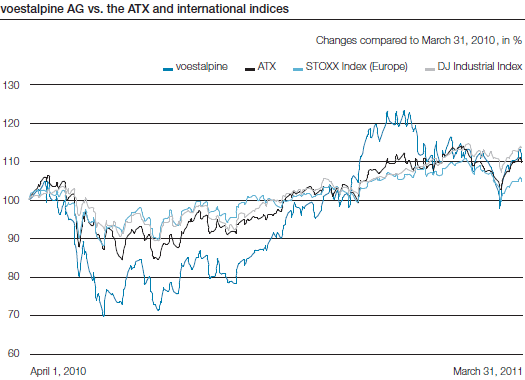

The development of the voestalpine share in the business year 2010/11 reflects the extremely inconsistent stock market environment, which was affected primarily by macroeconomic factors. While, initially, capital markets reflected uncertainty about how global economic performance would develop, later on, they were affected by growing doubts about the long-term stability of government budgets (primarily in the euro zone, however, increasingly in the USA as well) and the sustainability of economic growth in China. Most recently, the uncertainty was exacerbated by continuing political instability in large parts of North Africa as well as the aftereffects of the earthquake, tsunami, and nuclear disaster in Japan.

Against this backdrop, the price of the voestalpine share during the past business year was very volatile, at the same time reflecting overall performance on the stock exchanges. After the share lost up to 30% of its value in the early part of the business year, in the period from July to December 2010, its value rose by about 64% due to the increasingly dynamic trend in the global economy. However, the share was unable to sustain this trend in the fourth quarter.

Looking at the business year 2010/11 overall, the price of the voestalpine share rose from EUR 29.95 to EUR 33.13, an increase in value of 10.6% (which approximately corresponds to the performance of the ATX, Austria’s leading share index).

| (XLS:) Download |

|

|

EUR 307,132,044.75 divided into | |

|

|

|

Shares in proprietary possession |

|

Class of shares |

|

Ordinary bearer shares |

|

Stock identification number |

|

93750 (Vienna Stock Exchange) |

|

ISIN |

|

AT0000937503 |

|

Reuters |

|

VOES.VI |

|

Bloomberg |

|

VOE AV |

| (XLS:) Download |

|

Prices (as of end of day) |

|

|

|

Share price high April 2010 to March 2011 |

|

EUR 36.86 |

|

Share price low April 2010 to March 2011 |

|

EUR 20.87 |

|

Share price as of March 31, 2011 |

|

EUR 33.13 |

|

Initial offering price (IPO) October 1995 |

|

EUR 5.18 |

|

All-time high price (July 12, 2007) |

|

EUR 66.11 |

|

Market capitalization as of March 31, 2011* |

|

EUR 5,585,098,104.57 |

|

|

|

|

|

* Based on total number of shares minus repurchased shares | ||

| (XLS:) Download |

|

Business year 2010/11 |

|

|

|

Earnings per share |

|

EUR 3.04 |

|

Dividend per share |

|

EUR 0.80* |

|

Book value per share |

|

27.39 EUR |

|

|

|

|

|

* As proposed to the Annual General Shareholders’ Meeting | ||