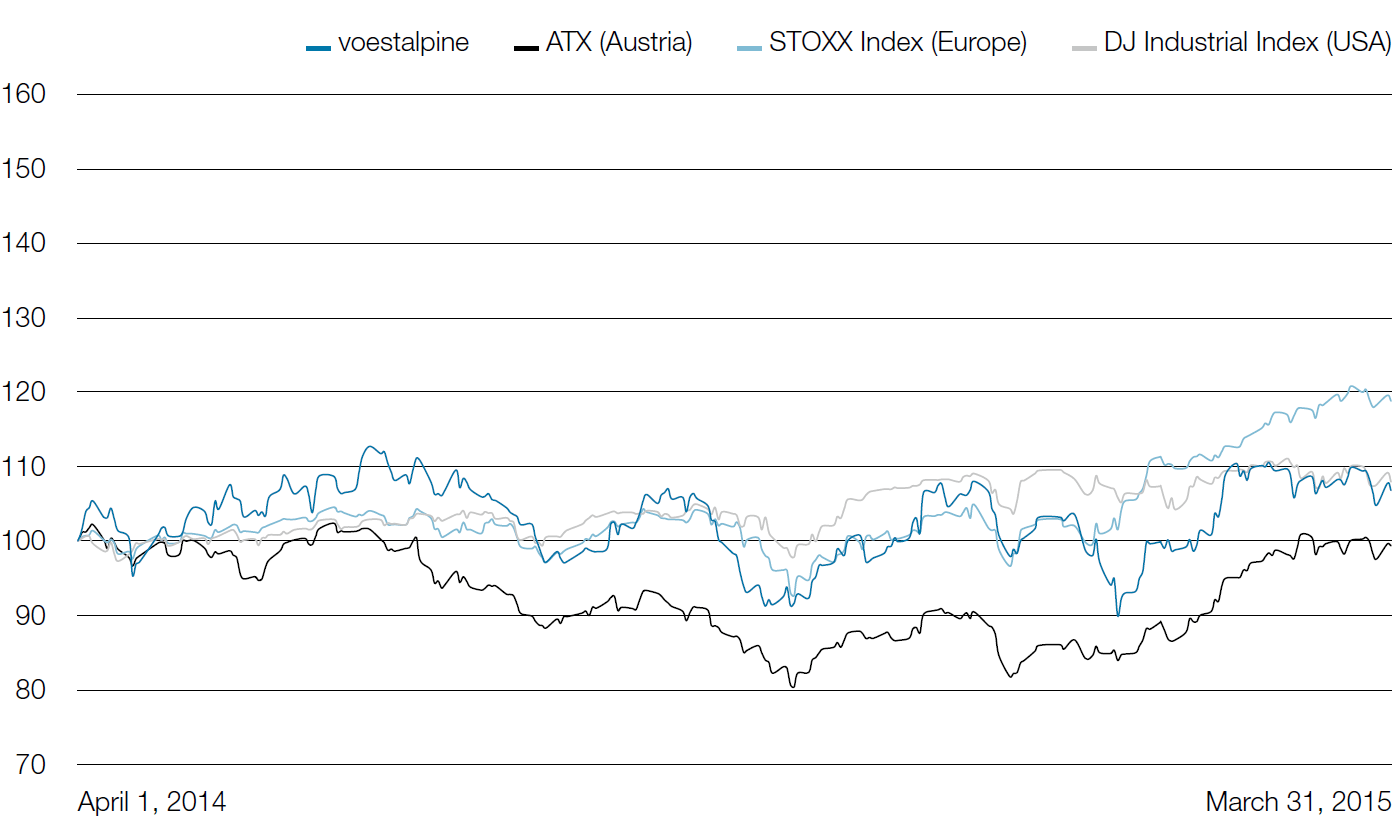

The development of the voestalpine share during the entire business year 2014/15 demonstrated a lateral movement. The share price remained within a corridor of +10% almost throughout the entire year and by the end of the business year had ultimately risen by 5% in a year-to-year comparison. In addition to the largely stable earnings situation of the voestalpine Group, political and macroeconomic events once again dictated the development of the prices on the European stock exchanges and thus the performance of the voestalpine share as well. While the European economy stagnated at a low level and showed a slight recovery trend only toward the end of the business year, political developments in Europe did not result in an easing of the situation on the capital markets. Particularly, the conflict in the Ukraine and the resulting sanctions and counter-sanctions had an adverse impact on the mood and subsequently, increasingly on the real economy in Europe as well.

The election result in Greece in January 2015, which made the discussion about just how crisis-proof the euro is front page news, had an adverse impact on the capital market. As opposed to 2011, however, this time there was no panic reaction on the stock markets. Even the term “Grexit,” which became a buzz word in the media, was more an expression of the general political uncertainty rather than serious speculation about the viability of the common currency.

Despite these negative impacts from the political front, the European stock markets—and with them the voestalpine share—experienced a modest rally in the last quarter of the business year, due on one hand to improved economic forecasts and on the other, to the quantitative easing program amounting EUR 1.140 billion that was resolved by the European Central Bank (ECB). To combat the risk of deflation and recession, bank balance sheets are strengthened by way of bond purchases by the ECB. The intention is to increase loans to the real economy and thus stimulate economic growth overall. After the bursting of the real estate bubble and the resulting recession, this concept enabled the USA to return relatively quickly to a solid growth pattern, although this meant accepting negative debt effects.

Compared to the indices, the voestalpine share left Austria’s leading share index in the dust in the past business year, and it was not until the last quarter that it was outperformed by the broad European STOXX Index. In a year-to-year comparison, the voestalpine share was able to keep up with the US stock market, which has already been performing strongly for a number of years.

Share page