In the first nine months of the business year 2012/13, the trend on the European capital markets continued to be closely associated with the sovereign debt crisis and the global economic expectations. Especially in the first third of the business year, substantial uncertainty became noticeable on the part of investors who, as a result, tended to avoid cyclical sectors. The (moderate) revision of the earnings outlook for the current business year shortly prior to the publication of the half-yearly results affected the share price only briefly. Due to the Group’s operating results for the second quarter of 2012/13, which were above the expectations of the analysts, and an increasingly positive mood of the capital market, within just a few weeks, the voestalpine share subsequently rose by more than 20%.

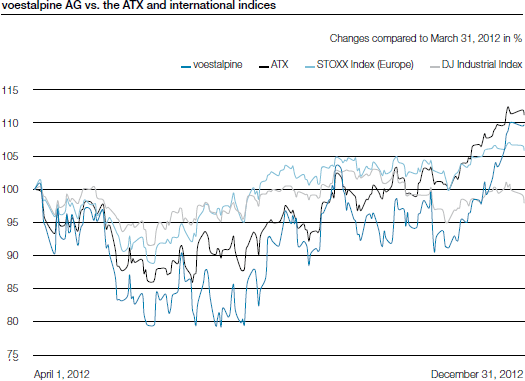

Over the entire period from April 1, 2012 to December 31, 2012, both the price of the voestalpine AG share and the ATX, the leading index of the Vienna Stock Exchange, went up by about 10%. During the same time period, the performance of the Stoxx Index Europe, the index of the most important European shares, was slightly weaker, while the U.S. Dow Jones Industrial Index performed significantly worse. As of the end of December 2012, the share price of voestalpine AG was EUR 27.66, just slightly lower than the highest price during the period under review (EUR 27.76).

Around 20 analysts report regularly about the performance of the voestalpine Group. Their current recommendations are largely positive, with none of them giving a sell recommendation.

Capital increase by 2% for the purpose of continued expansion of the employee shareholding scheme

On September 12, 2012, the Management Board of voestalpine AG resolved to exercise its authorization to increase the Company’s share capital pursuant to Section 4 (2) of the Articles of Incorporation and increase the share capital of voestalpine AG by around 2% by issuing 3,400,000 new, no-par value bearer shares. The issue price per no-par value share was fixed at EUR 23.51. The issue price corresponds to the average closing price of the voestalpine share on the stock exchange during the last ten trading days immediately preceding the resolution by the Management Board on September 12, 2012.

The new shares will ensure continued expansion and consolidation of the employee shareholding scheme of voestalpine AG. An employee shareholding scheme was put in place in 2000 and has been continuously expanded since then. The capital increase from the authorized capital was recorded in the Commercial Register on November 24, 2012. Therefore, the share capital of voestalpine AG now amounts to EUR 313,309,235.65 and is divided into 172,449,163 shares. Each share carries the right to one vote.

Share information

| (XLS:) Download |

|

Share capital |

|

EUR 313,309,235.65 divided into |

|

Shares in proprietary possession as of December 31, 2012 |

|

90,629 shares |

|

Class of shares |

|

Ordinary bearer shares |

|

Stock identification number |

|

93750 (Vienna Stock Exchange) |

|

ISIN |

|

AT0000937503 |

|

Reuters |

|

VOES.VI |

|

Bloomberg |

|

VOE AV |

| (XLS:) Download |

|

Prices (as of end of day) |

|

|

|

Share price high April 2012 to December 2012 |

|

EUR 27.76 |

|

Share price low April 2012 to December 2012 |

|

EUR 19.98 |

|

Share price as of December 31, 2010 |

|

EUR 27.66 |

|

Initial offering price (IPO) October 1995 |

|

EUR 5.18 |

|

All-time high price (July 12, 2007) |

|

EUR 66.11 |

|

Market capitalization as of December 31, 2011* |

|

EUR 4,767,437,050.44 |

|

|

|

|

|

* Based on total number of shares minus repurchased shares. | ||

| (XLS:) Download |

|

Business year 2011/12 |

|

|

|

Earnings per share |

|

EUR 1.98 |

|

Dividend per share |

|

EUR 0.80 |

|

Book value per share |

|

EUR 28.24 |