The market environment in the business year 2010/11 varied greatly for the individual business areas of the Railway Systems Division.

For example, while the railway markets in the rail segment were characterized by stable demand in Europe and high demand from overseas export markets, standard products particularly were impacted by a significant price decline, aggressive quantity competition, and increased pressure on profit resulting from massive increases in raw materials costs. It was only at the end of the business year that prices began to gradually bottom out. In contrast, the trend in the premium rails segment, which is even more important for the division, was comparatively stable.

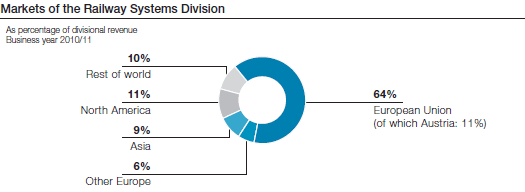

Rising steel prices resulted in a certain amount of temporary pressure on operating results in the turnout systems segment, however, overall, this area experienced a continuing stable development, aided by a noticeable recovery in North America and Eastern Europe. The market environment in China, Brazil (driven by the raw materials boom and the infrastructure offensive associated with the Soccer World Championship in 2014), and Australia (also due to raw materials) was extremely dynamic.

The economic situation in the seamless tube segment continued to be positive, with high demand from North America and from the Middle East and increasing oil and natural gas drilling and extraction activities in Europe being particularly noteworthy in this regard.

Due to a consistently positive demand in the wire segment, this area experienced optimum technical and organizational capacity utilization. Consistently focusing the portfolio on products of the highest quality is reflected in the extremely successful business associations that have been formed with technologically sophisticated industries, particularly the automotive and the automotive supplier industries.

In the steel segment, after the scheduled major repair of a blast furnace that was carried out in the summer of 2010, both blast furnaces have been in operation since fall. Solid growth in demand enabled subsequent and consistent full capacity utilization right up to the end of the business year 2010/11 and also made it possible to pass on most of the exorbitantly higher raw materials costs (ore, coal/coke, scrap, alloys) to the market.

Compared to the previous business years, the welding consumables segment (previously part of the Special Steel Division) is new in the Railway Systems Division’s portfolio, which has profited from both the noticeable market recovery in Europe and continuing dynamic growth in China, India, and South America and which has been performing outstandingly.