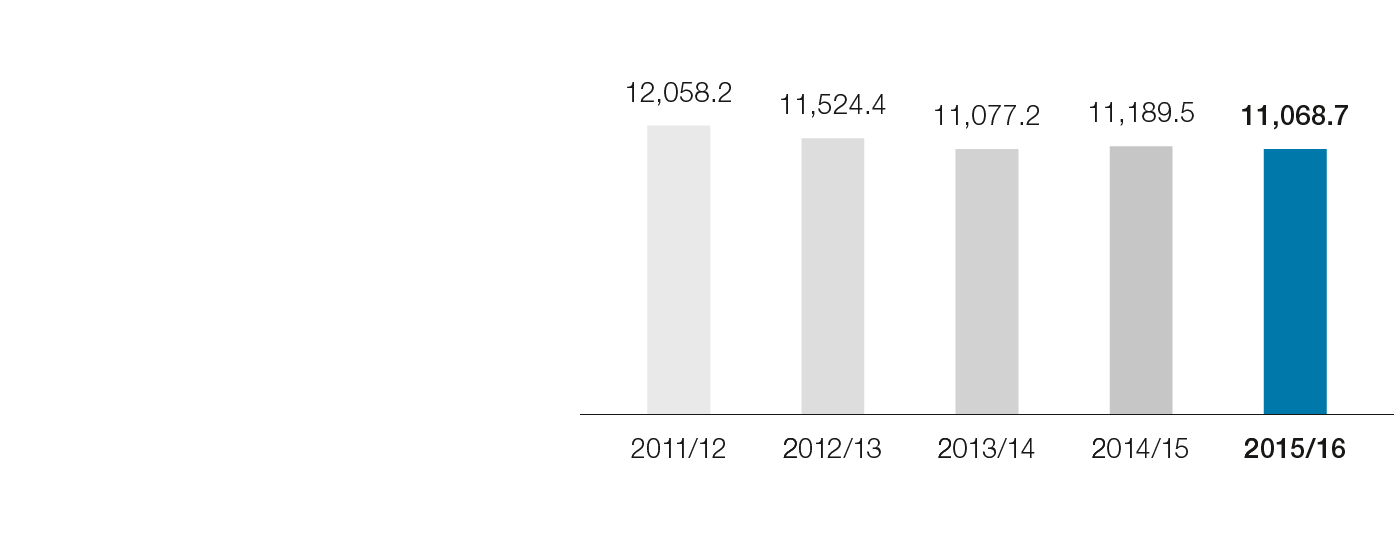

Revenue of the voestalpine Group

In millions of euros

In 2015/16, the revenue generated by the voestalpine Group was EUR 11,068.7 million, exactly 1.1% below the previous year’s figure of EUR 11,189.5 million. The main reasons are the generally lower price level due to declining raw materials and pre-material costs in all four divisions as well as the streamlining in the Metal Forming Division in the business year 2014/15, which resulted in a drop in revenue of around EUR 100 million due to the sale of companies that were no longer relevant to the Group’s core activities (Flamco Group and plastics companies, both in the Netherlands, and Rotec AB, Sweden).

Furthermore, the volume delivered was slightly below the previous year’s level due to the (scheduled) major repair of blast furnace 5 in the Steel Division and in the Special Steel Division as a result of the substantial softening in the oil and natural gas sector. Expansion of investment, particularly in the Special Steel Division, supported revenue generation, as did the continuing development of internationalization activity in the Metal Forming Division. In the Metal Engineering Division, the companies acquired in the business year 2014/15 in the special wire segment (Trafilerie Industriali S.p.A., now voestalpine Wire Italy s.r.l., Italy) and the turnout systems segment (Bathurst Rail Fabrication Center, BRFC, Australia), contributed to an increase in revenue in the past business year. The greatest contribution to a boost in revenue in this division in absolute figures, however, resulted from positive effects of the first-time consolidation of companies previously consolidated at equity (voestalpine Tubulars GmbH & Co KG, voestalpine Tubulars GmbH, both in Austria, and CNTT Chinese New Turnout Technologies Co., Ltd., China). This means that the Metal Engineering Division was the only division in the voestalpine Group that saw an increase in revenue in 2015/16.

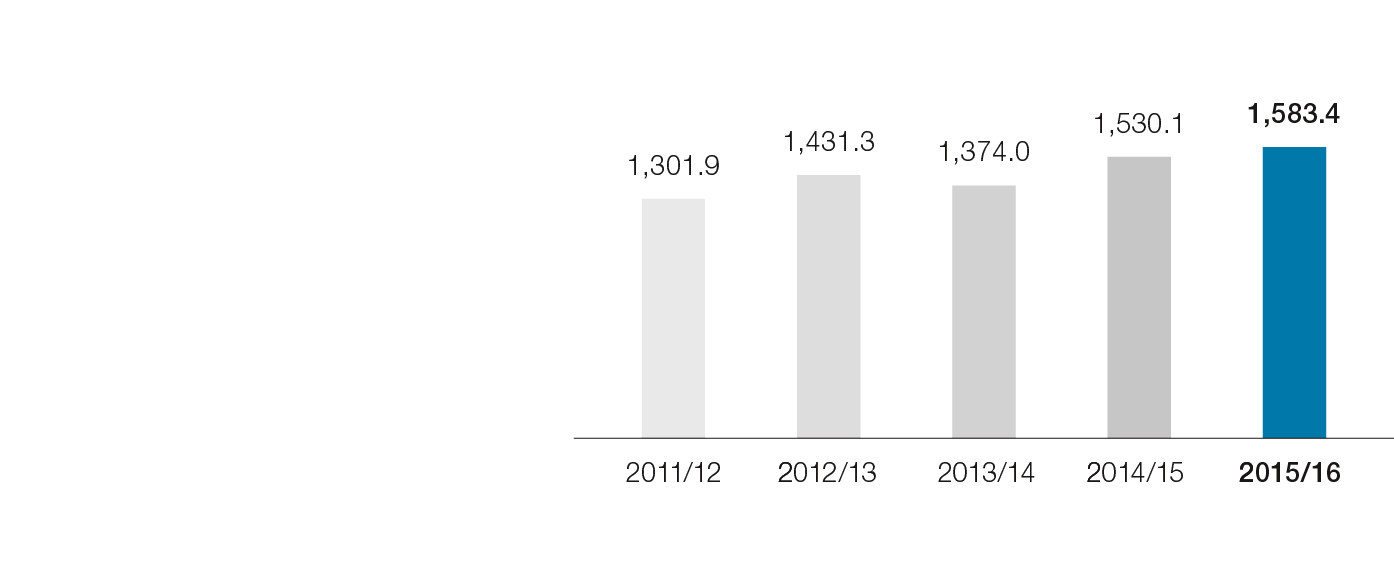

The consolidated operating result (EBITDA) in the past business year rose by 3.5% to EUR 1,583.4 million (previous year: EUR 1,530.1 million), which corresponds to a reported EBITDA margin of 14.3% (previous year: 13.7%). However, the reported results contained substantial non-recurring effects both in the previous year and in the business year 2015/16. In 2014/15, the non-recurring effects resulting from divestments and other structural measures in the Metal Forming Division amounted to a total of EUR 61.9 million reported in EBITDA and EUR 45.2 million reported in EBIT. The current figures for the business year 2015/16 published in accordance with IFRS contain non-recurring income in connection with the change in the method of consolidation relative to the previously mentioned companies in the Metal Engineering Division amounting to EUR 137.6 million reported in EBITDA and EUR 74.4 million reported in EBIT (due in both cases to the required fair value measurement and the depreciation of the disclosed hidden reserves). This also includes the depreciation of intangible fixed assets relative to the hidden reserves disclosed when the method of consolidation was changed for voestalpine Tubulars GmbH & Co KG in the fourth quarter of 2015/16. This need to record an impairment adjustment was caused by the negative situation during the year, especially the prices for oil and natural gas, which have fallen significantly. Adjusted for all of these non-recurring effects (clean EBITDA), EBITDA declined slightly in a year-over-year comparison by 1.5% from EUR 1,468.2 million to EUR 1,445.8 million. The adjusted EBITDA margin remained unchanged at 13.1%. As far as earnings are concerned, the Steel Division and the Metal Forming Division both increased the (adjusted) earnings reported in EBITDA from 2014/15 to 2015/16. In both divisions, they are primarily the result of the broadly implemented cost optimization measures, as there was no substantial upward trend in their most important customer segments with the exception of the automotive industry. In the Metal Forming Division, contributions from internationalization activity also had a positive effect on earnings. The main reason for the decline in the operating result (EBITDA) in the Special Steel and Metal Engineering Divisions is the slump in the oil and natural gas sector, which affected both divisions with equal intensity.

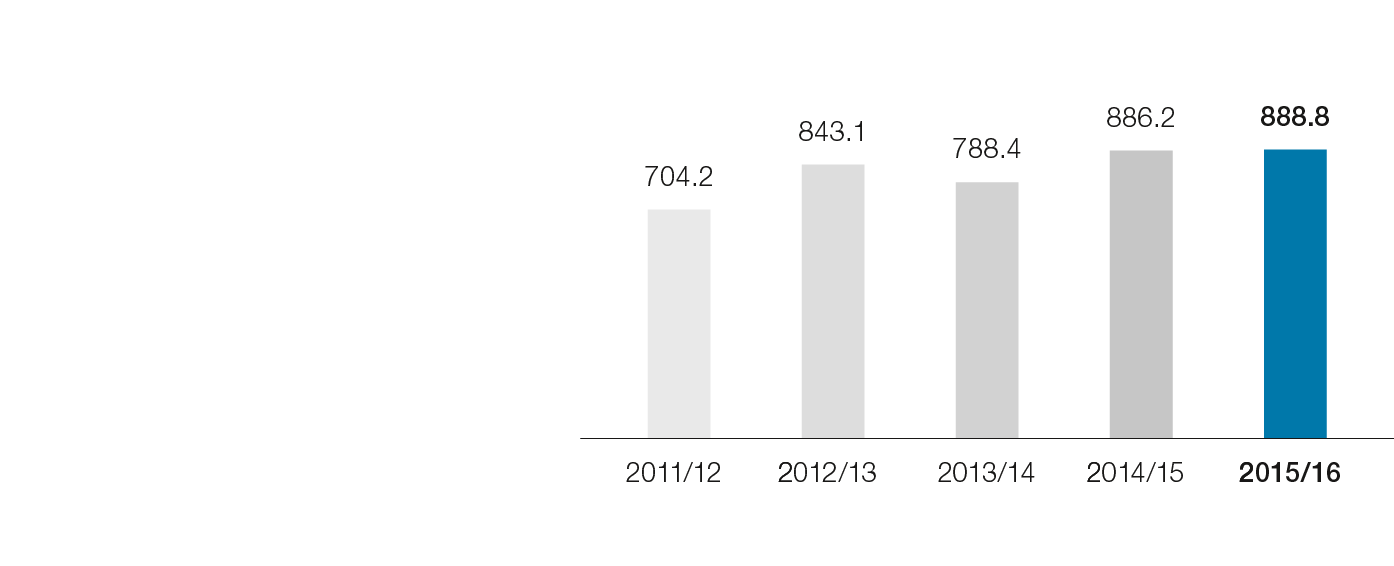

Based on the reported figures (i.e., including the non-recurring effects), at EUR 888.8 million, profit from operations (EBIT) in the business year 2015/16 was slightly higher than in the previous year (EUR 886.2 million), with the EBIT margin going from 7.9% in 2014/15 to 8.0% in 2015/16. After deducting the non-recurring effects, EBIT fell by 3.2% from EUR 841.0 million to EUR 814.4 million, resulting in a virtually stable EBIT margin of 7.4% (previous year: 7.5%).

Share page