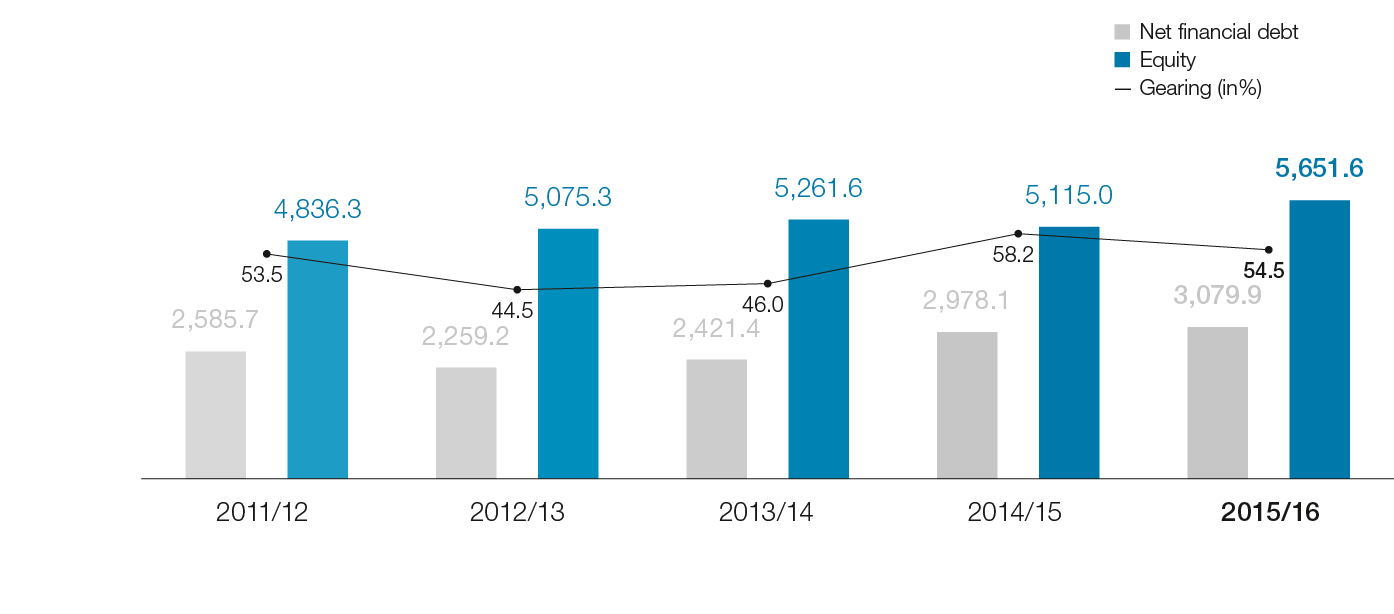

Despite record investment of more than EUR 1.3 billion in the business year 2015/16—due to largely finalizing important future-oriented projects—which resulted in a commensurate cash outflow, the gearing ratio (net financial debt in percent of equity) of 58.2% as of March 31, 2015 was reduced to 54.5% as of March 31, 2016. This trend shows that the high-tech/high-quality growth strategy that the voestalpine Group has been pursuing for many years is not mutually exclusive with sound financial management despite its high level of investment. The most significant factor was stable and solid development of earnings that made an increase of the equity base by a healthy 10.5% from EUR 5,115.0 million at the end of the business year 2014/15 to EUR 5,651.6 million as of the end of the business year 2015/16 possible. Despite the massive expansion in investment activity in the past twelve months, net financial debt rose only slightly by 3.4% from EUR 2,978.1 million as of March 31, 2015 to EUR 3,079.9 million as of March 31, 2016.

- The Group

- Management Report

- Menu item: Market environment

- Menu item: Key figures

- Menu item: Events in the course of the year

- Menu item: Investments

- Menu item: Acquisitions

- Menu item: Employees

- Menu item: Raw materials

- Menu item: Research and development

- Menu item: Environment

- Menu item: Risk report

- Menu item: Rights and obligations

- Menu item: Outlook

- Divisional Reports

- Financial Statements

- Notes

- Menu item: General information

- Menu item: Accounting policies

- Menu item: Scope of consolidated financial statements

- Menu item: Acquisitions

- Menu item: Subsidiaries

- Menu item: Investments in associates and joint ventures

- Menu item: Notes to the income statement

- Menu item: Notes to the statement of financial position – Assets

- Menu item: Notes to the statement of financial position – Equity and liabilities

- Menu item: Other Notes

- Menu item: 23. Financial instruments

- Menu item: 24. Statement of cash flows

- Menu item: 25. Related party disclosures

- Menu item: 26. Employee information

- Menu item: 27. Expenses for the Group auditor

- Menu item: 28. Disclosures

- Menu item: 29. Events after the reporting period

- Menu item: 30. Earnings per share

- Menu item: 31. Appropriation of net profit

- Menu item: Auditor’s report

- Menu item: Management Board statement

- Menu item: Investments

Share page