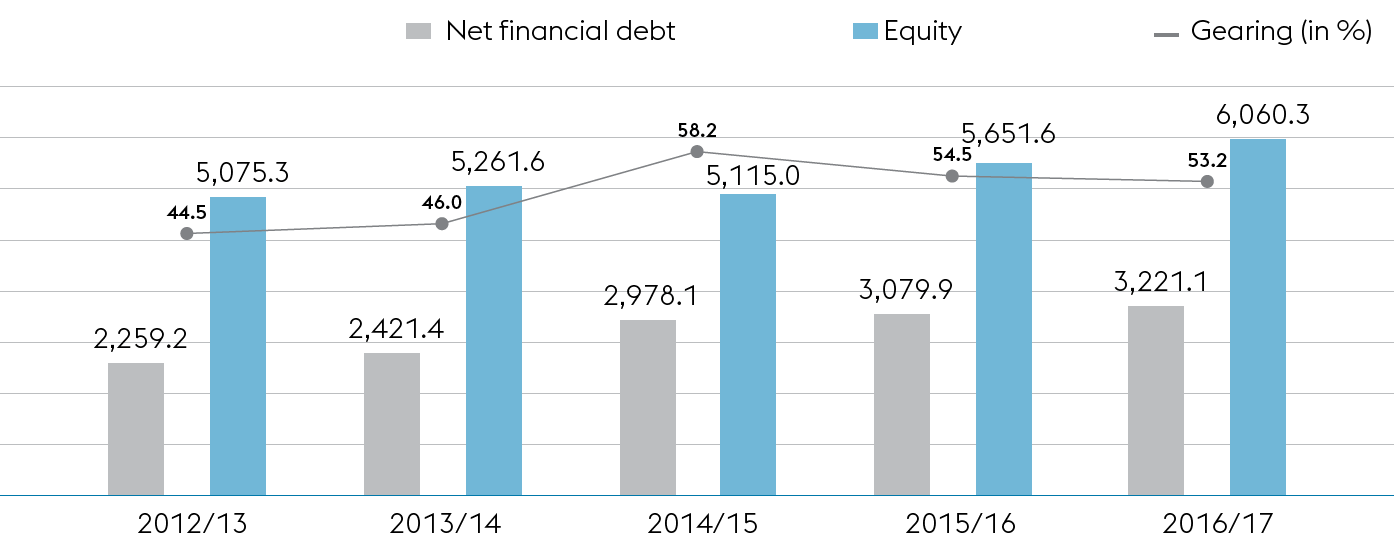

Net financial debt – Equity – Gearing ratio

In millions of euros

After having already declined in the previous year despite record investment in a year-to-year comparison, the voestalpine Group’s gearing ratio (net financial debt as a percentage of equity) again decreased in the business year 2016/17 from 54.5% as of March 31, 2016, to 53.2% as of March 31, 2017. This was achieved despite the fact that investment in the past business year was again much higher than the level of depreciation, an increase in net working capital, mainly due to pricing factors, and another increase in the dividend. The long-term level of investment required to focus on the high-end quality segment and to implement the growth-driven internationalization strategy is therefore once again not in contradiction with solid financial growth. Against this backdrop, equity also rose by 7.2% from EUR 5,651.6 million as of March 31, 2016, to EUR 6,060.3 million as of March 31, 2017. Consequently, this also rose at a faster rate than net financial debt, which increased by 4.6% from EUR 3,079.9 million to EUR 3,221.1 million in the same period.

Net financial debt can be broken down as follows:

Net financial debt |

||||

In millions of euros |

|

03/31/2016 |

|

03/31/2017 |

|

|

|

|

|

Financial liabilites non-current |

|

3,342.8 |

|

2,764.7 |

Financial liabilites current |

|

898.2 |

|

1,332.9 |

Cash and cash equivalents |

|

–774.8 |

|

–503.3 |

Other financial assets |

|

–355.8 |

|

–348.3 |

Loans and other receivables from financing |

|

–30.5 |

|

–24.9 |

Net financial debt |

|

3,079.9 |

|

3,221.1 |

Share page