General information

The principal financial instruments used by the voestalpine Group consist of bank loans, bonds, borrower’s notes, and trade payables. The primary aim of the financial instruments is to finance the business activities of the Group. The Group holds various financial assets, such as trade receivables, short-term deposits, and non-current investments, which result directly from the Group’s business activities.

The Group also uses derivative financial instruments. These instruments mainly include interest rate swaps, forward exchange transactions, and commodity swaps. These derivative financial instruments are used to hedge interest rate and currency risks and risks from fluctuations in raw materials prices, which result from the business activities of the Group and its sources of financing.

Capital management

In addition to ensuring availability of the liquidity necessary to support business activities and maximizing shareholder value, the primary objective of the Group’s capital management is to ensure appropriate creditworthiness and a satisfactory equity ratio.

Capital management in the voestalpine Group is performed using the net financial debt to EBITDA ratio and the gearing ratio, i.e., the net financial debt to equity ratio. Net financial debt consists of interest-bearing loans less financing receivables and other loan receivables, securities, cash and cash equivalents. Equity includes non-controlling interests in Group companies and the hybrid capital.

The target amount for the gearing ratio is 50% and may only be exceeded up to a maximum of 75% for a limited period of time. The net financial debt to EBITDA ratio may not exceed 3.0. All growth measures and capital market transactions are based on these ratios.

The following table shows these two ratios for the reporting period:

|

|

|

03/31/2014 |

|

03/31/2015 |

|

|

|

|

|

|

|

Gearing ratio in % |

|

46.0% |

|

58.4% |

|

Net financial debt to EBITDA ratio |

|

1.8 |

|

1.9 |

Financial risk management – Corporate finance organization

Financial risk management also includes the area of raw material risk management. Financial risk management is organized centrally with respect to policy-making power, strategy determination, and target definition. The existing policies include targets, principles, duties, and responsibilities for both the Group Treasury and individual Group companies. In addition, they govern the areas of pooling, money market, credit and securities management, currency, interest rate, liquidity, and commodity price risk, and reporting. The Group Treasury, acting as a service center, is responsible for implementation. Three organizationally separate units are responsible for closing, processing, and recording transactions, which guarantees a six-eyes principle. Policies, policy compliance, and the ICS conformity of business processes are additionally audited at regular intervals by an external auditor.

It is part of the voestalpine Group’s corporate policy to continuously monitor, quantify, and, where reasonable, hedge financial risks. The Group’s willingness to accept risk is relatively low. The strategy aims at achieving natural hedges and reducing fluctuations in cash flows and income. Market risks are largely hedged by means of derivative financial instruments.

To quantify interest rate risk, voestalpine AG uses interest rate exposure and fair value risk as indicators. Interest rate exposure quantifies the impact of a 1% change in the market interest rate on interest income and interest expenses. Fair value risk means the change in the fair value of an interest rate-sensitive item with a 1% parallel shift of the interest yield curve.

voestalpine AG uses the “@risk” concept to quantify currency risk. The maximum loss within one year is determined with 95% certainty. Risk is calculated for the open position, which is defined as the budgeted quantity for the next twelve months less the quantity that has already been hedged. The variance-covariance approach is used to evaluate foreign currency risk.

Liquidity risk – Financing

Liquidity risk refers to the risk of not being able to fulfill the payment commitments due to insufficient means of payment.

The primary instrument for controlling liquidity risk is a precise financial plan that is submitted quarterly by the operating entities directly to the Group Treasury of voestalpine AG. The funding requirements with regard to financing and bank credit lines are determined based on the consolidated results.

Working capital is financed by the Group Treasury. A central clearing system performs intra-group netting daily. Entities with liquidity surpluses indirectly put these funds at the disposal of entities requiring liquidity. The Group Treasury places any residual liquidity with their principal banks. This allows the volume of outside borrowing to be decreased and net interest income to be optimized.

Financing is carried out in the local currency of the borrower in order to avoid exchange rate risk or is currency-hedged using cross-currency swaps.

voestalpine AG holds securities and current investments as a liquidity reserve. As of March 31, 2015, non-restricted securities amounted to EUR 383.8 million (March 31, 2014: EUR 374.7 million). Furthermore, cash and cash equivalents in the amount of EUR 464.5 million (March 31, 2014: EUR 532.4 million) are reported in the consolidated financial statements.

Additionally, adequate credit lines that are callable at any time exist with domestic and foreign banks. These credit lines have not been drawn. In addition to the possibility of exhausting these financing arrangements, contractually guaranteed credit lines of EUR 896 million (2013/14: EUR 400 million) are available to bridge any economic downturns.

The sources of financing are managed on the basis of the principle of bank independence. Financing is currently being provided by approximately 20 different domestic and foreign banks. Covenants agreed for a minor part of the total credit volume with a single bank are adhered to. The capital market is also used as a source of financing. No capital market transactions were carried out during the business year 2013/14. The following capital market transactions were performed in the business year 2014/15:

|

Issue of new borrower’s notes |

|

EUR 221.0 million |

|

Issue of new borrower’s notes |

|

USD 100.0 million |

|

|

|

|

|

Restructuring of existing borrower’s notes |

|

|

|

Early extensions |

|

EUR 250.0 million |

|

Early repayment |

|

EUR 337.5 million |

|

|

|

|

|

Issue of a new senior bond |

|

EUR 400.0 million |

The capital increase decided by the Management Board on March 9, 2015, and approved by the Supervisory Board on March 26, 2015, was entered on April 25, 2015 in the amount of 2.5 million shares and is therefore effective as of this date.

A maturity analysis of all liabilities existing as of the reporting date is presented below:

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Due within one year |

|

Due between one and five years |

|

Due after more than five years |

||||||

|

|

|

2013/14 |

|

2014/15 |

|

2013/14 |

|

2014/15 |

|

2013/14 |

|

2014/15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bonds |

|

0.0 |

|

0.0 |

|

994.1 |

|

995.4 |

|

0.0 |

|

391.8 |

|

Bank loans |

|

755.0 |

|

742.6 |

|

1,456.9 |

|

1,349.9 |

|

80.1 |

|

176.7 |

|

Trade payables |

|

1,093.0 |

|

1,260.4 |

|

5.5 |

|

0.1 |

|

0.0 |

|

0.0 |

|

Liabilities from finance leases |

|

5.8 |

|

6.0 |

|

16.5 |

|

24.3 |

|

16.3 |

|

6.5 |

|

Derivative liabilities |

|

18.1 |

|

28.8 |

|

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

|

Other financial liabilities |

|

7.6 |

|

57.2 |

|

32.8 |

|

9.9 |

|

0.1 |

|

50.1 |

|

Total liabilities |

|

1,879.5 |

|

2,095.0 |

|

2,505.8 |

|

2,379.6 |

|

96.5 |

|

625.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In millions of euros |

||||

As estimated as of the reporting date, the following (prospective) interest charges correspond to these existing liabilities:

|

|

|

Due within one year |

|

Due between one and five years |

|

Due after more than five years |

||||||

|

|

|

2013/14 |

|

2014/15 |

|

2013/14 |

|

2014/15 |

|

2013/14 |

|

2014/15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest on bonds |

|

43.8 |

|

52.8 |

|

151.3 |

|

143.5 |

|

0.0 |

|

18.0 |

|

Interest on bank loans |

|

45.3 |

|

38.3 |

|

75.3 |

|

95.3 |

|

4.4 |

|

13.7 |

|

Interest on liabilities from finance leases |

|

1.7 |

|

1.6 |

|

4.9 |

|

2.9 |

|

0.8 |

|

0.8 |

|

Interest on other financial liabilities |

|

1.1 |

|

1.4 |

|

0.1 |

|

0.0 |

|

0.0 |

|

0.0 |

|

Total interest charges |

|

91.9 |

|

94.1 |

|

231.6 |

|

241.7 |

|

5.2 |

|

32.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In millions of euros |

||||

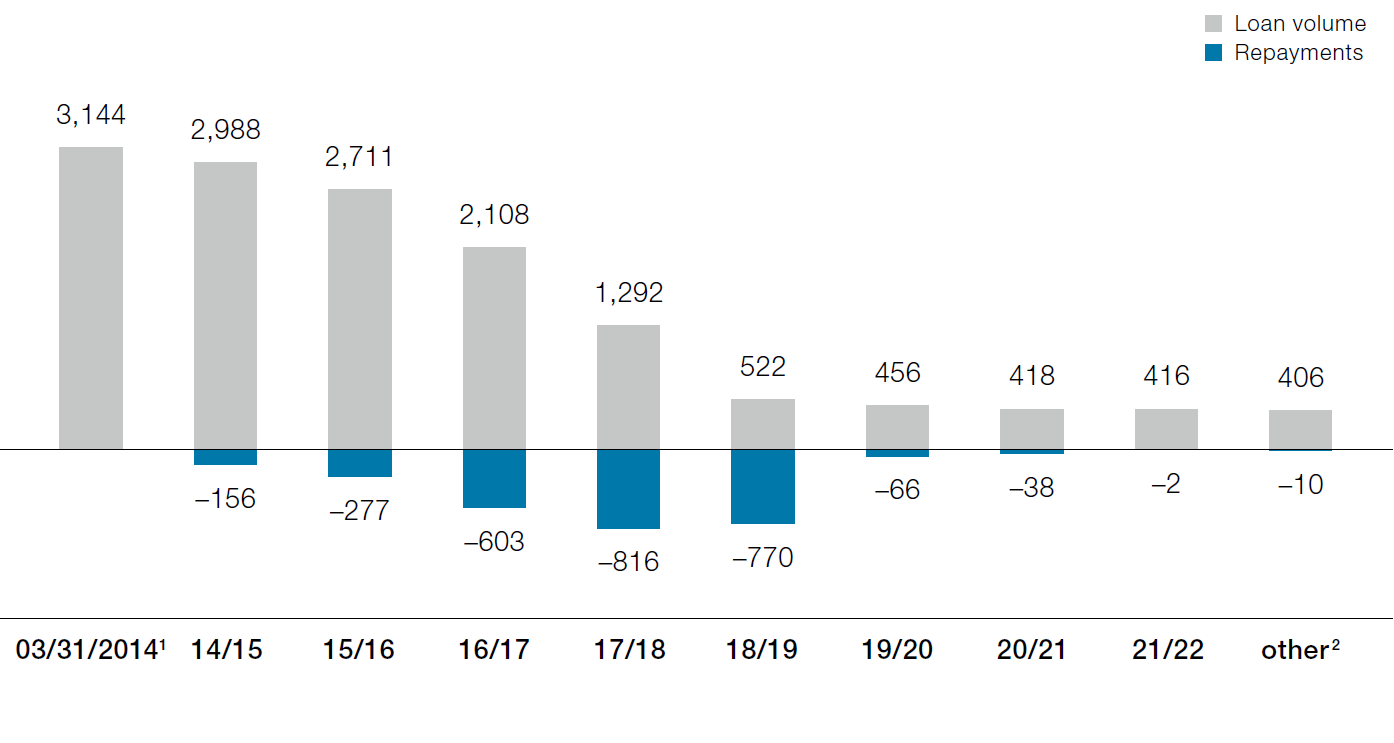

As of March 31, 2014, the maturity structure of the loan portfolio had the following repayment profile for the next several years:

Loan portfolio maturity structure as of March 31, 2014

In millions of euros

1 Debit balances with banks not included

2 Contains EUR 406.1 million of revolving export loans

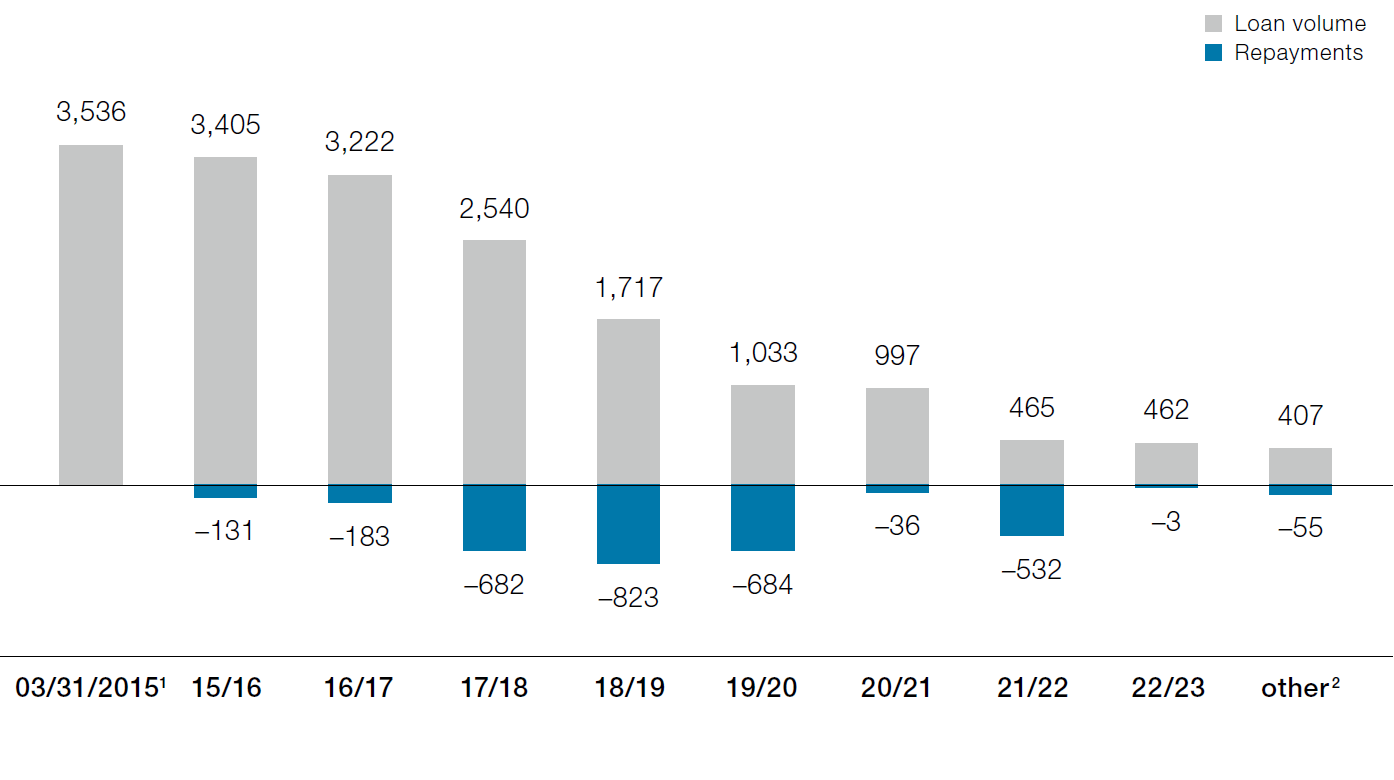

As of March 31, 2015, the maturity structure of the loan portfolio has the following repayment profile for the next several years:

Loan portfolio maturity structure as of March 31, 2015

In millions of euros

1 Debit balances with banks not included

2 Contains EUR 406.1 million of revolving export loans

Credit risk

Credit risk refers to financial losses that may occur through non-fulfillment of contractual obligations by business partners.

The credit risk of the underlying transactions is kept low by precise management of receivables. A high percentage of delivery transactions is covered by credit insurance. Bankable security is also provided, such as guarantees and letters of credit.

The following receivables, for which no impairment has yet been recorded, were past due as of the reporting date:

|

Receivables that are past due but not impaired |

|

|

|

|

|

|

|

03/31/2014 |

|

03/31/2015 |

|

|

|

|

|

|

|

Up to 30 days past due |

|

136.2 |

|

149.8 |

|

31 to 60 days past due |

|

31.6 |

|

35.1 |

|

61 to 90 days past due |

|

13.6 |

|

12.7 |

|

91 to 120 days past due |

|

9.6 |

|

10.0 |

|

More than 120 days past due |

|

24.3 |

|

23.3 |

|

Total |

|

215.3 |

|

230.9 |

|

|

|

|

|

|

|

|

|

In millions of euros |

||

The following impairment was recorded for receivables of voestalpine AG during the reporting period:

|

Impairment for receivables |

|

|

|

|

|

|

|

2013/14 |

|

2014/15 |

|

|

|

|

|

|

|

Opening balance as of April 1 |

|

41.4 |

|

33.7 |

|

|

|

|

|

|

|

Additions |

|

6.2 |

|

8.6 |

|

Net exchange differences |

|

–0.9 |

|

0.2 |

|

Changes in the scope of consolidated financial statements |

|

–0.2 |

|

–0.2 |

|

Reversal |

|

–5.0 |

|

–2.5 |

|

Use |

|

–7.8 |

|

–5.0 |

|

Closing balance as of March 31 |

|

33.7 |

|

34.8 |

|

|

|

|

|

|

|

|

|

In millions of euros |

||

As most of the receivables are insured, the risk of bad debt losses is limited. The maximum loss, which is theoretically possible, equals the amount at which the receivables are stated in the statement of financial position.

The management of credit risk from investment and derivative transactions is governed by internal guidelines. All investment and derivative transactions are limited for each counterparty, with the size of the limit dependent on the rating of the bank.

The credit risk for derivative financial instruments is limited to transactions with a positive market value and to the replacement cost of such transactions. Therefore, derivative transactions are only valued at their positive market value up to this limit. Derivative transactions are exclusively based on standardized master agreements for financial forward transactions.

|

Breakdown of investments at financial institutions by rating classes |

|

|||||||||

|

|

|

AAA |

|

AA |

|

A |

|

BBB |

|

<BBB/NR |

|

|

|

|

|

|

|

|

|

|

|

|

|

Bonds |

|

79.5 |

|

197.1 |

|

12.8 |

|

7.6 |

|

3.6 |

|

Money market investments excl. account credit balances |

|

0.0 |

|

48.0 |

|

123.6 |

|

0.0 |

|

0.0 |

|

Derivatives1 |

|

0.0 |

|

0.3 |

|

32.4 |

|

6.2 |

|

0.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In millions of euros |

||

Currency risk

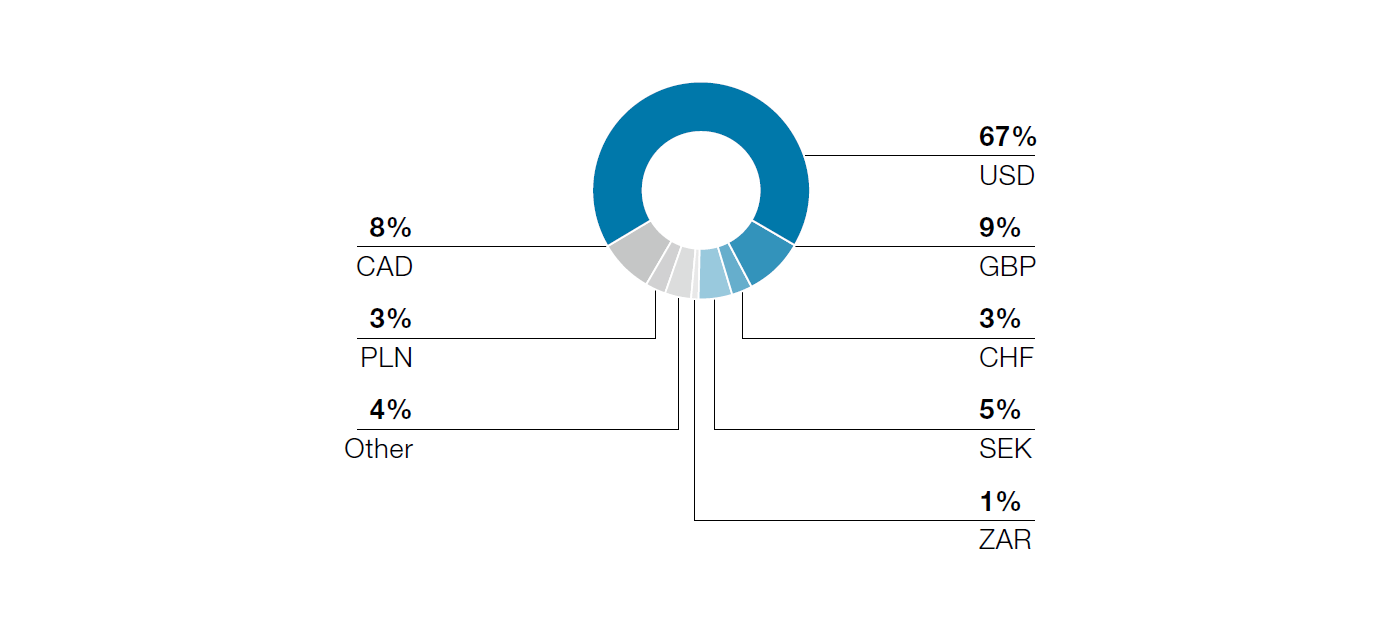

The largest currency position in the Group arises from raw materials purchases in USD and to a lesser degree from exports to the “non-euro area.”

An initial hedge is provided by naturally covered items where, for example, trade receivables in USD are offset by liabilities for the purchase of raw materials also in USD (USD netting). The use of derivative hedging instruments is another possibility. voestalpine AG hedges budgeted (net) foreign currency payments over the next twelve months. Longer-term hedging occurs only for contracted projects. The hedging ratio is between 50% and 100%. The further in the future the cash flow lies, the lower the hedging ratio.

The net requirement for USD in the voestalpine Group, including the joint venture voestalpine Tubulars GmbH & Co KG, which processes foreign currency transactions through the Group Treasury, was USD 716.8 million in the business year 2014/15. The decrease compared to the previous year (USD 936.8 million) was due primarily to the decrease in prices of raw materials purchased. The remaining foreign currency exposure, resulting primarily from exports to the “non-euro area” and raw material purchases, is significantly lower than the USD risk.

Foreign currency portfolio 2014/15 (net)

Based on the Value-at-Risk calculation, as of March 31, 2015, the risks for all open positions for the upcoming business year are as follows:

|

Undiversified |

|

USD |

|

PLN |

|

ZAR |

|

GBP |

|

CAD |

|

CHF |

|

SEK |

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Position1 |

|

–336.1 |

|

0.9 |

|

7.2 |

|

40.9 |

|

61.6 |

|

10.2 |

|

–11.3 |

|

26.2 |

|

VaR (95%/year) |

|

50.3 |

|

0.1 |

|

1.5 |

|

4.8 |

|

8.9 |

|

1.4 |

|

1.3 |

|

3.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In millions of euros |

||||||||||||

Taking into account the correlation between the different currencies, the resulting portfolio risk is EUR 42.1 million (March 31, 2014: EUR 35.6 million) for the voestalpine Group, including the joint venture voestalpine Tubulars GmbH & Co KG, which processes foreign currency transactions through the Group Treasury.

Interest rate risk

voestalpine AG differentiates between cash flow risk (the risk that interest expenses or interest income will undergo a detrimental change) for variable-interest financial instruments and present value risk for fixed-interest financial instruments. The positions shown include all interest rate-sensitive financial instruments (loans, money market, issued and purchased securities, as well as interest rate derivatives).

The primary objective of interest rate management is to optimize interest expenses while taking the risk into consideration. In order to achieve a natural hedge for interest-bearing positions, the modified duration of assets is closely linked to the modified duration of the liabilities.

The variable-interest positions on the liabilities side significantly exceed the positions on the assets side so that a 1% increase in the money market rate increases the interest expense by EUR 2.9 million (2013/14: EUR 6.5 million increase).

The weighted average interest rate for asset positions is 0.89% (2013/14: 1.22%) with a duration of 1.25 years (2013/14: 1.31 years)—including money market investments—and 2.48% (2013/14: 2.86%) for liability positions with a duration of 2.52 years (2013/14: 1.96 years).

|

|

|

Position1 |

|

Weighted average interest rate |

|

Duration (years) |

|

Average capital commitment (years)2 |

|

Sensitivity to a 1% change in the interest rate1 |

|

Cash flow risk1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets |

|

990.9 |

|

0.89% |

|

1.25 |

|

1.82 |

|

–7.7 |

|

–7.4 |

|

Liabilities |

|

–3,777.2 |

|

2.48% |

|

2.52 |

|

3.99 |

|

111.9 |

|

10.3 |

|

Net |

|

–2,786.3 |

|

|

|

|

|

|

|

104.2 |

|

2.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

||||||||||

The present value risk determined using the Value-at-Risk calculation for March 31, 2015, is equal to EUR 15.6 million (2013/14: EUR 99.7 million) for positions on the assets side given a 1% change in the interest rate and EUR 181.5 million (2013/14: EUR 393.6 million) for positions on the liabilities side. Therefore, in the event of a 1% drop in the interest rate, voestalpine AG would have an imputed (unrecognized) net present value loss of EUR 165.9 million (2013/14: EUR 293.9 million).

The asset positions include EUR 417.9 million (previous year: EUR 406.2 million) of investments in the V54 fund of funds. 100% of the fund assets are invested in bonds and money market securities in euros or in cash in the three sub-funds V101, V102, V103 and in various special funds as follows:

|

Funds |

|

Investment currency |

||

|

|

|

|

|

|

|

Sub-fund V101 |

|

EUR 66.7 million |

|

with a duration of 3.58 |

|

Sub-fund V102 |

|

EUR 144.0 million |

|

with a duration of 3.87 |

|

Sub-fund V103 |

|

EUR 124.9 million |

|

with a duration of 2.84 |

|

Special funds |

|

EUR 80.7 million |

|

(only included in V54) |

In addition to the investment fund, there are also securities exposures in the amount of EUR 6.4million (March 31, 2014: EUR 7.8 million).

In the business year 2014/15, gains in the amount of 4.9% (2013/14: 1.88%) were recorded in the V54 fund of funds.

Securities are measured at fair value. For the determination of the fair value, quoted prices for identical assets or liabilities in active markets (unadjusted) are used. Net profit amounting to EUR 20.7 million (2013/14: EUR 8.2 million) is recognized at fair value through profit or loss for financial instruments that are measured using the fair value option.

Derivative financial instruments

Portfolio of derivative financial instruments:

|

|

|

Nominal value (in millions of euros) |

|

Market value (in millions of euros) |

|

Of which accounted for in equity |

|

Maturity |

||||||||

|

|

|

03/31/2014 |

|

03/31/2015 |

|

03/31/2014 |

|

03/31/2015 |

|

03/31/2014 |

|

03/31/2015 |

|

03/31/2014 |

|

03/31/2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Forward exchange transactions (incl. currency swaps) |

|

915.8 |

|

900.9 |

|

–3.9 |

|

47.8 |

|

–2.0 |

|

37.4 |

|

< 2 years |

|

< 2 years |

|

Interest rate derivatives |

|

506.5 |

|

525.4 |

|

–5.2 |

|

–14.3 |

|

–8.7 |

|

–4.4 |

|

< 6 years |

|

<= 5 years |

|

Commodity swaps |

|

12.0 |

|

24.8 |

|

–0.1 |

|

–1.6 |

|

0.0 |

|

0.0 |

|

< 4 years |

|

< 3 years |

|

Total |

|

1,434.3 |

|

1,451.1 |

|

–9.2 |

|

31.9 |

|

–10.7 |

|

33.0 |

|

|

|

|

The derivative transactions are marked to market daily by determining the value that would be realized if the hedging position were closed out (liquidation method). Input for the calculation of market values are observable currency exchange rates and raw materials prices as well as interest rates. Based on the input, the market value is calculated using generally accepted actuarial formulas.

Unrealized profits or losses from hedged transactions are accounted for as follows:

- If the hedged asset or liability is already recognized in the statement of financial position or an obligation not recorded in the statement of financial position is hedged, the unrealized profits and losses from the hedged transaction are recognized through profit and loss. At the same time, the hedged item is reported at fair value, regardless of its initial valuation method. The resulting unrealized profits and losses are offset with the unrealized results of the hedged transaction in the income statement, so that in total, only the ineffective portion of the hedged transaction is reported in profit or loss for the period (fair value hedges).

- If a future transaction is hedged, the effective portion of the unrealized profits and losses accumulated up to the reporting date is recognized directly in other comprehensive income. The ineffective portion is recognized through profit and loss. When the transaction that is hedged results in the recognition of an asset or a liability in the statement of financial position, the amount recognized in other comprehensive income is taken into account when the carrying amount of this item is determined. Otherwise, the amount reported in other comprehensive income is recognized through profit or loss in accordance with the income effectiveness of the future transaction or the existing obligation (cash flow hedges). Hedges of net investments in foreign operations are accounted for similarly to cash flow hedges: The share of gain or loss from a hedging instrument that is reported as an effective hedge is included in other comprehensive income; the ineffective part is to be included through profit and loss. The gain or loss on the hedging instrument, attributable to the effective portion of the hedging relationship and recognized in other comprehensive income, is reclassified from equity to profit or loss on the disposal or partial disposal of the foreign operations.

In the business year 2014/15, hedge accounting in accordance with IAS 39 was used for hedging foreign currency cash flows, interest-bearing receivables and liabilities, and raw materials purchase agreements. The interest rate and currency hedges are mainly cash flow hedges, while the raw material hedges are designated almost exclusively as fair value hedges. Hedge accounting is only applied to a part of currency and raw material hedges.

As of March 31, 2015, three forward exchange transactions were held totaling USD 110.0 million (fair value: EUR 13.8 million) that are a hedge of an investment (future capital contributions) in voestalpine Texas Holding LLC and which also serve to hedge against the currency risk of the Group arising from these investments. Other cash flow hedges are accounted for at a fair value of EUR 19.2 million.

The profits (EUR 13.8 million) arising from the translation of these hedging transactions are reported directly under other comprehensive income. They will be offset by any profits or losses arising from the currency translation of the net investment in the subsidiary. Hedges to the amount of USD 150.0 million (nominal value: EUR 108.7 million) expired in the business year 2014/15.

In the business year 2014/15, no ineffective hedging was recorded in respect of the hedging mentioned above. There was no hedging of investments in other foreign operations belonging to the Group.

Net losses of foreign currency and interest rate derivatives (cash flow hedges) amounting to EUR 1.1 million (2013/14: net losses amounting to EUR 4.7 million) were recognized through profit and loss in the reporting period.

Losses amounting to EUR 1.4 million (2013/14: losses amounting to EUR 0.1 million) on raw material hedges, which are designated as fair value hedges, were recognized through profit and loss. Gains for the corresponding underlying transactions amounting to EUR 1.4 million (2013/14: gains amounting to EUR 0.1 million) were also recognized through profit and loss.

Negative market values amounting to EUR 2.0 million (2013/14: positive market values amounting to EUR 6.2 million) previously recorded in the reserve for foreign exchange hedges were recognized through profit and loss during the reporting period; positive market values amounting to EUR 37.4million (2013/14: negative market values amounting to EUR 2.0 million) were allocated to the reserve. In business year 2014/15, the reserve for interest rate hedges was increased by EUR 4.3 million (2013/14: EUR 6.5 million) due to changes in the fair values. In addition, during the business year 2014/15, EUR 7.4 million were shifted from the hedging of financial liabilities to reserves and subsequently deducted from the acquisition costs of the financial liabilities.

Derivatives designated as cash flow hedges have the following effects on cash flows and profit or loss for the period:

|

|

|

Total contractual cash flows |

|

Contractual cash flows |

||||||||||||

|

|

|

|

< 1 year |

|

> 1 year and < 5 years |

|

> 5 years |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

2013/14 |

|

2014/15 |

|

2013/14 |

|

2014/15 |

|

2013/14 |

|

2014/15 |

|

2013/14 |

|

2014/15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest derivatives |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets |

|

8.7 |

|

1.6 |

|

3.3 |

|

0.8 |

|

5.3 |

|

0.8 |

|

0.1 |

|

0.0 |

|

Liabilities |

|

–17.4 |

|

–6.0 |

|

–5.4 |

|

–1.7 |

|

–11.9 |

|

–4.3 |

|

–0.1 |

|

0.0 |

|

|

|

–8.7 |

|

–4.4 |

|

–2.1 |

|

–0.9 |

|

–6.6 |

|

–3.5 |

|

0.0 |

|

0.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Currency derivatives |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets |

|

0.4 |

|

38.1 |

|

0.4 |

|

38.1 |

|

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

|

Liabilities |

|

–2.3 |

|

–0.7 |

|

–2.3 |

|

–0.7 |

|

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

|

|

|

–1.9 |

|

37.4 |

|

–1.9 |

|

37.4 |

|

0.0 |

|

0.0 |

|

0.0 |

|

0.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In millions of euros |

||||

|

Categories of financial instruments |

|

|

|

|

|

|||||||

|

Classes |

|

Financial assets measured at amortized cost |

|

|

|

Financial assets measured at fair value |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Categories |

|

Loans and receivables |

|

Available for sale at cost |

|

Available for sale at fair value |

|

Financial assets measured at fair value through profit or loss |

|

|

||

|

|

|

|

|

|

|

|

|

Held for trading (derivatives) |

|

Other |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets 2013/14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other financial assets – non-current |

|

24.9 |

|

17.9 |

|

41.1 |

|

|

|

6.8 |

|

90.7 |

|

Trade and other receivables |

|

1,612.4 |

|

|

|

|

|

8.6 |

|

|

|

1,621.0 |

|

Other financial assets – current |

|

|

|

|

|

|

|

|

|

413.8 |

|

413.8 |

|

Cash and cash equivalents |

|

532.4 |

|

|

|

|

|

|

|

|

|

532.4 |

|

Carrying amount |

|

2,169.7 |

|

17.9 |

|

41.1 |

|

8.6 |

|

420.6 |

|

2,657.9 |

|

Fair value |

|

2,169.7 |

|

17.9 |

|

41.1 |

|

8.6 |

|

420.6 |

|

2,657.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets 2014/15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other financial assets – non-current |

|

19.0 |

|

18.0 |

|

36.7 |

|

|

|

4.0 |

|

77.7 |

|

Trade and other receivables |

|

1,607.2 |

|

|

|

|

|

60.7 |

|

|

|

1,667.9 |

|

Other financial assets – current |

|

|

|

|

|

|

|

|

|

405.7 |

|

405.7 |

|

Cash and cash equivalents |

|

464.5 |

|

|

|

|

|

|

|

|

|

464.5 |

|

Carrying amount |

|

2,090.7 |

|

18.0 |

|

36.7 |

|

60.7 |

|

409.7 |

|

2,615.8 |

|

Fair value |

|

2,090.7 |

|

18.0 |

|

36.7 |

|

60.7 |

|

409.7 |

|

2,615.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In millions of euros |

||||

The carrying amount of the financial assets represents a reasonable approximation of fair value.

The item “Other” in the category “Financial assets measured at fair value through profit or loss” contains securities measured using the fair value option.

Subsidiaries, joint ventures and investments in associates that are not fully consolidated in these consolidated financial statements or are included using the equity method are held as “available for sale at cost” and measured at cost because these investments do not have a price quoted in an active market, and their fair value cannot be reliably determined. Only the non-consolidated investment in Energie AG Oberösterreich is measured at fair value as “available for sale at fair value” because the fair value of this company can be reliably determined based on the valuation report done once a year for Energie AG Oberösterreich as a whole.

|

Classes |

|

Financial liabilities measured at amortized cost |

|

Financial liabilities measured at fair value |

|

|

|

|

|

|

|

|

|

|

|

Categories |

|

Financial liabilities measured at amortized cost |

|

Financial liabilities measured at fair value through profit or loss – Held for trading (derivatives) |

|

Total |

|

|

|

|

|

|

|

|

|

Liabilities 2013/14 |

|

|

|

|

|

|

|

Financial liabilities – non-current |

|

2,596.8 |

|

|

|

2,596.8 |

|

Financial liabilities – current |

|

831.8 |

|

|

|

831.8 |

|

Trade and other payables |

|

2,074.0 |

|

18.1 |

|

2,092.1 |

|

Carrying amount |

|

5,502.6 |

|

18.1 |

|

5,520.7 |

|

Fair value |

|

5,608.9 |

|

18.1 |

|

5,627.0 |

|

|

|

|

|

|

|

|

|

Liabilities 2014/15 |

|

|

|

|

|

|

|

Financial liabilities – non-current |

|

3,004.6 |

|

|

|

3,004.6 |

|

Financial liabilities – current |

|

890.2 |

|

|

|

890.2 |

|

Trade and other payables |

|

2,180.7 |

|

28.8 |

|

2,209.5 |

|

Carrying amount |

|

6,075.5 |

|

28.8 |

|

6,104.3 |

|

Fair value |

|

6,213.8 |

|

28.8 |

|

6,242.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

In millions of euros |

||

The liabilities measured at amortized cost, whose fair value is stated, fall under Level 2. Valuation is performed according to the mark-to-market method, whereby the input parameters for the calculation of the market values are the foreign exchange rates, interest rates, and credit spreads observable on the market. Based on the input parameters, fair values are calculated by discounting estimated future cash flows at typical market interest rates.

The table below analyzes financial assets and financial liabilities that are measured at fair value on a recurring basis. These measurements are based on a fair value hierarchy that categorizes the inputs for the valuation methods used to measure fair value into three levels.

The three levels are defined as follows:

|

Inputs |

|

|

|

Level 1 |

|

Comprises quoted prices (unadjusted) in active markets for identical assets or liabilities that the entity can access at the measurement date. |

|

Level 2 |

|

Comprises inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly. |

|

Level 3 |

|

Comprises unobservable inputs for the asset or liability. |

|

Level of the fair value hierarchy for recurring fair value measurements |

|

|||||||

|

|

|

Level 1 |

|

Level 2 |

|

Level 3 |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

2013/14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial assets |

|

|

|

|

|

|

|

|

|

Financial assets measured at fair value through profit or loss |

|

|

|

|

|

|

|

|

|

Held for trading (derivatives) |

|

|

|

8.6 |

|

|

|

8.6 |

|

Fair value option (securities) |

|

420.6 |

|

|

|

|

|

420.6 |

|

Available for sale at fair value |

|

|

|

|

|

41.1 |

|

41.1 |

|

|

|

420.6 |

|

8.6 |

|

41.1 |

|

470.3 |

|

Financial liabilities |

|

|

|

|

|

|

|

|

|

Financial liabilities measured at fair value through profit or loss – Held for trading (derivatives) |

|

|

|

18.1 |

|

|

|

18.1 |

|

|

|

0.0 |

|

18.1 |

|

0.0 |

|

18.1 |

|

|

|

|

|

|

|

|

|

|

|

2014/15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial assets |

|

|

|

|

|

|

|

|

|

Financial assets measured at fair value through profit or loss |

|

|

|

|

|

|

|

|

|

Held for trading (derivatives) |

|

|

|

60.7 |

|

|

|

60.7 |

|

Fair value option (securities) |

|

409.7 |

|

|

|

|

|

409.7 |

|

Available for sale at fair value |

|

|

|

|

|

36.7 |

|

36.7 |

|

|

|

409.7 |

|

60.7 |

|

36.7 |

|

507.1 |

|

Financial liabilities |

|

|

|

|

|

|

|

|

|

Financial liabilities measured at fair value through profit or loss – Held for trading (derivatives) |

|

|

|

28.8 |

|

|

|

28.8 |

|

|

|

0.0 |

|

28.8 |

|

0.0 |

|

28.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In millions of euros |

||||

The underlying assets of the fund of funds are reported as part of the “fair value option.” The designation of fair value was selected to convey more useful information because this group of financial assets is managed according to their fair value, as documented in the risk management and investment strategy, and performance is observed and reported by means of fair value.

The derivative transactions (Level 2) are marked to market by determining the value that would be realized if the hedging position were closed out (liquidation method). The observable currency exchange rates and raw materials prices as well as the interest rates are the input for the calculation of fair values. Fair values are calculated based on the inputs by discounting expected future cash flows at typical market interest rates.

There were no transfers between Level 1 and Level 2, nor any reclassifications into or out of Level 3, during the reporting period. The reconciliation of Level 3 financial assets measured at fair value from the opening balance to the closing balance is depicted as follows:

|

Level 3 – Available for sale at fair value |

|

|||

|

|

|

2013/14 |

|

2014/15 |

|

|

|

|

|

|

|

Opening balance |

|

44.0 |

|

41.1 |

|

Total of gains/losses recognized in the income statement: |

|

|

|

|

|

Finance costs/Finance income (impairment) |

|

–2.9 |

|

–4.4 |

|

Closing balance |

|

41.1 |

|

36.7 |

|

|

|

|

|

|

|

|

|

In millions of euros |

||

Level 3 includes the non-consolidated investment in Energie AG Oberösterreich that is measured at fair value as “available for sale at fair value.” The fair value of this company can be reliably determined based on the valuation report done once a year for Energie AG Oberösterreich as a whole.

Significant sensitivities in the determination of fair values can result from changes in the underlying market data of comparable entities and the input factors used to determine net present value (in particular discount rates, long-term forecasts, plan data, etc.).

The table below shows net gains and losses on financial instruments, which are shown according to categories:

|

|

|

2013/14 |

|

2014/15 |

|

|

|

|

|

|

|

Loans and receivables |

|

21.5 |

|

9.3 |

|

Available for sale at cost |

|

7.6 |

|

3.6 |

|

Held for trading (derivatives) |

|

–4.9 |

|

41.1 |

|

Available for sale at fair value |

|

–2.9 |

|

–4.4 |

|

Other |

|

8.2 |

|

20.7 |

|

Financial liabilities |

|

–126.9 |

|

–127.8 |

|

|

|

|

|

|

|

|

|

In millions of euros |

||

Total interest income and total interest expense for financial assets and financial liabilities that were not measured at fair value through profit or loss were recorded as follows:

|

|

|

2013/14 |

|

2014/15 |

|

|

|

|

|

|

|

Total interest income |

|

16.6 |

|

13.4 |

|

Total interest expense |

|

–126.9 |

|

–127.8 |

|

|

|

|

|

|

|

|

|

In millions of euros |

||

The impairment loss on financial instruments measured at amortized cost amounts to EUR 16.0million (2013/14: EUR 12.1 million).

Share page