At the beginning of the business year 2009/10, the situation of the international automobile industry was, quite simply put, dramatic. Demand was crumbling across the board and a massive reduction of inventory levels throughout the entire process chain resulted in the most extensive production cutbacks in the history of the industry. At this point in time, European production was more than 30% below its level prior to the crisis.

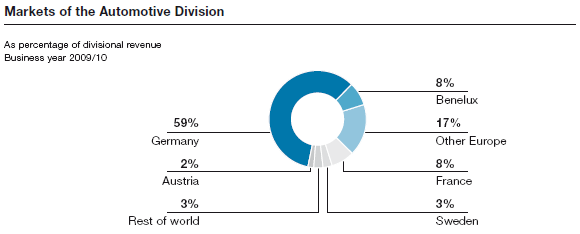

It was not until the comprehensive government-backed incentive programs to revitalize the automotive market were put into place that this trend could be curbed on the Western European markets, particularly Germany, France, and Italy. Initially, it was primarily the high-volume manufacturers and their sub-compact and compact car segments that benefited from these incentives. Among the premium manufacturers, it was mainly the sales numbers of the smaller models that picked up; the mid-sized, executive, and luxury classes did not show signs of recovery until the fall of 2009.

The beginning upward trend was mirrored in an upturn in production, keeping production going until right before Christmas 2009, just like before the economic crisis. Currently, European automobile production has settled at just above 80% of the pre-crisis level; in Europe, however, developments are strongly diverging. While automobile sales in Western Europe during the first calendar quarter of 2010 rose by 11% compared to the previous year, sales in the Eastern European countries during the same period declined by about 18%.