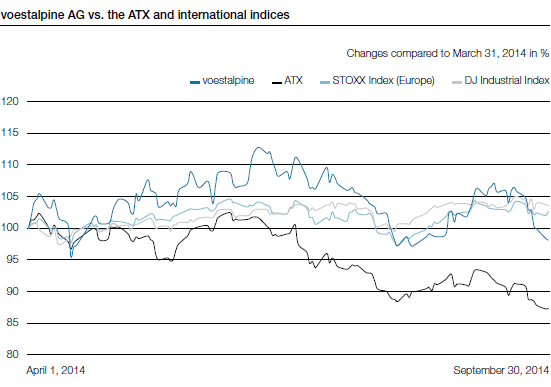

The beginning of the business year was characterized by optimistic economic expectations that were initially confirmed and supported the price development of the voestalpine share. However, certain developments, not least the escalating political tensions between the Russian Federation and the Ukraine and the resulting sanctions by the European Union subsequently increasingly curbed the positive economic trend. Over the summer, growing economic fears fueled nervousness that—after the hopes for solid economic growth in Europe had ultimately not been fulfilled in 2012 and 2013—the hoped for economic recovery would not materialize in the 2014 calendar year either. The price development of the voestalpine share reflected these macroeconomic circumstances with a rise of the share price to almost EUR 36 in mid-June 2014, followed by a decline to around EUR 30 by the end of September 2014. While the voestalpine share, with its minus of 1.9% as of September 30th, developed significantly better than the Austrian share index ATX (decline of 12.7%), it nevertheless lagged behind the other benchmark indices, Stoxx (Europe) and the Dow Jones Industrial Index, which rose by about 3 and 4% during the same time period. As of the end of the first half of the business year 2014/15, the price of the voestalpine share was at EUR 31.30, after being traded just above this level at EUR 31.91 at the beginning of the business year.