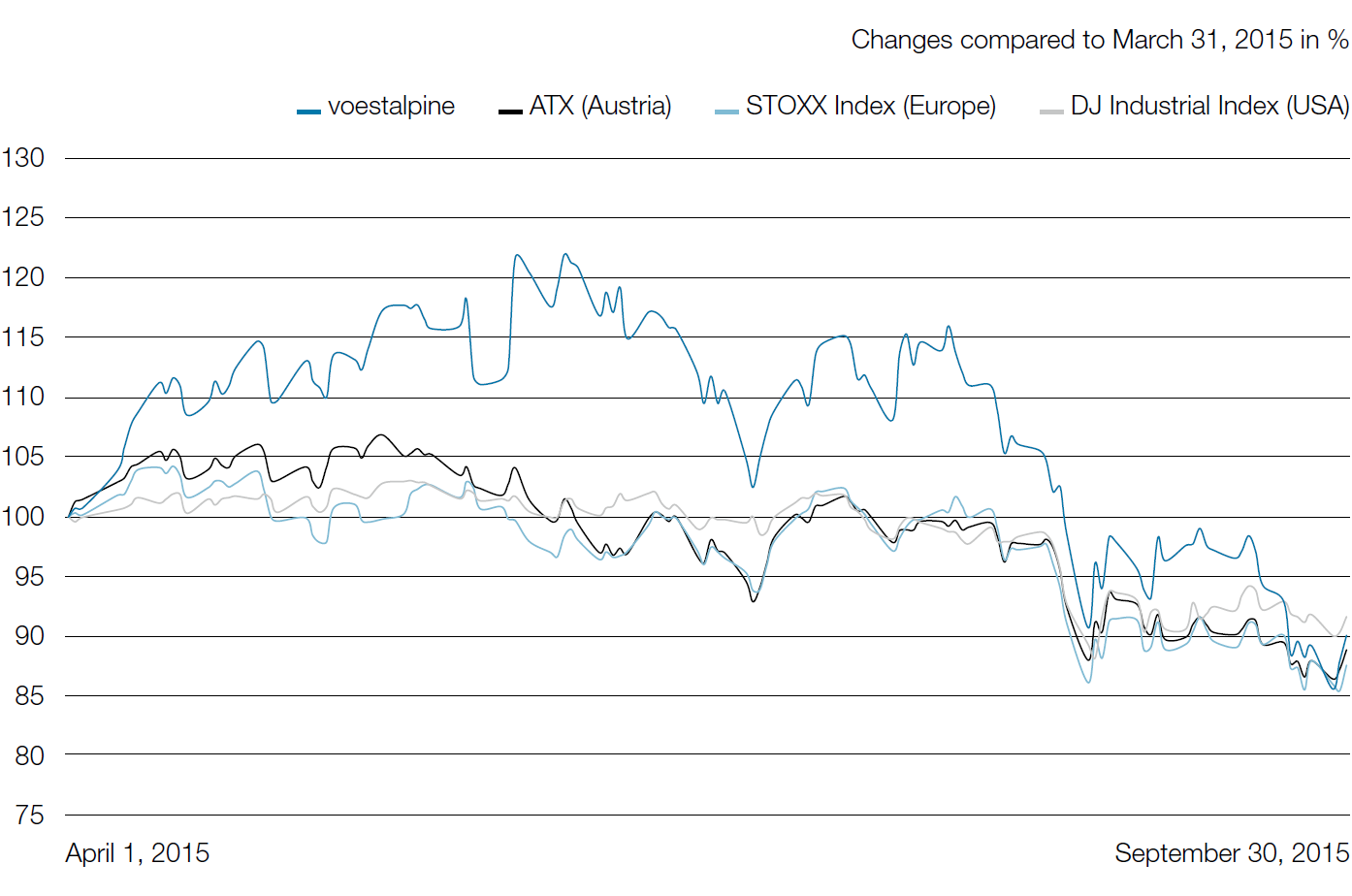

The first six months of the business year 2015/16 have been marked by considerable volatility on the international stock markets. While the rise of the voestalpine share in the early part of the business year was due to the positive economic outlook in Europe that resulted from a combination of factors (the weak euro, the low oil price, and a low interest rate), this positive trend was bolstered by the publication of the company’s key figures for 2014/15. The announcement of the annual results on June 3, 2015 triggered an immediate price gain for the share of more than 8%. Subsequently, however, the voestalpine share lost considerable value. In addition to geopolitical uncertainties, one of the main reasons for this were the macroeconomic developments in previously fast-growing emerging markets, which were forced to downgrade their growth prospects for a variety of reasons. While the Russian Federation slipped into a recession back in 2014 due to sanctions put into place against it as a result of the Ukraine crisis, the economic output in Brazil has kept dwindling due to numerous home-made problems. However, it was the doubts that began to emerge again in the summer of 2015 regarding the robustness of the Chinese economy that had an even greater global effect. At the same time, the problems surrounding the situation in Greece were again the focus of the European capital markets among new fears that the debt issue would spread to the European real economy. These critical developments ultimately led to permanent pressure on the international capital markets in the third calendar quarter and thus also to pressure on the voestalpine share.

In the first six months of the business year 2015/16, it performed at about the same level as the benchmark indices ATX, STOXX Index Europe, and Dow Jones showing a minus of 10.6% as of September 30, 2015. At the beginning of the business year, the share price was at EUR 34.34, while at the end of September, it was at EUR 30.70.

Share page