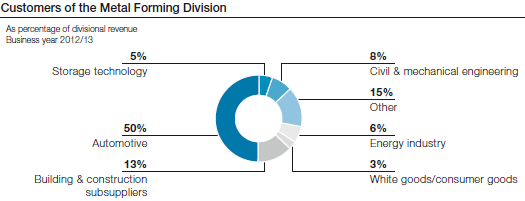

In 2012/13, business performance of the Metal Forming Division was affected by a market environment that became progressively more difficult, which, however, stabilized in the fourth quarter, albeit at a low level. But despite the challenging economic circumstances, the individual business segments demonstrated a performance that was satisfactory overall.

The Tubes & Sections segment was characterized primarily by falling demand from the construction machinery segment, while the agricultural machinery segment showed a consistent and favorable level of demand. The trend in Europe in the bus and commercial vehicle sectors was inconsistent. While export-oriented manufacturers profited from sales that—viewed globally—were satisfactory, those companies who do business primarily on the European markets came under pressure. The construction sector, however, which is important to the division, continued to be a challenge, as it has not shown any significant trends toward recovery. The aviation industry performed at a consistently solid level; the construction rates for new models were slightly below expectations, however, this did not have any negative effects.

The Automotive Body Parts business segment continued to operate at largely full production capacity despite the fact that automobile sales have been steadily decreasing. A good level of demand, especially from the premium segment, into the third quarter ensured very satisfactory growth of production. Toward the end of the calendar year, sales of individual models declined slightly, while mass market automobile sales stabilized during the course of the business year at a low level. In view of the continually falling sales figures in Europe, voestalpine’s internationalization strategy is becoming an ever more significant factor in ensuring the long-term stability of sales and profitability of this business segment.

In 2012/13, the Precision Strip business segment still performed satisfactorily all in all despite a decline in incoming orders, due primarily to demand from the consumer goods industry, for example, razor blades and highly precise cutting rules for the packaging industry.

A similar development can be seen with regard to incoming orders in the Material Handling business segment, where stable demand in the segment of high-bay warehouse systems came largely from consumer-oriented industries (food and beverage industries, clothing industry, and mail-order retail industry).

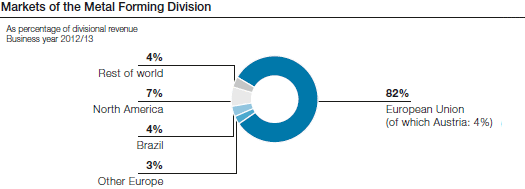

Viewed regionally, North America showed a marked uptick in demand, while European markets overall had to deal with economic setbacks. This applies particularly to Southern Europe and, most recently, to France, not, however, to Great Britain, where demand has been consistently stable. Subdued sales in Brazil in the early part of the business year experienced a noticeable upwards trend during the second half of the year as a result of state funding programs.