In the first half of the business year 2009/10, the market environment of the Special Steel Division was not only affected by the general decline in demand, but it had to deal with the challenge of a massive reduction of inventory along the entire value chain to the end consumer. The resulting losses in incoming orders led to significantly reduced capacity utilization in all four business segments.

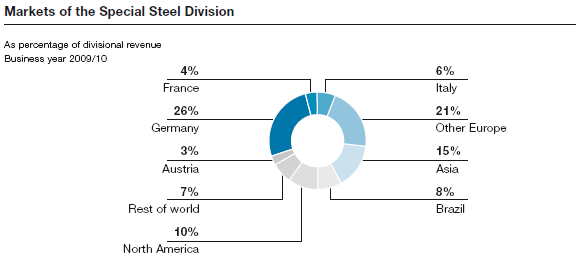

It was not until the fall of 2009, when inventories had fallen to a minimum, that demand picked up again slightly. The performance later on in the business year confirmed the (gradual) trend reversal, with the recovery being driven primarily by Asian markets, with China leading the way. The economic uptrend also gained momentum in South America, predominantly in Brazil, while recovery in North America began much more tentatively. In Europe, demand continued to stagnate at a low level.

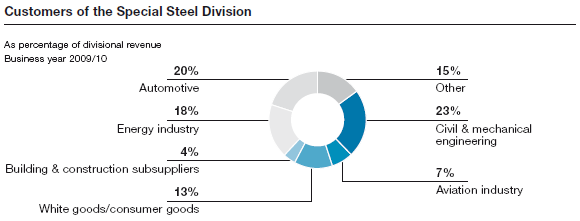

Toward the end of the business year, demand from some of the most important customer industries improved, with the consumer goods, automotive, and alternative energy sectors being at the forefront, so that all indicators are pointing to a sustained trend reversal in these segments. The economic situation in the mechanical engineering segment, however, continues to be difficult; the commercial vehicle and ship building industries are also not yet showing a sustained market recovery. Demand in the aviation and conventional energy generation sectors was still very weak even toward the end of the business year.

In the individual business segments1 the performance of the Special Steel Division was as follows:

After an extremely difficult beginning of the business year 2009/10, the high performance metals segment experienced a slight rise in demand for tool steel and high-speed steel. Demand for special steels and open-die forgings remained under expectations throughout the entire business year. There were some positive signals, primarily relative to China, Brazil, and to a lesser extent North America. Demand on the European markets, however, continued to lag behind other economic regions.

In the welding consumables segment, the initial favorable level of demand eroded during the course of the business year. At the same time, demand in the pipeline construction segment and to some degree also in the offshore and petrochemicals segments was mostly stable, although at a lower level than in the previous year. All other customer industries reduced their demand, in particular, the power plant construction, appliance manufacturing, and mechanical engineering segments.

Unsatisfactory demand during the first half of 2009/10 in the precision strip segment improved somewhat in the course of the second half of the business year, and capacity utilization in the production plants is again showing an upward trend. This segment’s profitability was substantially improved during the year, primarily by way of cost adjustments.

The special forgings segment also had to deal with a major decline in demand, especially in the early part of the business year 2009/10, from the aviation, energy generation, and commercial vehicle industries. As the business year progressed, the tension around the economic situation gradually abated somewhat, although it is not yet certain to what degree the improvement will be sustainable.

1 According to the division structure valid up to March 31, 2010. For the new organizational structure starting as of the business year 2010/11, please see the organizational chart of the voestalpine Group.