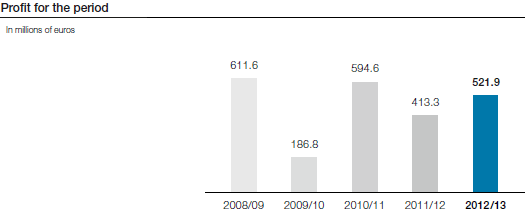

Profit before tax and profit for the period

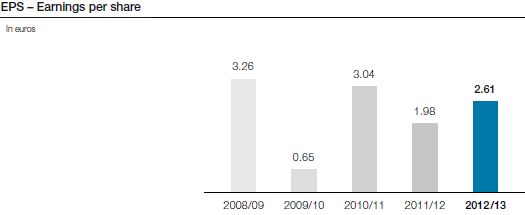

In a year-to-year comparison, profit before tax rose from EUR 504.4 million in the previous year to EUR 654.7 million in the business year 2012/13, a gain of 29.8%. As of March 31, 2013, profit for the period was EUR 521.9 million, an increase of 26.3% compared to the previous year’s figure of EUR 413.3 million. Earnings per share rose accordingly by 31.8% from EUR 1.98 per share in the previous year to EUR 2.61 per share for the business year 2012/13.

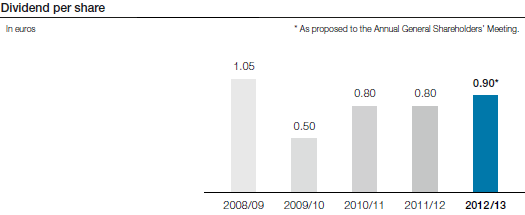

Proposed dividend

Subject to the approval of the Annual General Shareholders’ Meeting of voestalpine AG on July 3, 2013, a dividend of EUR 0.90 per share will be paid to shareholders, an increase of 12.5% compared to the previous year’s dividend of EUR 0.80 per share. Based on the earnings per share (EPS) of EUR 2.61 EUR, this recommendation corresponds to a distribution ratio of around 35%.

Based on the average share price in the business year 2012/13 of EUR 23.99, the dividend yield is 3.8%.

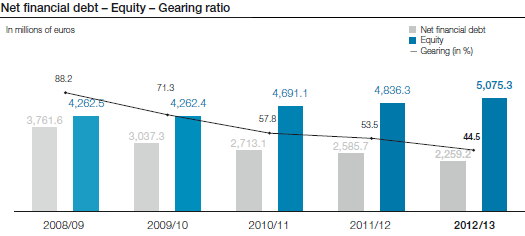

Gearing ratio falls from 53.5% to 44.5% as of March 31, 2013

The performance in the past business year brought another substantial consolidation for the structure of the statement of financial position of the voestalpine Group. Despite the difficult economic environment and an increase in investments by almost 50%, the gearing ratio (net financial debt in percent of equity) dropped as of March 31, 2013 in a year-to-year comparison by 9 percentage points to 44.5%.

The significant further improvement of the equity to debt ratio in the past business year, which was very challenging, was the result of both an increase in equity (by 4.9% from EUR 4.836.3 million as of March 31, 2012 to EUR 5,075.3 million as of March 31, 2013) and a decline in net financial debt (by 12.6% from EUR 2,585.7 million as of March 31, 2012 to EUR 2,259.2 million as of March 31, 2013). Above all, the reduction of debt by another EUR 326.5 million is a remarkable development, especially since the past business year saw investments in the amount of EUR 851.5 million due to the implementation of the first step of our Group Strategy 2020. The Group’s strong self-financing capability that was again demonstrated in 2012/13 forms a solid foundation that is vital for the realization of our ambitions for future growth.

Cash flow

At EUR 1,321.9 million, cash flow from operating activities went up compared to last year’s figure of EUR 856.5 million, a boost of 54.3%. This increase is due not only to the improved profit for the period but also to the performance of working capital, which enabled a release of cash and cash equivalents in the amount of EUR 225.0 million in the business year 2012/13. This positive development is due not only to the decline in revenue in a year-to-year comparison but to the structural reduction of working capital that was lowered in relation to revenue as of March 31, 2013 to 15.9% (down from 16.9% as of March 31, 2012).

Investments were considerably higher than in the previous year, which affected cash flow from investing activities in the business year 2012/13 (EUR –829.6 million)—a significant increase of 73.3% compared to the previous year’s figure of EUR –478.6 million. This increase in the use of appropriations was more than compensated by the cash flow from operating activities that rose even more substantially.

At EUR –74.7 million, the cash flow from financing activities in the business year 2012/13 was only slightly negative, a significant change compared to the previous year’s figure of EUR –933.7 million. This change in cash flow from financing activities is due not only to scheduled repayments of loans and debt securities but to the very successful international placement of another benchmark bond in October 2012.