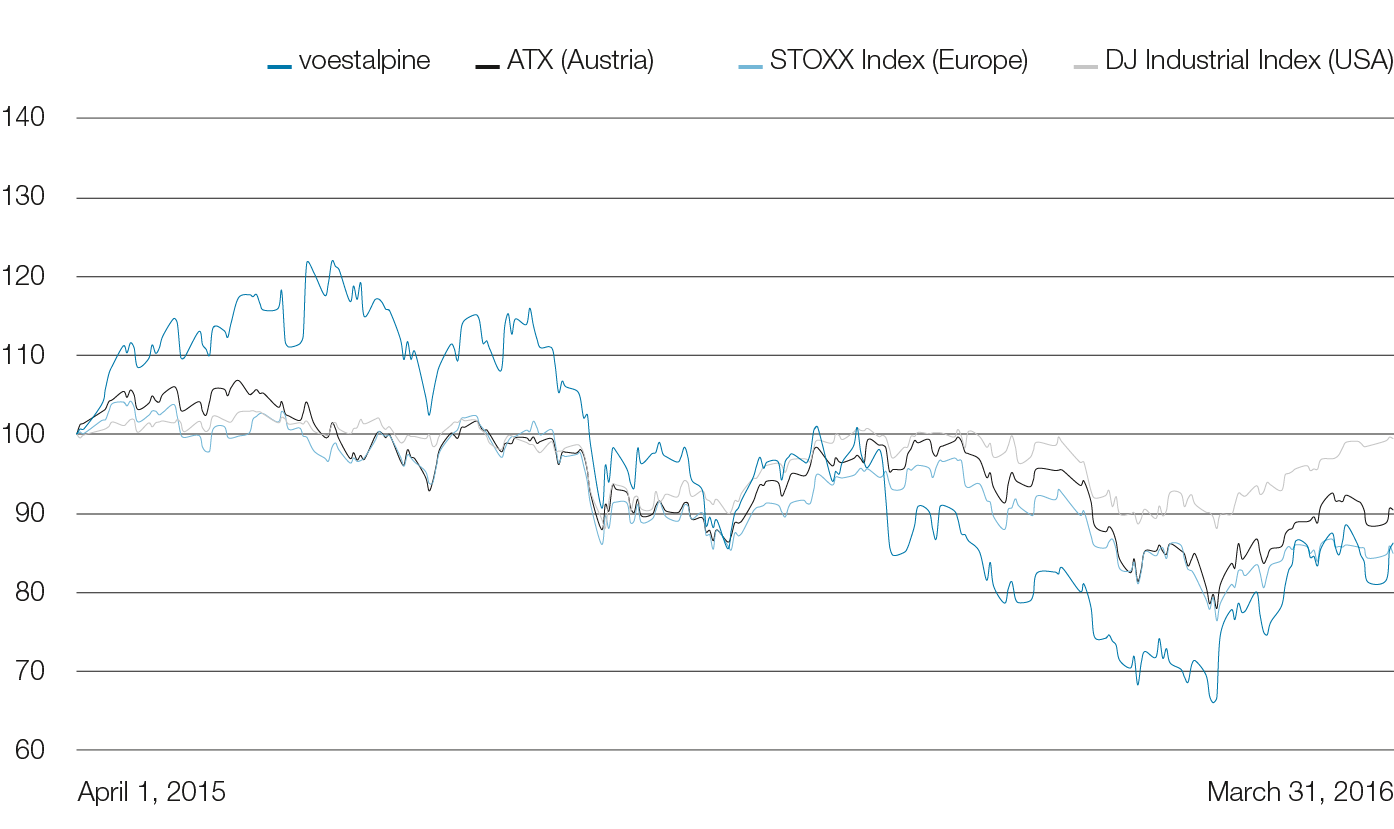

In the business year 2015/16, the voestalpine share experienced a significantly more volatile development than in the previous year, an indication that macroeconomic uncertainties have again gained in intensity. The early part of the business year was characterized by an optimistic mood that relied on positive economic indicators. With the solid annual key figures, which were published in early June 2015, providing an additional tailwind, the share price gained more than 20% over two and one half months. Subsequently, within a period of exactly eight months—between June 10, 2015, when the highest share price of the year was reached at EUR 41.58 and February 10, 2016, which saw the lowest price in the past business year at EUR 22.52—the price of the voestalpine share plummeted by more than 45%. The sharp fall of the share price was caused, first of all, by external factors, such as the increasing doubts in the course of 2015 regarding the health of the Chinese economy and the international ramifications of Brazil and Russia sliding deeper and deeper into a recession. Additionally, the intensifying political situation in the troublespots in the Middle East and Africa had an increasingly adverse impact on the mood of the international capital markets. Following customary patterns, the increasingly uncertain market conditions primarily affected the development of equities sensitive to fluctuations in the economy. The trend on the capital markets finally slipped into the negative zone during late fall of 2015 as a result of the rapid decline of the oil and natural gas prices on one hand and the dramatically increasing trade conflicts between China and the rest of the world on the other, triggered, among other things, by the global glut of artificially cheap Chinese mass market steel products.

It was not until around mid-February 2016 that international stock markets settled down somewhat. Overall, the value of the voestalpine share declined in the course of the business year 2015/16 by 14.4%, falling to EUR 29.41 by March 31, 2016 from EUR 34.34 at the beginning of the business year. Therefore, the voestalpine share trended slightly better than the STOXX Index Europe, but somewhat below the ATX, the leading Austrian share index. As of March 31, 2016, the US benchmark index Dow Jones Industrial closed at practically the same level as twelve months before.

Share page