The development of the European steel industry in the course of the business year 2011/12 was marked by dramatically increasing volatility both on the cost side, particularly for the raw materials iron and coal, and with regard to price trends. The cycles, which have become considerably shorter than prior to the crisis, reflect customers’ order patterns on one hand, which are far more cautious than in the past, and on the other, the more rapid reaction of the steel manufacturers (meaning greater flexibility with regard to production adjustments that are demand-driven).

In Europe overall, despite sporadically occurring closures, the steel industry continues to experience very significant structural overcapacity, particularly for standard grades.

The economic situation was very inconsistent throughout the course of the year. While demand in the early part of the business year was still at a very high level, over the summer, steel prices on the spot market were already in decline. On the other hand, the raw materials prices reacted with a significant delay and did not begin their downtrend until September (for coal) and October 2011 (for ore). By the third quarter of the business year 2011/12, this combination of relatively high costs for raw materials and already substantially lower earnings for short-term transactions resulted in a noticeable pressure on margins for the Steel Division as well. In the final quarter, an even more significant negative effect on earnings was only prevented by an upswing in demand from the turn of the year 2011/12 on.

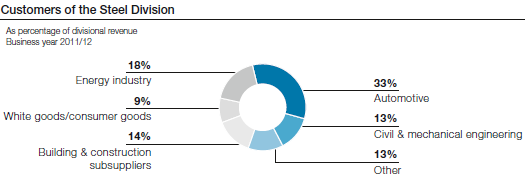

The situation in the customer industries that are important for the Steel Division was equally inconsistent in the year under review. The overall picture in the European automobile and automotive supply industries was positive, however, it was sharply differentiated both regionally and with regard to individual manufacturers. While the strongly export-oriented premium manufacturers in Germany continued to experience a boom, the situation for manufacturers of compact and subcompact cars was increasingly difficult from the fall of the year on, especially in Southern Europe.

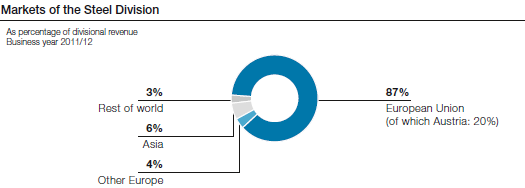

Initially, the energy sector still showed a noticeable willingness to invest—not least driven by the high oil prices—but in the course of the year, here too, growing pressure from the competition created a market environment that became progressively more challenging. Brisk exports to non-European markets, in particular to Australia, Brazil, North America, and the Middle East, did result in a very satisfactory development in the heavy plate segment that delivers to the conventional energy sector.

The mechanical engineering sector experienced a positive sales trend; its German sector, which is dominant compared to other European countries, even reported two-digit growth. In the 2011 calendar year, the level of the tubes and sections industry was stable, albeit still significantly below pre-crisis figures. On the other hand, sales volumes to the European white goods industry declined slightly compared to the previous year against a backdrop of growing import pressure, particularly from Asia.

Due to volatility, the market environment was difficult for the steel trading and Steel Service Center segments. Volume overall shrank again slightly in the construction industry, although most recently, a certain trend toward stabilization has been observed.