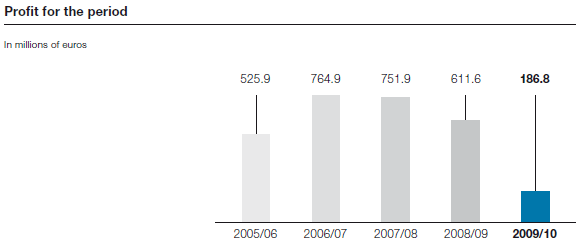

Profit before tax fell by 73.8% to EUR 183.3 million and profit for the period by 69.5% to EUR 186.8 million

Low interest levels, positive results from investments in securities (as opposed to the previous year), and declining net financial debt resulted in a financial result that went up by EUR 120.1 million compared to the previous year. Despite the positive development of the financial result, due to the declining operating profit, lower profit before tax, which dropped by 73.8% from EUR 700.0 million to EUR 183.3 million, and the reduced profit for the period1, which fell by 69.5% from EUR 611.6 million to EUR 186.8 million compared to 2008/09, were clearly lower in 2009/10 than last year’s figures. Due to the lower pre-tax result and taking the tax deduction items into consideration, the tax rate is –1.9% compared to 12.6% in the previous year.

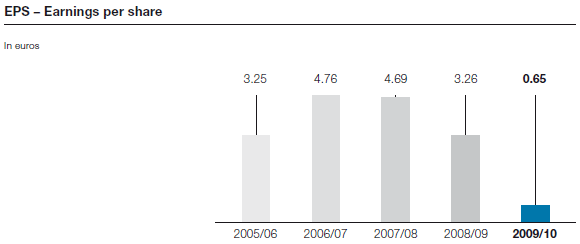

At EUR 0.65, earnings per share are significantly under the previous year’s level

While at EUR –0.05, the earnings per share (EPS) for the first three quarters of 2009/10 were still slightly negative, the fourth quarter with earnings per share of EUR 0.70 brought the earnings per share back to a positive range for the year overall. Therefore, the earnings per share for the business year 2009/10 equal EUR 0.65 (after EUR 3.26 per share in the previous year).

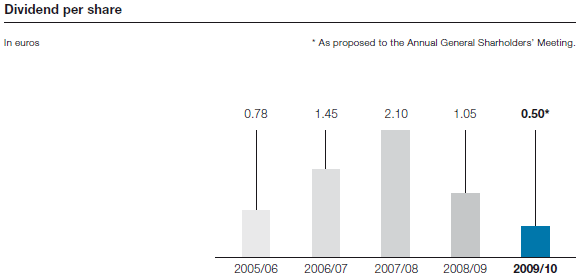

Proposed dividend: EUR 0.50 per share

Subject to the approval of the Annual General Shareholders’ Meeting of voestalpine AG, which will take place on July 7, 2010, a dividend of EUR 0.50 per share will be distributed to the shareholders for the business year 2009/10 despite the extremely difficult economic environment. This corresponds to just below half of the previous year’s dividend of EUR 1.05 per share or last year’s dividend yield of 3.6%. Relative to the average share price of the business year 2009/10 of EUR 22.41, this represents a dividend yield of 2.2%.

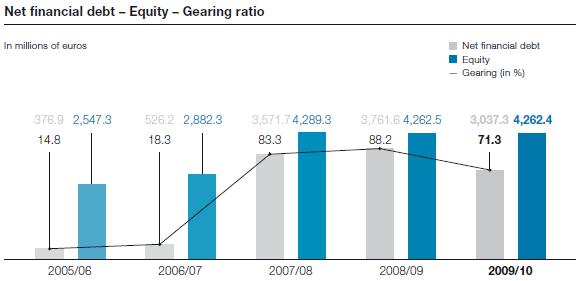

Substantial reduction of the gearing ratio to 71.3%

Although equity capital remained unchanged in the past business year at EUR 4,262.4 million compared to the end of the business year 2008/09 (EUR 4,262.5 million), the voestalpine Group was able to reduce its gearing ratio by about 17 percentage points. The reason for this improvement is a massive reduction of net financial debt in the past 12 months, which was made possible by investment expenditure that was lower than depreciation and working capital that was reduced compared to March 31, 2009, from EUR 2,450.1 million to EUR 1,648.2 million or by 32.7%. Thus, as of March 31, 2010, the voestalpine Group’s gearing ratio (net financial debt as a percent age of equity) was 71.3%. Reduction of the gearing ratio compared to that of March 31, 2008, (88.2%) reflects the Group’s strong self-financing capability and its consistent liquidity management despite the challenging economic circumstances and a dividend policy that has been consistently applied.

Cash flow shows the high self-financing capability of the voestalpine Group

Despite a profit for the period that was down significantly (from EUR 611.6 million to EUR 186.8 million) in the business year 2009/10, due to a substantial release of liquidity from working capital, the cash flow from operating activities increased by 18.3% from EUR 1,357.9 million to EUR 1,606.1 million. The cash flow from investment activities reflects the investment and acquisition policy that has been adjusted to the conditions brought on by the economic crisis. Without changes in financial assets, it went down from EUR –1,311.1 million to EUR –586.9 million so that there is a free cash flow of EUR 1,019.2 million for the business year 2009/10. Taking the changes in financial assets into consideration, the cash flow from investing activities declined from EUR –1,249.4 million to EUR –914.5 million.

Cash flow from financing activities turned from EUR 413.4 million in the previous year to EUR –539.6 million in the business year 2009/10. This was primarily due to the repayment of financial liabilities in the amount of EUR 289.3 million as compared to borrowings in the amount of EUR 715.5 million in the previous year.

Against this backdrop, cash and cash equivalents were increased in the business year 2009/10 by another EUR 170.9 million (including net exchange differences) from EUR 857.7 million to EUR 1,028.6 million.

Crude steel production down by 10.9% to 6.07 million tons

The Group’s crude steel production in the business year 2009/10 was 6.07 million tons, 10.9% below the previous year’s figure (6.81 million tons). Therefore, with a production output of 4.36 million tons, the Steel Division saw a decline by 5.0%, while the Railway Systems Division had a production output of 1.20 million tons, which corresponds to a decrease by 18.4%. The Special Steel Division reported the greatest cutback in crude steel production from 0.75 million tons to 0.51 million tons or by 32.0%.

1 Before minority interests and interest on hybrid capital.