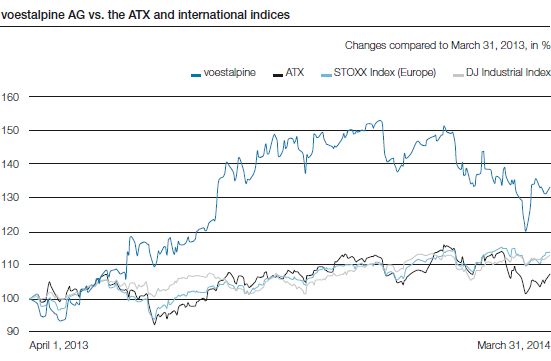

In the first six months of the business year 2013/14, the voestalpine share rose steadily in value. As the fundamentals continued to be very good and an upswing of the global economy was expected before long due to the positive economic indicators, market capitalization increased by more than half within just a few months. Due to the sharp rise of the share price, cautious behavior on the part of many investors in the third quarter of the business year initially triggered a trend toward lateral movement. The fourth quarter once again demonstrated how sensitively markets react to external disruptions. The political tension between the Ukraine and Russia was the deciding factor for the decline of both the ATX, the leading index of the Vienna Stock Exchange, and the voestalpine share. It was not until the announcement of the Group’s efficiency improvement and cost optimization program, which is planned for a period of three years and is expected to save EUR 900 million, helped the share price to rally. As of the end of the business year 2013/14, the share price was at EUR 31.91, thus achieving an increase in value of almost one third over the course of one year, thus clearly outstripping the Austrian ATX index, the Stoxx Index (Europe), and the DJ Industrial Index.

- The Group

- Management Report

- Menu item: Market environment

- Menu item: Regional

- Menu item: Divisions

- Menu item: Steel industry

- Menu item: Key figures

- Menu item: Important events

- Menu item: Investments

- Menu item: Acquisitions

- Menu item: Employees

- Menu item: Raw materials

- Menu item: Research and development

- Menu item: Environment

- Menu item: Risk report

- Menu item: Rights and obligations

- Menu item: Outlook

- Divisional Reports

- Financial Statements

- Notes

- Menu item: General information

- Menu item: Accounting policies

- Menu item: Scope of consolidated financial statements

- Menu item: Acquisitions

- Menu item: Notes to the income statement

- Menu item: Notes to the statement of financial position – Assets

- Menu item: Notes to the statement of financial position – Equity and liabilities

- Menu item: Other Notes

- Menu item: Financial instruments

- Menu item: Statement of cash flows

- Menu item: Related party disclosures

- Menu item: Employee information

- Menu item: Expenses for the Group auditor

- Menu item: Disclosures

- Menu item: Events after the reporting period

- Menu item: Earnings per share

- Menu item: Appropriation of net profit

- Menu item: Auditor’s report

- Menu item: Management Board statement

- Menu item: Investments