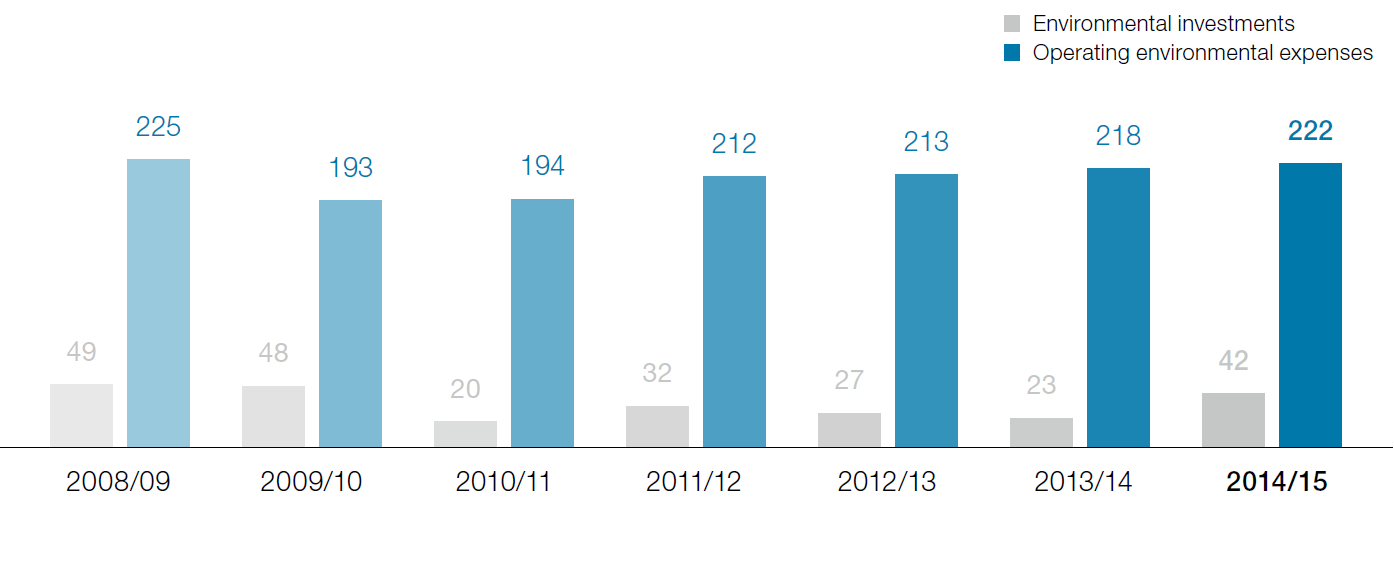

Environmental expenditures1

In millions of euros

Based on Austrian locations

1 Basis: Austrian Group locations as it is here that the greatest portion of the Group’s environmentally sensitive emissions accrue.

Environmental expenditures

The environmental expenditures of the voestalpine Group in the business year 2014/15 amounted to EUR 42 million, an increase of around 90% compared to the previous business year (EUR 23 million). Ongoing operating expenses for environmental systems came to EUR 222 million1, a rise of 2% (EUR 218 million) compared to the previous year’s figure.

Environmental projects in the past business year

The focus of environmental projects in the past business year was on the areas of air purification, water management, energy efficiency, noise reduction, and waste and recycling management. In the following are some examples that represent the large number of measures that were implemented:

In the Steel Division at the Linz site, a new fabric filter system in the indoor dedusting system of the sintering plant was able to significantly reduce diffuse emissions; the new slab scarfing machine in the steelworks had a similarly positive effect by enabling an optimization in capturing diffuse dust emissions by way of higher suction power.

In the Metal Forming Division at voestalpine Precision Strip GmbH at the Böhlerwerk site in Austria grinding dust is no longer disposed of but is pressed into briquettes using a grinding dust press; these briquettes can be recycled as they have a high iron content. In the Special Steel Division, a new dust extraction system in the steelworks area of Buderus Edelstahl GmbH in Wetzlar, Germany, was put into operation, which enables both significantly reduced emissions and lower specific energy requirements. At Uddeholms AB in Hagfors, Sweden, gas (LNG) was substituted for heavy oil, resulting in substantial energy savings and an enormous reduction of NOX, SOX, and CO2. In the Metal Engineering Division at voestalpine Böhler Welding in Kapfenberg, Austria, a new extraction system was installed to enable more efficient cleaning of dust-laden air from wire production; during the winter, filtered exhaust air is routed back into the production hall as an additional source of heat.

Environmental management

In the last business year, implementation of additional environmental management systems began. These systems include the energy management system based on EN ISO 50001 at voestalpine Böhler Welding Group GmbH Düsseldorf, Germany, and the ISO 14001 certification of voestalpine Sadef N.V. in Hooglede, Belgium. As had been the case in previous years, in 2014/15 various Group companies in a number of countries were honored with awards recognizing their environmental management measures. voestalpine VAE GmbH, voestalpine Weichensysteme GmbH, and voestalpine SIGNALING Zeltweg GmbH, all in Zeltweg, Austria, received the European EMAS Award 2014 for “eco-innovations (products and services),” “environmental measures,” and “international health, safety, environment & energy-related (HSEE) standards” at 40 production sites worldwide. Villares Metals S.A. in Sumaré, Brazil, received the CIP Award 2014/15 in the “Environment” category for the project “Increasing treated water storage for industrial reuse.” voestalpine Roll Forming Corporation in Shelbyville, Kentucky was awarded the “Certificate of Environmental Recognition from Closed Loop Recycling.” voestalpine Tubulars GmbH & Co KG, Kindberg, Austria, received the ÖKOPROFIT Club Award as well as an award for competence in climate protection (energy efficiency) within the scope of the Austrian klima:aktiv initiative.

Current environmental policy topics

The most important current topic in terms of environmental policy is preparation of the EU position for the 21st UN Climate Change Conference in Paris in December 2015, the goal of which is to achieve a binding global climate protection treaty for the period after 2020.

In the spring of 2015, the European Environment Agency presented its most recent report on the state of the environment, and its conclusions are being discussed. Another current area of focus is the energy sector, where the current Latvian presidency of the European Council is endeavoring to create a concept for the proposed European energy union.

Climate and energy policy

After the European Council summit in October 2014, for the energy-intensive industries, it is important that the prospective decisions by the heads of state and government of the EU member states be defined as quickly as possible so that there is certainty concerning the regulatory framework that will make reliable planning for industrial capital investments possible.

The European Council has resolved a binding target value for a reduction of the EU’s CO2 emissions of –40% based on the emissions level in 1990. This future “2030 climate target” was determined as a part of a political framework that comprises the aspects of greenhouse gases, renewable energy, and energy efficiency. At the present time, it appears that the EU—regardless of any global treaties—plans on adhering to these quantitative “2030 targets” and on introducing mechanisms that increase the CO2 price (currently around EUR 7/ton of CO2) to a targeted magnitude of EUR 20 to EUR 40/ton. This would result in yet another blatant disadvantage for the energy-intensive manufacturing industries not only vis-à-vis the energy sector but especially vis-à-vis overseas competitors and thus contradict the declarations of intent by the Council stating the desire to ensure the competitiveness of these industries in Europe in the long term.

These plans overlook the fact that the result of a high CO2 price is not necessarily to bolster investment in low-carbon production technologies because carbon pricing can usually only be avoided to a limited degree even through expensive, more emission-friendly alternative technologies, as it does not just apply to coal or oil, but it also applies to other energy sources such as natural gas and electricity, albeit indirectly by way of being “passed on” to industry.

In order to permanently prevent carbon leakage under the EU Trading Scheme (ETS) for European industry and thus create certainty regarding investments/capital expenditures, it is absolutely necessary—in accordance with the conclusions of the European Council—to separate the energy industry and the manufacturing industry with regard to their cost burden from carbon pricing. In this context, the primary issue is to ensure a 100% allocation of free certificates for the most efficient plants based on technically possible benchmark figures and actual production levels. If this is not the case, the future of energy-intensive industry in Europe is a priori called into question.

Current status of the negotiations on the “Energy Climate Package 2030”

Currently, the introduction of a “market stability reserve” (MSR) to the system of European emissions trading is being discussed. The goal is to transfer CO2 certificates from the trading system to a so-called “reserve” in order to push the CO2 price higher. After the environmental committee of the European Parliament defined its position in February 2015, recently, agreement was also reached at the working level of the Council. This agreement stipulates that the MSR will be implemented from 2019 on, that so-called backloaded allowances will be directly transferred to the MSR, and that unallocated certificates will be considered separately by the Commission when the ETS Directive is revised. Further informal talks between Council, European Parliament, and Commission began on March 30, 2015. These negotiations have particular importance for the steel industry because in this context the topic of carbon leakage will also be discussed.

1 Basis: Austrian Group locations as it is here that the greatest portion of the Group’s environmentally sensitive emissions accrue.

Share page