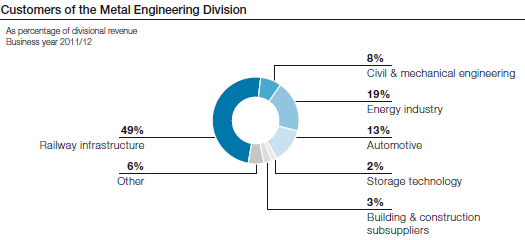

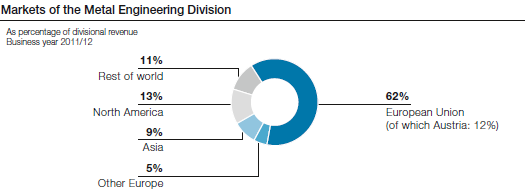

In the year under review, the market environment for the Metal Engineering Division was positive overall, although there were great differences between the individual business areas.

In the Rail Technology segment, the contrasting trend between premium qualities and standard products continued unabated. The capacity utilization of the production site in Donawitz, Austria, which specializes in heat-treated special rails, was at a high level throughout the entire business year, while the production site in Duisburg, Germany, came under mounting pressure due to the deteriorating situation for standard grades, which is marked by overcapacities that have led to a sharply falling price level in Europe and competition that is becoming more and more cutthroat, especially on the part of Asian manufacturers on the international export markets.

As a direct consequence of this development that has been ongoing for several years and the negative perspectives, the voestalpine Group—after a thorough analysis—decided in mid-March to close TSTG Schienentechnik GmbH & Co KG (“TSTG”) in Duisburg. On March 31, 2012, a provision in the amount of EUR 205.0 million was formed to cover costs associated with the closure and for risks connected with the rail antitrust proceedings in Germany (for more details, please refer to the section ”Significant events during the course of the year“).

The Turnout Technology unit experienced stable demand on the European core markets and, at the same time, a sustained outstanding development in North America, South Africa, Brazil, and Australia. After sharply declining investments in the 2011 calendar year, China saw the beginnings of a revival of demand in the railway infrastructure sector.

In the Seamless Tube segment, the market environment was quite positive in the business year 2011/12; due to the higher oil prices, there was a stable demand at a high level in the OCTG segment (oil country tubular goods/oilfield tubes), especially in North America and the MENA region. There was also a slight uptrend in demand from Russia. A very good level of incoming orders for industrial tubes for the commercial vehicle and automobile industries—based on the thermomechanical rolling technology developed by voestalpine—enabled full capacity utilization.

Order volume in 2011/12 in the Wire business segment was at a very good level; however, most recently, due to a decline in demand resulting from the economic situation, competitive pressure increased and the market environment became more volatile.

The Welding Technology business segment continued to experience a decline in investments for major projects (power plant construction and petrochemicals) and significant margin pressure in the standard segment of welding consumables. The Steel business segment was characterized by full capacity utilization throughout 2011/12, but it was also marked by high volatility in raw material costs.