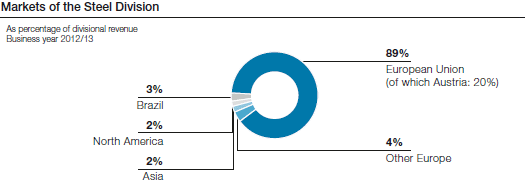

The development of the European steel industry in the past business year continued to be precarious. The fact that demand dropped again compared to the previous year, while crude steel capacity remained largely the same, resulted in increasing competition for volume and capacity utilization, which was conducted to a great extent by way of prices.

At the same time, raw materials prices, which are crucial for the development of the cost structure, remained extremely volatile as they were significantly affected by the situation in China and, as a result, triggered additional negative effects. Due to substantial declines in the price of iron ore—sparked by purchasing restraint on the part of Chinese traders—steel prices came under massive pressure in the fall of 2012, resulting in a wait-and-see attitude by customers that impacted their purchasing and thus additionally accelerated the downward spiral.

This trend continued until the end of the 2012 calendar year. As by then inventories had dropped to an extremely low level, the fourth quarter initially saw a positive inventory cycle, which, however, lost its momentum by the end of the quarter.

This trend corresponds to a customer behavior pattern that has been increasingly observed in recent years—a trend that is characterized by short-term reactivity rather than long-term planning.

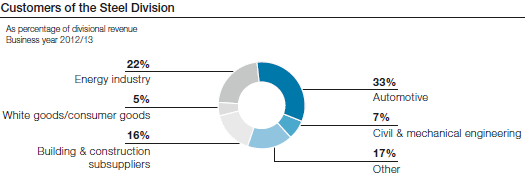

Considering these circumstances, the Steel Division’s good results and capacity utilization compared to industry competitors are yet another confirmation that it had been a wise decision to focus the production program years ago on the most sophisticated quality and customer segments.

A look at the division’s most important customer segments makes it clear just how challenging the market environment was, which it faced in the business year 2012/13. While in previous years, it was the mass market manufacturers in the automotive and automotive supply industries that were impacted by declining demand in Europe, in the course of this business year, the premium manufacturers were increasingly affected by global market fluctuations.

Projects in the segment of oil and natural gas production, which are particularly vital for the heavy plate segment, failed to materialize in the past twelve months due to postponements. With regard to the few remaining projects, there were significant competitive disadvantages for European producers due to the monetary policies in some countries that benefited Asian manufacturers. In the field of alternative energies, there has been a considerable decline in demand in the past quarters as a result of the increasingly restrictive award of subsidies in more and more countries.

On the other hand, business in consumer-oriented industries, especially in the white goods and electrical industries, has been relatively stable. The mechanical engineering industry, which is supported by the strong export position of German manufacturers, continues to show a satisfactory trend. The construction and construction supply industries remained at a very weak level during the entire course of the business year 2012/13. Orders from the tube and section industries were also subdued during the past business year.