Profit before tax, profit for the period, and earnings per share all surpass the previous year’s figures several times over

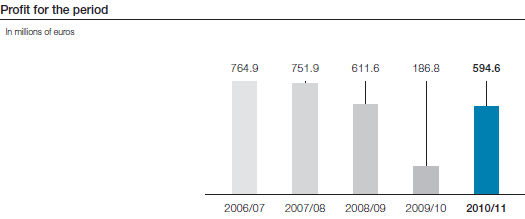

Due to an operating result that was up strongly compared to the previous year, profit before tax (EBT) in the business year 2010/11 more than quadrupled, going from EUR 183.3 million to EUR 781.0 million. Taking the tax rate of 23.9% into account, profit for the period (net income)1 came to EUR 594.6 million and is thus 218.3% higher than the previous year’s figure (EUR 186.8 million).

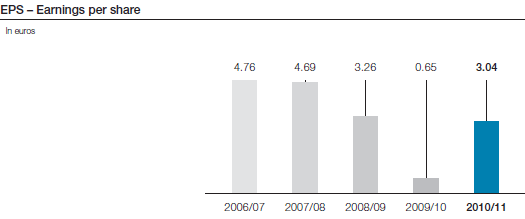

Based on this figure, the earnings per share (EPS) for the business year 2010/11 are EUR 3.04 (previous year: EUR 0.65).

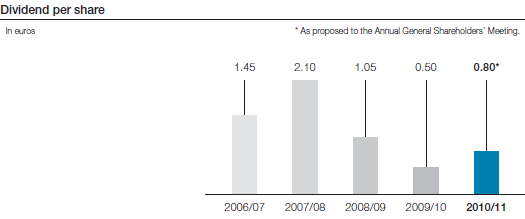

Proposed dividend: EUR 0.80 per share

Subject to the consent of the Annual General Shareholders’ Meeting of voestalpine AG which will take place on July 6, 2011, a dividend of EUR 0.80 per share will be distributed to the Company’s shareholders for the business year 2010/11. Compared to the previous year (EUR 0.50 per share), this represents an increase of EUR 0.30 per share or 60.0%. Based on the earnings per share (EPS) of EUR 3.04, the distribution ratio is 26.3% (previous year: 77.7%). Taking the average share price during the business year 2010/11 of EUR 28.77 into consideration, the dividend yield is 2.78% (previous year: 2.23%).

Gearing continues to fall

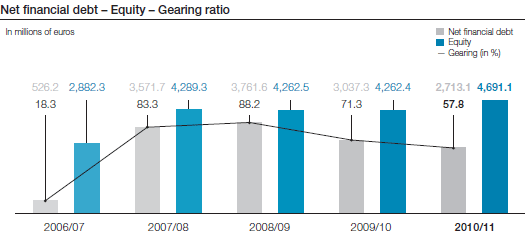

Compared to March 31, 2010, equity rose in the business year 2010/11 by 10.1% from EUR 4,262.4 million to EUR 4,691.1 million. The increase in equity due to the profit for the period of EUR 594.6 million and positive currency translation and hedging effects were accompanied by impairment effects generated by the dividend distribution to shareholders and owners of hybrid capital totaling EUR 155.5 million.

Due to the very good result and the investment expenditure that was considerably lower than depreciation, net financial debt dropped compared to March 31, 2010, by 10.7% from EUR 3,037.3 million to EUR 2,713.1 million despite the build-up of working capital resulting from price-related issues and dividend payments. Thus, as of the end of the business year 2010/11, the voestalpine Group’s gearing ratio (net financial debt as a percentage of equity) dropped to 57.8% compared to 71.3% as of March 31, 2010.

Free cash flow at about half a billion euros

Although profit for the period rose considerably in the business year 2010/11 from EUR 186.8 million to EUR 594.6 million, cash flows from operating activities fell by 40.4% from EUR 1,606.1 million to EUR 957.6 million due to the fact that the amount of liquidity tied up in working capital went up. However, due to very consistent and meticulous working capital management, working capital rose by a disproportionately small percentage vis-à-vis revenue in the business year 2010/11. As a result of the Group’s restrictive investment policy that was retained in the past year, at EUR –466.9 million, cash flows from investing activities (without taking financial investments into account) continued to be low and even remained below the previous year’s level (EUR –586.9 million) so that ultimately free cash flows came to EUR 490.7 million (2009/10: EUR 1,019.2 million). Taking changes in financial investments into account, cash flows from investing activities fell substantially from EUR –914.5 million to EUR –366.7 million. Due to a smaller dividend payout that went down from EUR –539.6 million to EUR –390.5 million, cash flows from financing activities decreased. Against this backdrop, cash and cash equivalents rose in the business year 2010/11 by another EUR 204.8 million (including net exchange differences), going from EUR 1,028.6 million to EUR 1,233.4 million.

At 7.72 million tons, crude steel production at an all-time high

The economic environment, which improved significantly during the business year 2010/11, is also reflected in a substantial increase in crude steel production across the Group. The total production volume in the business year 2010/11 of 7.72 million tons was not only 27.2% higher than the comparative figure of the previous year (6.07 million tons) but represented a new production record for the voestalpine Group. With a production volume of 5.46 million tons, the Steel Division reported an increase of 25.2% and the Railway Systems Division recorded an output of 1.42 million tons, a gain of 18.3%; the strong growth in demand is reflected most clearly in the production figures of the Special Steel Division, which improved its output from 510,000 tons to 841,000 tons, a surge of 64.9%.

1 Before non-controlling interests and interest on hybrid capital.