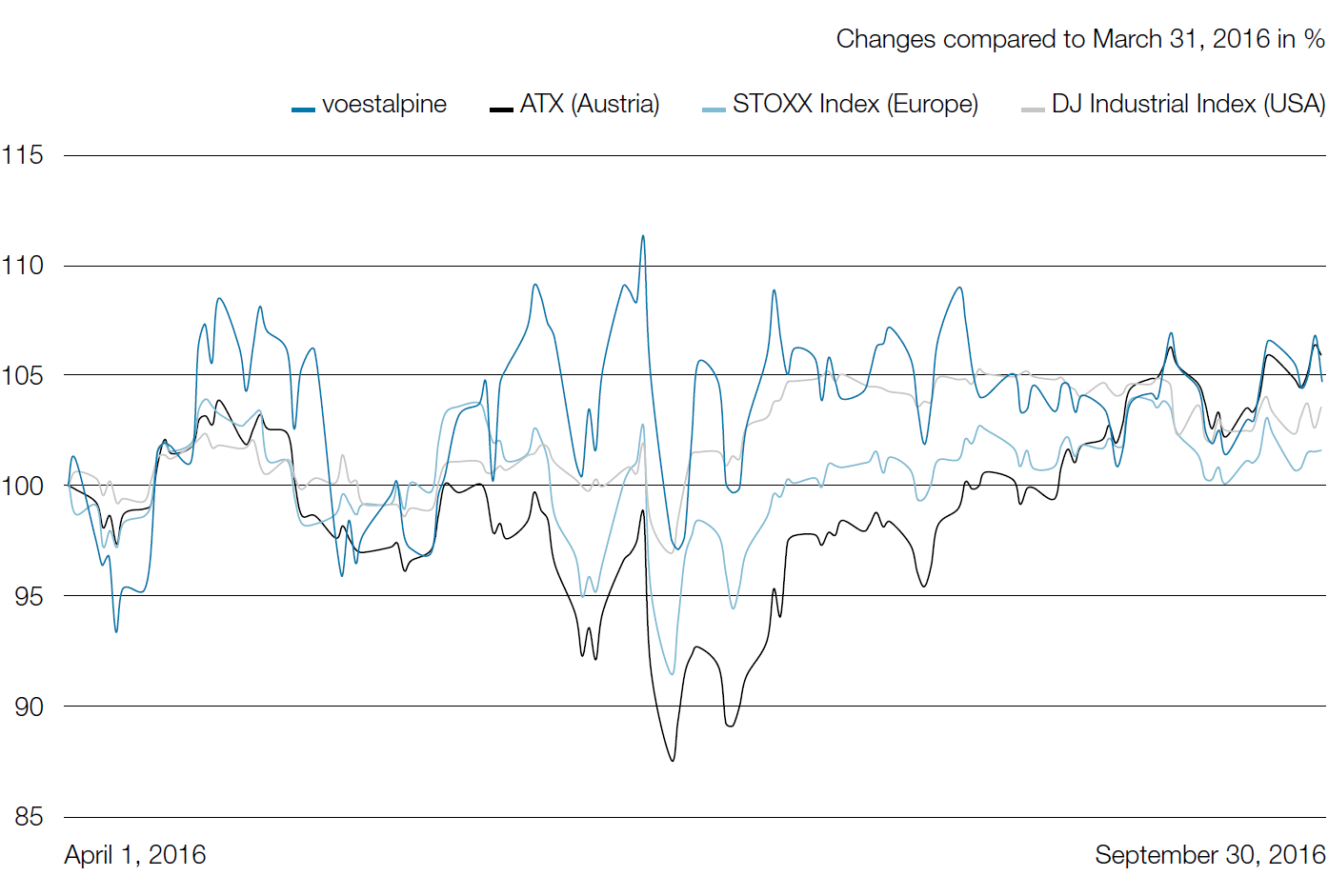

voestalpine AG vs. the ATX and international indices

During the past six months the environment on the European capital markets was characterized by great uncertainty, resulting in increased volatility. Without a doubt, the Brexit vote in Great Britain in late June 2016 was a significant driver of this development; after all, the effects of this decision on the European economies and on the idea of Europe itself are almost impossible to gauge reliably. As a first reaction to the vote, the growth prognoses of the EU were revised downward, inevitably intensifying discussions about the smoldering banking crisis in Italy— and elsewhere—which had been an issue even prior to the Brexit vote. As a result of these circumstances—and exacerbated by the escalating presidential campaign in the USA—the European capital markets have gone into roller coaster mode in recent months.

Under these unusual framework conditions, the price of the voestalpine share in the first half of 2016/17 did not only fluctuate turbulently but ended the reporting period with an increase of only 3.4% (from EUR 29.78 in early April 2016 to EUR 30.80 at the end of September 2016)—a very modest improvement.

Share page