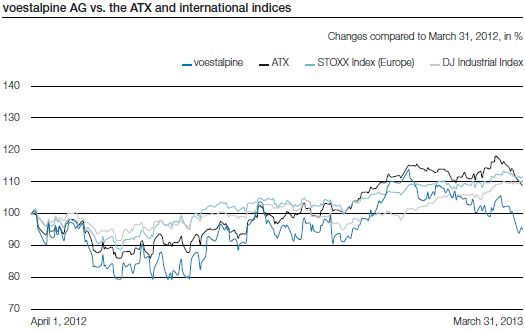

The negative mood on the financial markets in the early part of the business year 2012/13, which also affected the voestalpine AG share, was the result of global fears surrounding the economy on one hand and on the other, of the continuing sovereign debt crisis, primarily in Europe, but in the USA as well. In the summer of 2012, at a time when economic expectations began to deteriorate, a counter movement began to emerge on the international stock exchanges that was triggered by the announcement made by ECB President Mario Draghi that in the event of a worsening of the crisis, action would be taken to provide de facto unlimited assistance to already struggling nations. As a result, despite a phase of economic gloom, shares went up with some experiencing tremendous gains. The voestalpine share’s sharp price increases toward the end of the 2012 calendar year were, however, not only due to external factors but were also based on the solid earnings performance of the first half of the business year 2012/13. The bank crisis in Cyprus, which escalated in the first quarter of 2013, demonstrated once again—using the performance of the voestalpine share as an example—that in times of uncertain market conditions, international investors will first of all pull back from less liquid markets and sell off equities sensitive to fluctuations in the economy. Furthermore, from a fundamental perspective, no support could be identified in the first calendar quarter of 2013; indeed, growth expectations for Europe in 2013 were lowered in the course of the quarter.

Viewed over the course of the entire business year 2012/13, as a result of this market environment, the ATX, the STOXX Index (Europe), and the DJ Industrial Index each gained around 10% in the course of the business year, but the value of the voestalpine share lost about 5% in the same period, going from EUR 25.22 to EUR 23.96.

| (XLS:) Download |

|

|

EUR 313,309,235.65, divided into | |

|

Shares in proprietary possession as of March 31, 2013 |

|

90,629 shares |

|

Class of shares |

|

Ordinary bearer shares |

|

Stock identification number |

|

93750 (Vienna Stock Exchange) |

|

ISIN |

|

AT0000937503 |

|

Reuters |

|

VOES.VI |

|

Bloomberg |

|

VOE AV |

|

Prices (as of end of day) |

|

|

|

Share price high April 2012 to March 2013 |

|

EUR 28.71 |

|

Share price low April 2012 to March 2013 |

|

EUR 19.98 |

|

Share price as of March 31, 2013 |

|

EUR 23.96 |

|

Initial offering price (IPO) October 1995 |

|

EUR 5.18 |

|

All-time high price (July 12, 2007) |

|

EUR 66.11 |

|

Market capitalization as of March 31, 2013* |

|

EUR 4,128,848,681.97 |

|

|

|

|

|

* Based on total number of shares minus repurchased shares. | ||

|

Business year 2012/13 |

|

|

|

Earnings per share |

|

EUR 2.61 |

|

Dividend per share |

|

EUR 0.90* |

|

Book value per share |

|

EUR 29.06 |

|

|

|

|

|

* As proposed to the Annual General Shareholders’ Meeting. | ||