voestalpine ATX (Austria) STOXX Index (Europe) DJ Industrial Index (USA)

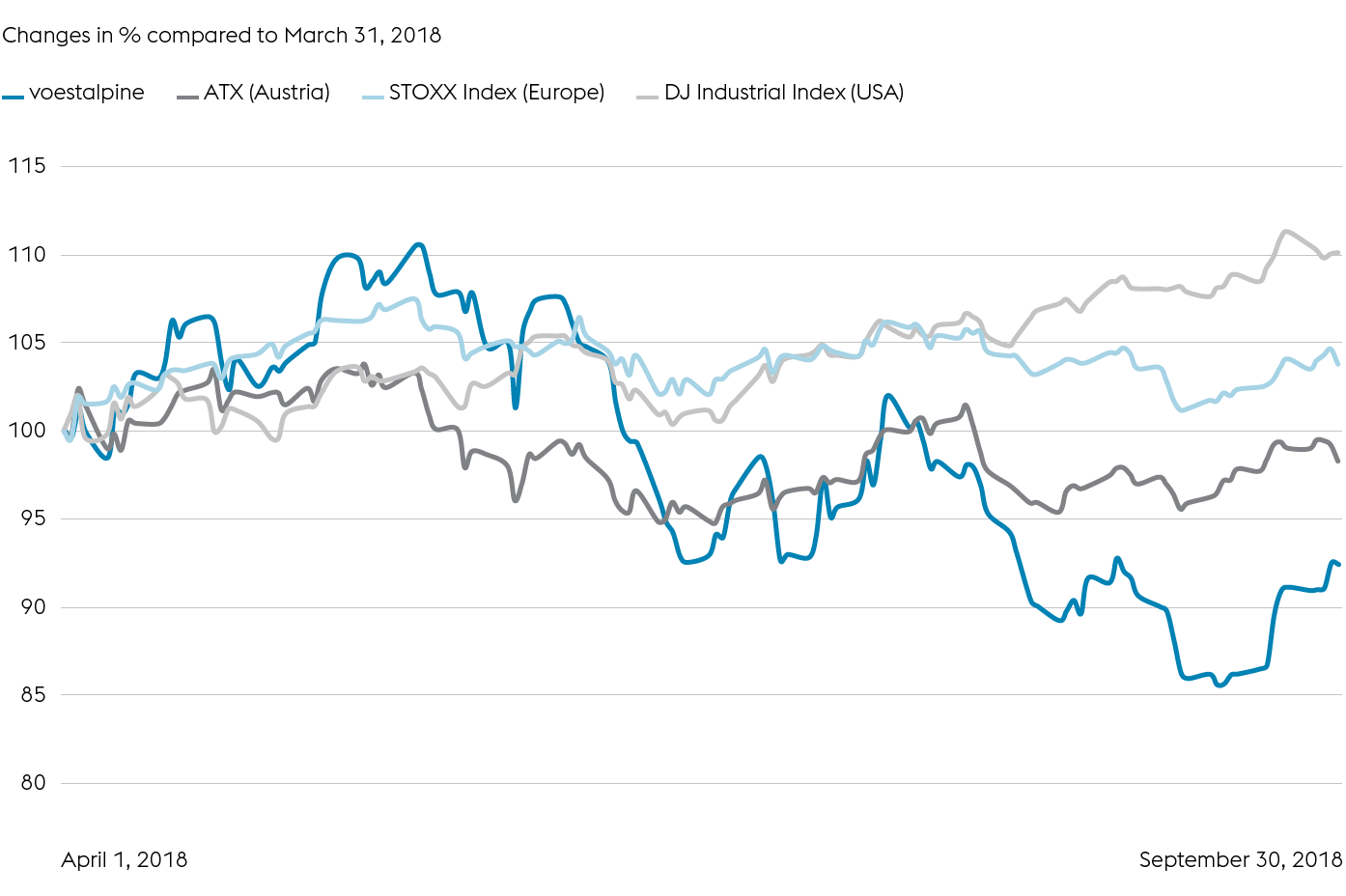

After delivering very strong price gains in the 2017 calendar year, the voestalpine share presented an altogether different picture in 2018. Particularly the first few months of 2018 were dominated by largely negative sentiment, which brightened but briefly at the start of the business year 2018/19. The share price weakened again thereafter even though the economic climate in both the voestalpine Group’s key global sales regions and its key customer segments remained favorable until the summer of 2018. What has had a particular impact in this connection is the US administration’s increasingly isolationist stance: Aside from (manageable) direct effects on voestalpine stemming from import tariffs, it has kindled investors’ fears that the solid global economic picture may be undermined by countermeasures the countries affected by the tariffs might take in response to the United States’ protectionist measures. At the same time, the voestalpine Group’s strong orientation toward the automotive industry was yet another negative factor that weighed on the price of the Group’s share. The backlog regarding numerous vehicle models in connection with registrations under the newly created “Worldwide Harmonized Light Vehicle Test Procedure” (WLTP) from September 1, 2018, led to growing fears that the automotive industry in Europe might be weakened as a result. All of these factors taken together caused the price of the voestalpine share to decline by 7.6% in the first half of the business year 2018/19, i.e. from EUR 42.64 per share to EUR 39.40 per share. While the share’s performance fell only slightly short of that of the Austrian ATX stock index, it underperformed significantly compared with both the Dow Jones Industrial and the STOXX Index Europe, both of which delivered gains in the same period.

Share page