As the growth expectations for the economy in Europe were recently cut back, over the past months, investors also turned their attention to companies whose business models are less sensitive to economic fluctuations; previously, cyclical stocks tended to be more desirable because they would profit more from an economic recovery. Despite the overall somewhat cautious mood, the stock markets stayed in a phase of lateral movement as investment alternatives to stocks are currently limited as a result of the continuing low interest rates.

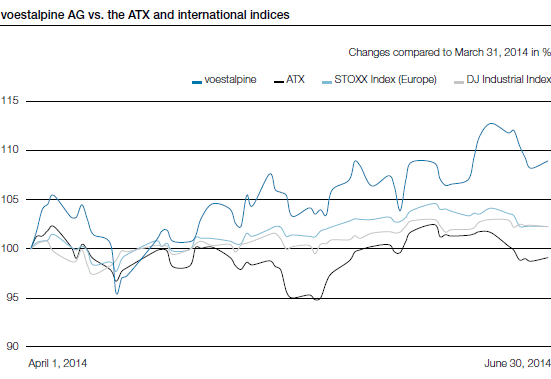

In the first quarter of the business year 2014/15, the performance of the voestalpine share demonstrated a light but steady upwards trajectory, bolstered by the results for the business year 2013/14 that were published in early June and were in line with expectations. In the first three months of the current business year, the voestalpine share rose by a total of 8.9%, thus outperforming Austria’s leading share index ATX as well as the major international benchmark indices. As of June 30, 2014, the voestalpine share was being traded at EUR 34.76, up from EUR 31.91 at the beginning of the business year.