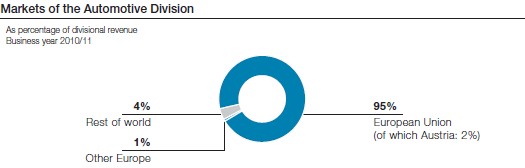

The underlying economic tendency that has prevailed in the automotive industry worldwide for some time continued during the business year 2010/11: Brazil, India, and China as well as North America—albeit with some delay and to a somewhat lesser extent—continue to be the drivers of the industry’s global growth, while automobile sales in Europe are still stagnating at a rather moderate level.

Within Europe too, which remains the Automotive Division’s largest market by far in terms of revenue, the disparate development of the past several years continued, marked by a significant sales pick-up in Eastern Europe, a slight decline in demand in Western and Central Europe, which was anticipated after the discontinuation of government incentive programs, and ongoing consumer reticence in Southern Europe.

However, the production figures of European automobile manufacturers developed much more favorably. Primarily due to the strong export performance of Western European premium brands—the division’s main customer segment—, overall European automobile production during the business year 2010/11 increased substantially, although it still remained about 12% below the pre-crisis level.

The commercial vehicle industry showed a continuing uptrend, and it is expected that its recovery will continue and increasingly accelerate in the current business year.

Against this backdrop, the Automotive Division’s capacity utilization at almost all of its production sites and in practically all segments showed ongoing improvement so that by the end of the reporting period, all facilities were largely running at full capacity. Furthermore, the measures to increase efficiency that were initiated during the economic crisis and that have been rigorously implemented (for example, the product and technology offensive or the optimization of organization and internal processes) have shown considerable positive effects.