The volatility on the international stock markets that has been typical for the “post-Lehman period” continued in 2012. This affects primarily the shares of those companies that are particularly sensitive to economic cycles. Even though processing activities now represent around two thirds of the revenue of the voestalpine Group and thus, short-term dependence on the economy has been dramatically reduced in the last ten years, the company is still perceived on the capital market as a “classic,” cyclical steel producer.

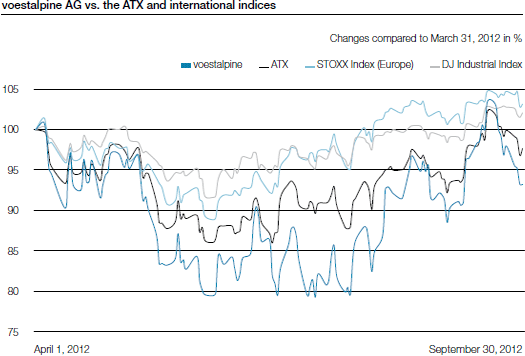

Although the voestalpine share lost around 20% of its value in the first three months of the current business year as a result of the negative overall mood on the stock markets, subsequently, despite a deterioration of the global economic situation, the share performed significantly better, apparently due to the expectation of an economic trend reversal in the coming year. Around mid-September, the share even rose slightly above its price at the beginning of the business year, before the trend reversed again toward the end of the period under review.

The development of the ATX, STOXX Index (Europe), and DJ Industrial Index, but also the price of the voestalpine share, reflects the fears and hopes with regard to the general economic situation. Development of individual companies has long been eclipsed by macroeconomic trends.

In this respect, the up-and-down movement on the capital markets continues to be determined by the still unsolved sovereign debt crisis in Europe which keeps the real economy on tenterhooks, particularly in Southern Europe, but increasingly in the other EU countries as well. Increasingly, economic data from China is being critically discussed and interpreted with regard to its global effects.

Against this backdrop, the price decline of the voestalpine share in the first half of 2012/13 from EUR 25.22 to EUR 23.29 represents a comparatively moderate loss of value of 7.7%.

Share information

| (XLS:) Download |

|

Share capital as of September 30, 2012 |

|

EUR 307,132,044.75 divided into |

|

Shares in proprietary possession as of September 30, 2012 |

|

146,368 shares |

|

Class of shares |

|

Ordinary bearer shares |

|

Stock identification number |

|

93750 (Vienna Stock Exchange) |

|

ISIN |

|

AT0000937503 |

|

Reuters |

|

VOES.VI |

|

Bloomberg |

|

VOE AV |

| (XLS:) Download |

|

Prices (as of end of day) |

|

|

|

Share price high April 2012 to September 2012 |

|

EUR 26.10 |

|

Share price low April 2012 to September 2012 |

|

EUR 19.98 |

|

Share price as of September 30, 2012 |

|

EUR 23.29 |

|

Initial offering price (IPO) October 1995 |

|

EUR 5.18 |

|

All-time high price (July 12, 2007) |

|

EUR 66.11 |

|

Market capitalization as of September 30, 2012* |

|

EUR 3,933,746,095.55 |

|

|

|

|

|

* Based on total number of shares minus repurchased shares. | ||

| (XLS:) Download |

|

Business year 2011/12 |

|

|

|

Earnings per share |

|

EUR 1.98 |

|

Dividend per share |

|

EUR 0.80 |

|

Book value per share |

|

EUR 28.24 |