with high volatility in the first six months of 2016/17. The share price initially rallied in the second half of the business year but relinquished some of these gains toward the end of the period. Overall, the voestalpine share gained 23.9% over the past business year, rising by EUR 29.78 (as of April 1, 2016) to EUR 36.90 (as of March 31, 2017). It slightly outperformed the ATX and significantly outperformed the STOXX Index Europe and Dow Jones Industrial benchmark indices.

Share page