Outlook

Following considerable uncertainty after the United States’ economic repositioning at the start of the 2025/26 fiscal year, the global economy appears to have adjusted broadly to the new environment as the year progressed. Against this backdrop, despite continued high uncertainty, the trends observed to date are expected to persist in the final quarter of 2025/26.

In Europe, positive measures were introduced in the current fiscal year, but most of their economic impact is expected to materialize in the 2026/27 fiscal year. Accordingly, Europe is expected to experience largely stable economic development at a generally subdued level in the final quarter of 2025/26. In North America, the economic growth—so far driven primarily by the tech sector—is expected to continue throughout the remainder of the 2025/26 business year, while Brazil, following an economic cooldown, continues to show weak economic momentum. In China, economic development is expected to continue largely unchanged through the end of 2025/26.

Annual Report 2024/25

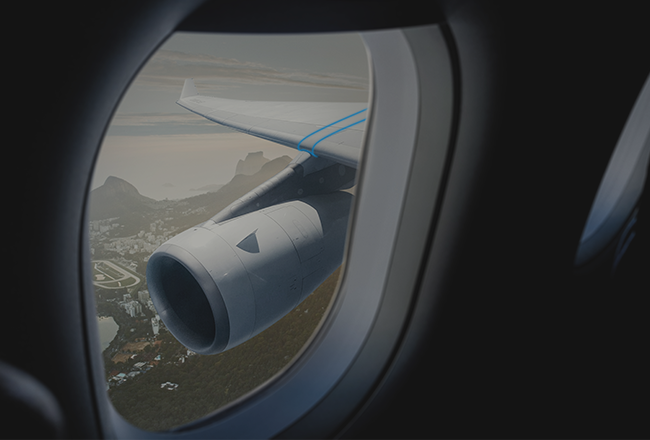

The key trends in the market segments are also expected to continue until the end of the 2025/26 fiscal year. The mechanical engineering, construction, and consumer goods segments are expected to remain stable at their current levels. Demand from the conventional energy sector is expected to remain strong in the pipeline plate segment for the remainder of 2025/26, while no positive signs are currently evident on the exploration side. In the automotive sector, the situation remains mixed as well. While demand for high quality steel sheets continues at a solid level, no significant recovery is expected in the automotive components segment by the end of the current business year. The positive development in railway infrastructure, aerospace, and storage technology is expected to continue.

The reorganization measures implemented within the voestalpine Group are proceeding as planned.

Against this backdrop, the Management Board of voestalpine AG continues to expect EBITDA in the range of EUR 1.4 to 1.55 billion for the 2025/26 fiscal year.