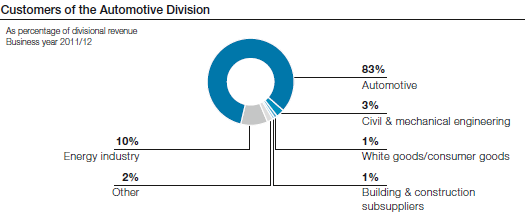

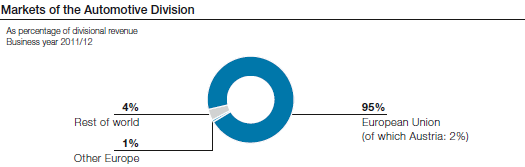

Over the major part of the business year 2011/12, the production figures of the European automobile manufacturers remained stable at a high level. In the course of 2011, they experienced an increase of just above 6%, although this momentum began to slow down in the first calendar quarter of 2012. The development of the premium manufacturers—first and foremost the German brands—who are of crucial importance for the voestalpine Group, was continuously positive over the entire course of the year. However, it merits mentioning that growth in this segment continues to shift to regions outside of Europe. The voestalpine Group is addressing this issue by accelerating its investments in production capacity in these growth markets (particularly China, South Africa, and the USA) in order to be able to keep pace with the global development of its strategic customers.

While the commercial vehicle market recovered somewhat in the course of the year under review, it is still below its pre-crisis level. The (manageable) non-automotive segment of the division was characterized by a sustained momentum; demand for highest quality product solutions for solar heating/photo voltaics and the heating technology segment was particularly strong.

Against this backdrop, the Automotive Division had very good capacity utilization at almost all of its production sites and in virtually all of its segments in the course of the business year 2011/12.