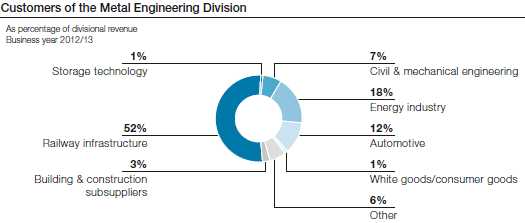

The Metal Engineering Division’s performance in the business year 2012/13 was at a solid level, which has practically become a tradition. Based on the railway infrastructure customer segment, which has performed reliably for years and which is the source of about half of the division’s revenue, it continues to be the Group’s most profitable division.

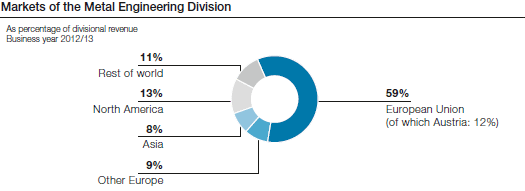

In the business year 2012/13, the Rail Technology business segment’s capacity utilization for premium quality products continued to be excellent despite persistent weak demand in Europe, as it was able to shift part of its business to overseas markets. Intense competition in the standard rail segment due to massive overcapacities and resulting price pressure emphasizes the wisdom of the decision to withdraw from this segment with the closure of the Duisburg site.

Due to its worldwide presence, the Turnout Technology business segment was able to compensate for weaker sales in Europe due to budget restrictions and declining investments by European railways by increasing its global activities. We anticipate that there will be pent-up demand in the railway infrastructure segment in North and South America, Africa, the Near and Middle East, and Turkey for some time.

The Seamless Tube business segment continued to be in robust shape in 2012/13. Despite declining drilling activities in the American market that is important for the OCTG segment (oil country tubular goods/oilfield tubes), results remained stable at a high level. The reason for this development is that the segment shifted its attention to other regions that have been newly developed or where sales activities have been intensified (Russia, the MENA region, Australia). As drilling has become increasingly demanding both in oil and natural gas production, necessitating more and more complex processes, the focus in the Seamless Tube business segment is on continuing to develop new technologies for its product portfolio.

In the Wire business segment, a drop in demand in the first three quarters of 2012/13, which was primarily a result of falling production figures among European automobile manufacturers, was reversed most recently as business began to recover. Here, too, the segment’s orientation toward a qualitatively sophisticated product portfolio prevented more dramatic losses.

The Welding Consumables business segment was also characterized by a restrained market environment in Europe. Mainly as a result of delays in power plant construction projects, demand for welding consumables in Asia was somewhat more subdued than in the previous years. In contrast, the development in North America improved significantly.

Due to very good sales in the downstream processing segment, production facilities in the Steel business segment enjoyed full capacity utilization. It even became necessary to temporarily purchase pre-materials for the production of rails, seamless tubes, and wire due to a (scheduled) repair of a blast furnace in the summer of 2012.