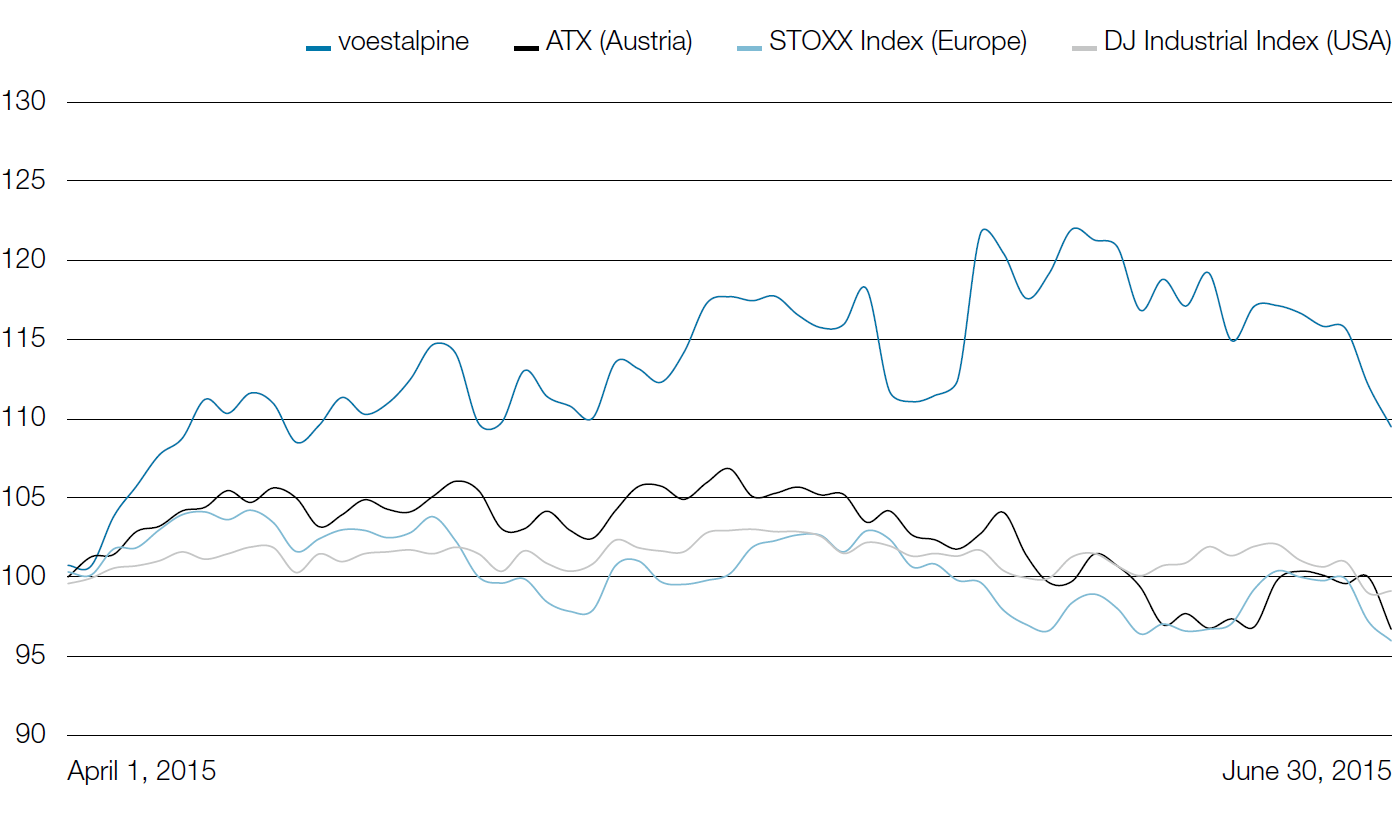

The price of the voestalpine share in the first quarter of 2015/16 was characterized by two marked gains, once at the beginning of the business year and again in early June 2015 as well as by a substantial drop toward the end of the reporting period. The boost in the early part of the business year was due primarily to a positive economic outlook so that the price of voestalpine share went up considerably in the wake of a market environment that was increasingly favorable. During this phase, the conflict between Russia and the Ukraine and the political trouble spots in the Middle East tended to recede more into the background, allowing the capital markets to manage themselves.

The publication of the Group’s annual figures on June 3, 2015 triggered a jump of more than 8% during the course of the day, and the voestalpine share saw the highest daily gain percentage-wise since the outbreak of the financial crisis in 2008. In addition to the outstanding results for the fourth reporting quarter, the solid outlook was also a driver for this increase. Due to the fact that the financial key performance indicators were substantially higher than analysts’ expectations, the voestalpine share was able to outperform the benchmark indices. In the second half of June toward the end of the first quarter, the problems surrounding the situation in Greece increasingly emerged as the focus of the European capital markets. In particular as a result of the announcement of a referendum on the austerity measures demanded by Greece’s lenders, European industrial stocks experienced a plunge across the board due to fears that the debt crisis would spread to other eurozone states, especially in Southern Europe, with commensurate effects on the European economy as a whole.

In the first three months of the business year 2015/16, the voestalpine share rose from EUR 34.34 to EUR 37.33, a plus of 8.7%, thus outperforming the benchmark indices ATX, STOXX Index Europe, and Dow Jones Industrial by a hefty margin.

Share page