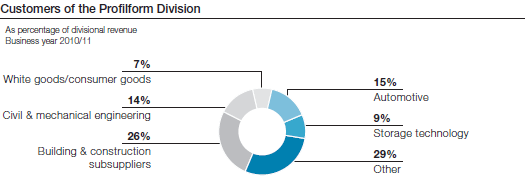

In the Profilform Division’s most important customer industries, the economic recovery that has been ongoing since the beginning of the business year 2010/11 created an upward trend that established itself more firmly during the course of the year.

The tubes and sections sector experienced continuously increasing demand, primarily from the solar energy industry. Despite a roll-back of subsidies for alternative energies in a number of European countries, overall demand from the energy generation sector in Europe also remained very satisfactory.

The bus and commercial vehicle manufacturing industries also reported rising sales volumes due to the global economic recovery. Business performance in the agricultural machinery sector was similarly positive, with North and South America at the forefront of demand.

In contrast, the construction and construction supply industries still lagged behind expectations. Whilst in Great Britain this segment began to show a slight recovery trend, business in Russia especially continued to be very restrained.

While the first half of the business year was disappointing in the storage technology/logistics segment, here too the last quarter showed a considerable pick-up in demand, with an increase in incoming orders—not only in Europe.

The precision strip sector, which was transferred from the Special Steel Division to the Profilform Division as of the beginning of the business year 2010/11, reported high and robust levels of demand from all customer segments. In the course of the business year 2010/11, the pre-crisis level was regained and was even surpassed in some business segments. Due to bottlenecks in the availability of some special steel grades, which are used as pre-materials, continuing steep demand resulted in significantly delayed delivery times for some orders.

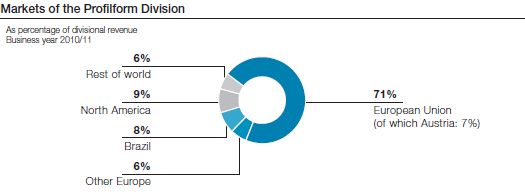

Viewed regionally, business performance in recent months was generally marked by a significantly invigorated market in Europe (with the exception of Russia) and a continuing stable and positive trend in North America.

Business performance in Brazil, however, noticeably lost some of its momentum during the business year 2010/11 due to extreme fluctuations in pre-materials prices. Nevertheless, the overall economic environment in Brazil remains promising.