|

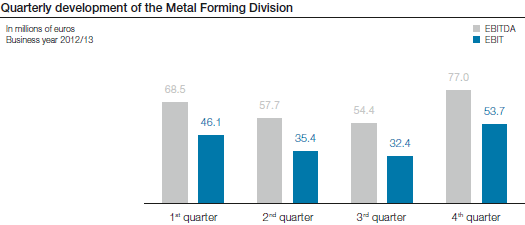

Quarterly development of the Metal Forming Division |

|

|

|

|||||||

|

In millions of euros |

|

1st quarter 2012/13 |

|

2nd quarter 2012/13 |

|

3rd quarter 2012/13 |

|

4th quarter 2012/13 |

|

BY |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

611.1 |

|

567.0 |

|

548.2 |

|

583.9 |

|

2,310.2 |

|

|

68.5 |

|

57.7 |

|

54.4 |

|

77.0 |

|

257.6 | |

|

|

11.2% |

|

10.2% |

|

9.9% |

|

13.2% |

|

11.1% | |

|

|

46.1 |

|

35.4 |

|

32.4 |

|

53.7 |

|

167.6 | |

|

|

7.5% |

|

6.2% |

|

5.9% |

|

9.2% |

|

7.3% | |

|

Employees (full-time equivalent) |

|

11,272 |

|

11,068 |

|

10,283 |

|

10,853 |

|

10,853 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The development of key financial figures of the Metal Forming Division was positively affected by non-recurring effects in the amount of around EUR 10 million. This non-operating result is based on a structural reorganization of pension obligations in individual divisional companies, which resulted, in some cases, in a reevaluation, resulting in positive effects in the fourth quarter.

Despite these non-recurring effects, the division’s operating result could not fully maintain the previous year’s trend. Revenue fell over the twelve-month period by 6.7% from EUR 2,475.2 million in the previous year to EUR 2,310.2 million in the business year 2012/13. The operating result (EBITDA) fell from EUR 276.2 million to EUR 257.6 million, which corresponds to a decline of 6.7% as well. This results in an EBITDA margin of 11.1%, remaining almost the same as the previous year’s figure (11.2%). Profit from operations (EBIT) fell during the period under review from EUR 185.1 million in the previous year to EUR 167.6 million, a decline of 9.5%. In relation to revenue, this results in an EBIT margin of currently 7.3%, a very slight decrease compared to 7.5% margin in the previous year.

The drop in revenue and operating result was due to the generally weaker economy on one hand and, on the other, to the specific development of the division’s most important customer industries: while optimism had still reigned in the Tubes and Sections business segment in the early part of the business year 2011/12 and the Automotive Body Parts business segment had experienced a level of demand during the first half of the period that had been stable at a high level, the trend had cooled substantially for both segments in the second half of the business year, finally stabilizing again toward the end of the last quarter. Viewed overall, in the business year 2012/13, the very good levels of the previous year—both as far as volumes and prices are concerned—could not quite be maintained.

In a direct comparison of the fourth quarter of the business year 2012/13 with the immediately preceding quarter (third quarter 2012/13), the cited non-recurring effect was one of the main factors behind the increase in the operating result. Not least due to this effect, the operating result (EBITDA) rose in the fourth quarter by 41.5% to EUR 77.0 million (third quarter: EUR 54.4 million) and profit from operations (EBIT) even gained 65.7% to EUR 53.7 million (third quarter: EUR 32.4 million). As a result, the EBITDA margin went up in the last quarter of the business year 2012/13 from 9.9% to 13.2%; the EBIT margin increased from 5.9% to 9.2%. However, the boost in sales revenue of 6.5% to EUR 583.9 million (third quarter: EUR 548.2 million) also demonstrates an improvement in the operating performance, due to the previously mentioned general stabilization of the negative, seasonal effects in the third quarter.

As of the end of the business year 2012/13, the Metal Forming Division had 10,853 employees (FTE, full-time equivalent), a decline of 4.5% compared to the same date in the previous year (11,365 employees).