Price development of the voestalpine share

In 2012, the capital markets overall and cyclical stocks in particular had to deal with an environment that continued to be challenging. The mood on the stock exchanges was also significantly affected by the continuing and intensifying debates about the uncertain prospects of the European Economic Community (sovereign debt crisis, liabilities of the euro countries, stability of the euro, etc.), especially as these problems have still not been permanently solved in a way that would pacify the financial markets. The situation was additionally exacerbated by the leading indicators from Asia, especially China, pointing to a noticeable cooling down of the economic momentum.

Furthermore, expectations for the development of the economy in Germany, which is particularly important for the voestalpine Group, have most recently been downgraded, despite the fact that the state of the German market has been quite robust in the past years. Looking at the economy by sectors, the structural overcapacities in the European steel industry represent an ever increasing burden. The temporary reduction of overcapacities is not a satisfactory solution to create a degree of balance between supply and demand in the long term.

In comparison to the “classic” steel companies, the voestalpine Group has been able to keep any price losses within reasonable limits due to its accelerated path to becoming a global processing and technology Group, which is less and less dependent on the traditional “steel cycle” and is aided by its more stable earnings situation and fundamentals that are quite sound, especially considering the overall economic environment.

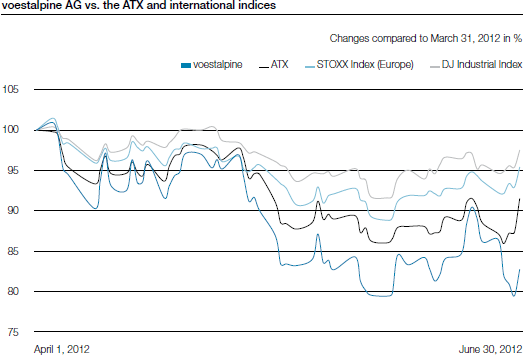

Due to the cyclical business model, the price development of the voestalpine share in the first quarter of 2012/13 was more dramatic both in its ups and downs than the average development of the ATX, Stoxx Index Europe, and Dow Jones Industrial indices, although its overall development shows a consistent pattern.

All told, the voestalpine share fell from EUR 25.22 to EUR 20.86 in the first quarter of the business year 2012/13, equaling a loss in value of 17.3%.

Share information

| (XLS:) Download |

|

Share capital |

|

EUR 307,132,044.75 divided into |

|

Shares in proprietary possession as of June 30, 2012 |

|

242,171 shares |

|

Class of shares |

|

Ordinary bearer shares |

|

Stock identification number |

|

93750 (Vienna Stock Exchange) |

|

ISIN |

|

AT0000937503 |

|

Reuters |

|

VOES.VI |

|

Bloomberg |

|

VOE AV |

| (XLS:) Download |

|

Prices (as of end of day) |

|

|

|

Share price high April 2012 to June 2012 |

|

EUR 25.45 |

|

Share price low April 2012 to June 2012 |

|

EUR 20.03 |

|

Share price as of June 30, 2012 |

|

EUR 20.86 |

|

Initial offering price (IPO) October 1995 |

|

EUR 5.18 |

|

All-time high price (July 12, 2007) |

|

EUR 66.11 |

|

Market capitalization as of June 30, 2012* |

|

EUR 3,520,469,818.16 |

|

|

|

|

|

* Based on total number of shares minus repurchased shares. | ||

| (XLS:) Download |

|

Business year 2011/12 |

|

|

|

Earnings per share |

|

EUR 1.98 |

|

Dividend per share |

|

EUR 0.80 |

|

Book value per share |

|

EUR 28.24 |