Price development of the voestalpine share

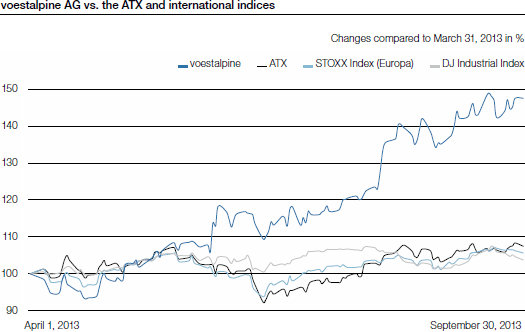

While sentiment at the beginning of the first half of 2013/14 was still cautious, subsequently, the mood on the stock markets improved—encouraged by the still low key interest rates set by the central banks in Europe and the USA and the slightly improved growth prospects for the global economy. Even in this more positive climate, the performance of the voestalpine share stood out significantly among the shares of most other industrial corporations on the market. The reason for this was that, on one hand, after a lengthy phase of reduced activity on the part of investors, companies that are more sensitive to the economic climate drew increased attention, and on the other hand, because voestalpine demonstrated a positive—and stable—earnings performance in a market environment that remains challenging. Particularly after the results for the business year 2012/13 and for the first quarter of 2013/14 were published, the voestalpine share bucked the trend and showed significant gains.

In the first half of 2013/14, the voestalpine share gained almost half of its value of EUR 23.96 as of March 31, 2013, climbing to EUR 35.35 as of September 30, 2013, while in the same period, the benchmark indices Stoxx (Europe) and the Dow Jones Industrial Index generated only about a 5% increase and the Austrian ATX Index a 7.5% increase.

Share information

| (XLS:) Download |

|

Share capital as of September 30, 2013 |

|

EUR 313,309,235.65 divided into |

|

Shares in proprietary possession as of September 30, 2013 |

|

28,597 shares |

|

Class of shares |

|

Ordinary bearer shares |

|

Stock identification number |

|

93750 (Vienna Stock Exchange) |

|

ISIN |

|

AT0000937503 |

|

Reuters |

|

VOES.VI |

|

Bloomberg |

|

VOE AV |

|

Prices (as of end of day) |

|

|

|

Share price high April 2013 to September 2013 |

|

EUR 35.68 |

|

Share price low April 2013 to September 2013 |

|

EUR 22.34 |

|

Share price as of September 30, 2013 |

|

EUR 35.35 |

|

Initial offering price (IPO) October 1995 |

|

EUR 5.18 |

|

All-time high price (July 12, 2007) |

|

EUR 66.11 |

|

Market capitalization as of September 30, 2013* |

|

EUR 6,094,204,905.27 |

|

|

|

|

|

* Based on total number of shares minus repurchased shares. | ||

|

Business year 2012/13 |

|

|

|

Earnings per share |

|

EUR 2.61 |

|

Dividend per share |

|

EUR 0.90 |

|

Book value per share |

|

EUR 29.06 |