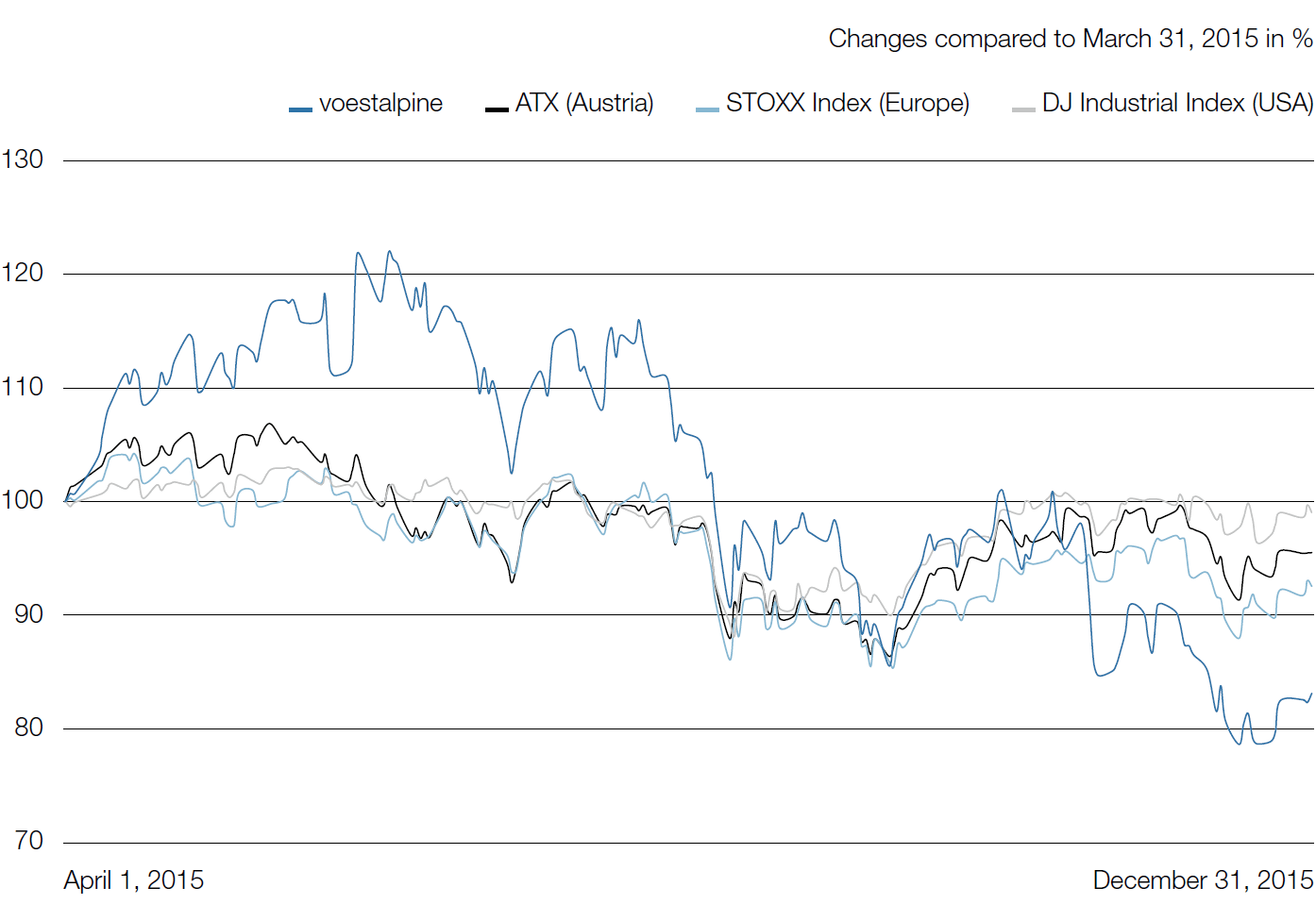

In times of escalating geopolitical crises, plunging commodity prices, and increasing global fears with regard to the economy, the pressure to sell cyclical stocks grows. Against this backdrop, it is not surprising that the performance of the voestalpine share in the first nine months of the business year 2015/16 lagged behind the benchmark indices ATX, STOXX Index Europe, and the Dow Jones Industrial. In the early part of the business year, the voestalpine share had wind in its sails in the form of a positive economic outlook and the publication of its solid figures in the past business year in early June 2015, and it was therefore able to move substantially ahead of the indices. The subsequent decline of the prices on the stock markets in the course of the summer was primarily due to the alarming news from China, where stock prices dropped dramatically and rapidly. Ultimately, they were stabilized, but only with state intervention. The fact that the previously thriving emerging economies in Brazil and Russia have not been able to stabilize has also been a consistent drag on the capital markets. In addition to the deterioration of prices for raw materials, which profoundly affects both countries equally due to their dependence on exports, the problems in Brazil lie in declining consumer spending and constant political turmoil, while Russia is still in the grip of a massive recession resulting from sanctions over the Ukraine crisis.

Looking specifically at the steel industry, it faced tough market conditions worldwide that grew persistently during the current business year due to the steady flood of exports, primarily from China and Russia. The plummeting prices resulting from dumping on the steel spot markets and extremely reduced investment activity by the oil and natural gas industries had commensurate effects on voestalpine, and in mid-November the earnings outlook for the entire business year 2015/16 was downgraded. As a result, the share price lost even more value during the following weeks.

Overall, in the first nine months of 2015/16, the price of the voestalpine share suffered losses amounting to 17.4%, and as of the end of December 2015, it was at EUR 28.35, considerably below its price at the beginning of the business year (EUR 34.34).

Share page