Development of the Special Steel Division’s economic environment remained positive throughout the entire business year 2010/11. The high number of incoming orders enabled full capacity utilization of the division’s production facilities during the second half of the year. While at the beginning of the business year it was the build-up of customer inventories in particular that drove the recovery, subsequently, the surprisingly strong economic upswing in many of the division’s core regions created a favorable and solidly reliable growth environment.

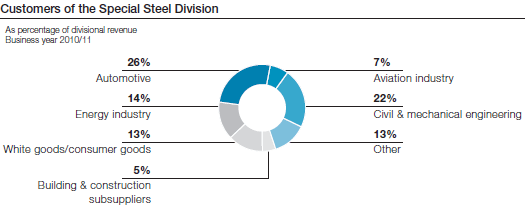

The significantly increased demand for special steel and special steel products compared to the difficult business year 2009/10 was primarily driven by the automotive, electronics, consumer goods, and oil and gas exploration customer sectors. The energy generation sector, however, declined even further over the year, with the exception of the alternative energy segment (particularly wind power) which saw an increase in demand. Demand from the aviation industry remained largely cautious during the majority of the reporting period although the first signs of an easing of the situation became apparent during the course of the year.

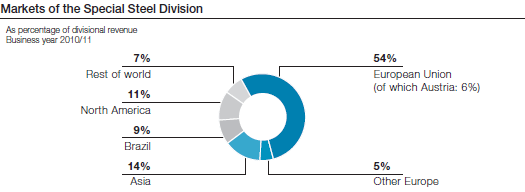

Viewed regionally, it is particularly the markets in Asia (China, India) and South America (Brazil) that continue to be the major drivers of growth. The economic climate in North America brightened somewhat in the course of the business year, but, viewed overall, it remained a volatile environment.

In Europe, the disparate trends became even more entrenched in the past year. The North and Central European region reported a substantial revival of demand—in particular thanks to the strong export showing of the German economy, which acted as a growth driver—, and Eastern Europe showed the first signs of recovery, whilst there was no perceptible sustained and sustainable uptrend in the Southern European markets.

With regard to the individual product groups of the Special Steel Division, the greatest increases in demand compared to the previous year were for tool steel, high-speed steel, valve steel, and to some degree special structural steel as well. These segments profited from solid demand from the automotive and automotive supplier industries, the consumer goods industry, as well as the mechanical and plant engineering sectors. Furthermore, higher demand from the electronics industry increased sales of powder-metallurgical special steels. Top-quality special steels also made gains, for example, anti-magnetic drill collars, for which there is massive demand due to the accelerated pace of oil and gas production worldwide.

As far as the division’s two business sectors are concerned, high performance metals profited particularly from the recovery in the automotive industry, which was fueled by the introduction of numerous new models. Generally, apart from aviation and power engineering, the broadly based upswing became more firmly established, including from a regional perspective.

While the early part of the business year 2010/11 was still difficult for the special forging sector, it subsequently experienced a trend reversal in its major customer segments, particularly the European commercial vehicle industry, and recorded a significant increase in incoming orders during the course of the year.