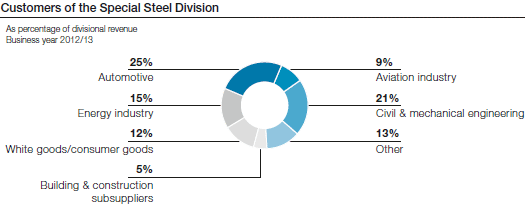

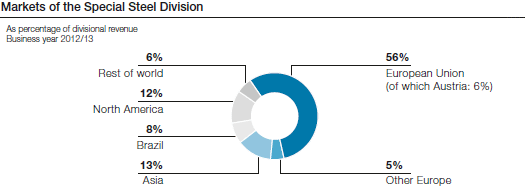

In the Special Steel Division, the business year 2012/13 was characterized by an economic environment that became more and more difficult as the year progressed. The performance in the first half of the year was still quite stable, starting in the fall, however, demand declined markedly. In Europe, this was caused primarily by increasing uncertainty in major customer segments due to the continuing sovereign debt crisis. Customers’ order patterns became more and more cautious and short-term, resulting in accelerated reduction of inventories so that, the division’s production and delivery volumes declined compared to the figures of the previous year.

Especially in the High Performance Metals business segment, these deteriorating framework conditions had a direct impact on business development. Most of the product segments saw incoming orders drop in the course of the business year, although in the last quarter, the situation for tool steel and high-speed steel began to stabilize. The order situation for special steels for oil and natural gas production and the aviation industry remained at a good level throughout the entire business year, although, here too, customers proceeded more cautiously. Valve steel and special constructional steel, however, experienced a downward trend. Demand for hot and cold work steel continued to be restrained due to weaker demand from the automotive sector and the metalworking industry. The situation in these sectors was marked by a reduction of inventories along the entire value chain. Overall, the High Performance Metals business segment experienced a solid level of demand in the first half of 2012/13, due primarily to orders from the automotive, mechanical engineering, oil and natural gas exploration, consumer goods, and aviation sectors. Weaker demand in the second half of the business year 2012/13 was largely the result of a downturn in the automotive industry, especially the commercial vehicle industry, and also—as opposed to the Steel Division—in the mechanical engineering and consumer goods industries as well.

All in all, performance in the Special Forgings business segment was satisfactory, even though demand for forged components in the commercial vehicle, agricultural machinery, and mechanical engineering sectors lagged behind expectations. On the other hand, aircraft manufacturers continually increased their production figures.