The early part of the business year 2009/10 was still adversely impacted to a significant degree by continuing weak demand that was carried over from the previous business year. However, after the summer of 2009, which was still strongly marked by long-term plant closures, reduced working hours, and personnel reductions in the major customer industries, demand began to increasingly stabilize, gradually gaining sustainability and strength and finally reaching a satisfactory level in the fourth quarter of the business year 2009/10.

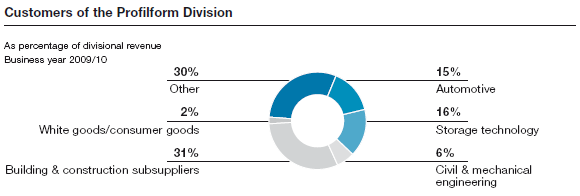

The economic development of the most relevant customer industries for the Profilform Division was sharply differentiated. While the energy generation sector, and here particularly the solar energy segment, experienced very strong growth, demand from the construction and construction supply industries remained disappointing. The production figures in the logistics segment exhibited sustained positive development, with the tubes and sections and storage technology segments profiting equally from this trend. Demand continued to be very subdued in the commercial vehicle sector, which was hit hardest by the global economic crisis in terms of volumes. It was not until the last quarter of the business year that demand in this sector showed slight signs of recovery, although, of course, the starting point of this trend reversal was 60 to 70% below the pre-crisis level.

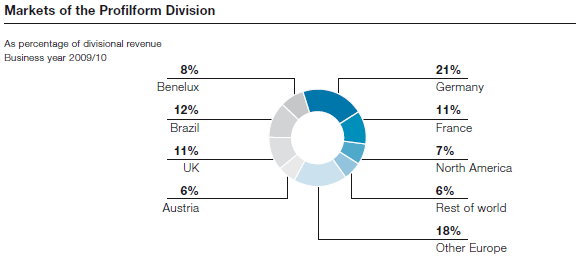

Observed regionally, business performance was stable in the USA, while Brazil has been recording significantly increasing volumes since the end of 2009 with very favorable prospects for the future. From the fall of 2009 on, Europe saw a stabilization and a moderate uptick in business, although Great Britain and Russia continue to face a weak economy, especially in the construction sector.